(Bloomberg) — Money managers rolled back bets against the biggest exchange-traded fund focused on oil-company stocks, signaling speculation that the price of crude is at least temporarily bottoming out after sliding sharply since last month.

Short sellers piled on to the $33 billion Energy Select Sector SPDR Fund (ticker XLE), the biggest ETF focused on large-cap U.S. energy stocks, as it rose along with the price of oil. But after the energy rally reversed, delivering profits to those betting against the ETF, traders closed out positions, cutting the number of shares sold short by 14% over the past 30 days, according to data compiled by S3 Partners.

“ETF short sellers are actively trimming their short exposure — possibly looking for a bottom in the market and removing some of their downside bets,” said Ihor Dusaniwsky, S3’s head of predictive analytics.

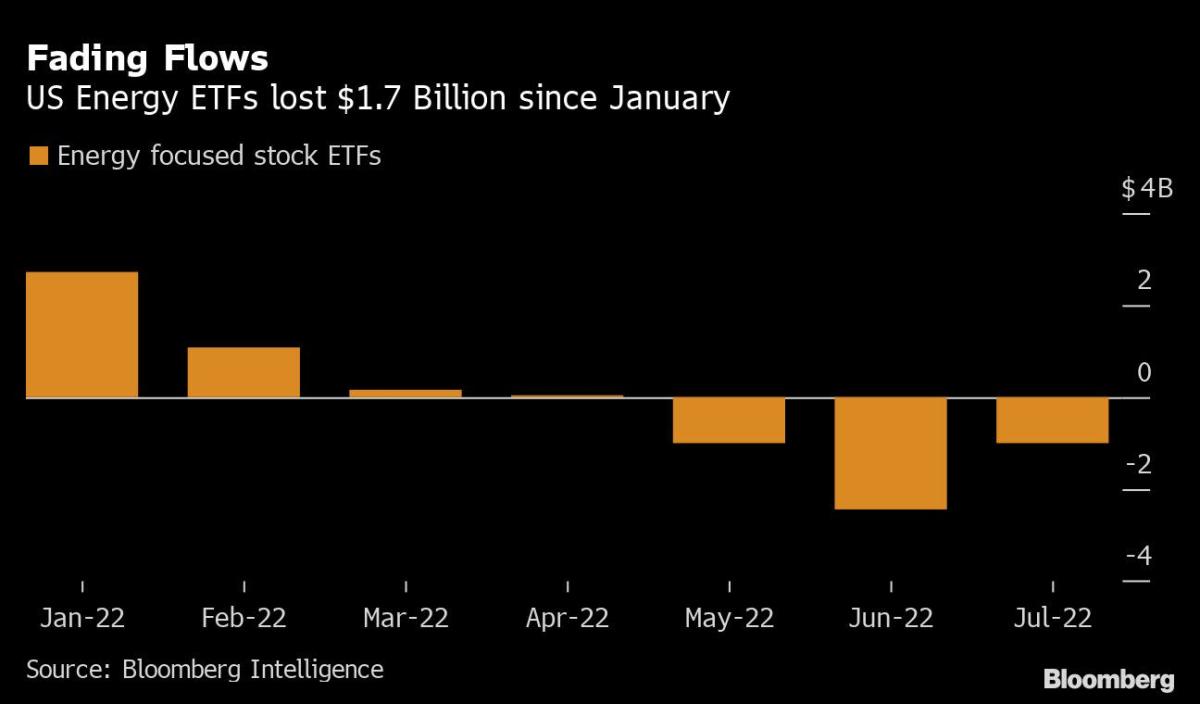

Oil prices have tumbled more than 20% since mid-June to around $95 a barrel amid mounting speculation that a recession, China covid lockdowns, and consumer cutbacks in the face of high gasoline prices could hurt demand. Investors pulled $1.7 billion from energy funds since January.

But some money managers say energy-based ETFs now look like bargains, citing the tight oil and gas market, producers’ high profits and growing optimism that any US recession will be shallow. XLE is now down more than 20% from its June peak.

“Investors were locking in profits, but for some there were concerns over a softer economic growth,” said Aniket Ullal, head of data and analytics at CFRA Research. “As we have more clarity on China reopening and the pace of global economic growth, investors will have more price support for oil and energy ETFs.”

But there’s still a lot of uncertainty, leading to some extremely divergent calls on global oil prices.

Ed Morse, global head of commodities research at Citigroup Inc., has said that global economic slowdowns and robust supply growth mean crude prices are moving “more towards $50 over time than $150, absent producer interventions.” Early this month, JPMorgan Chase & Co. analysts said oil could reach $380 if US and European penalties over the Ukraine war prompt Russia to inflict retaliatory output cuts.

With crude still hovering around $100, ETFs containing oil stocks look like good bets, said Mark Stoeckle, Adams Funds’ chief executive officer, who manages the Adams Natural Resources Fund.

“At $90 per barrel energy companies are printing money and it’s impossible to find a sector with free cash flows higher,” he said. “The big outflow is a perfect example showing that people were not investing, they were trading.”

©2022 Bloomberg L.P.