(Bloomberg) — Like clockwork, a decent few days lift stocks, and out come the charts. Have equities bottomed? Evidence is arrayed to argue this time is different, that this is the bounce that will last. Heeding it now requires conviction bordering on credulity.

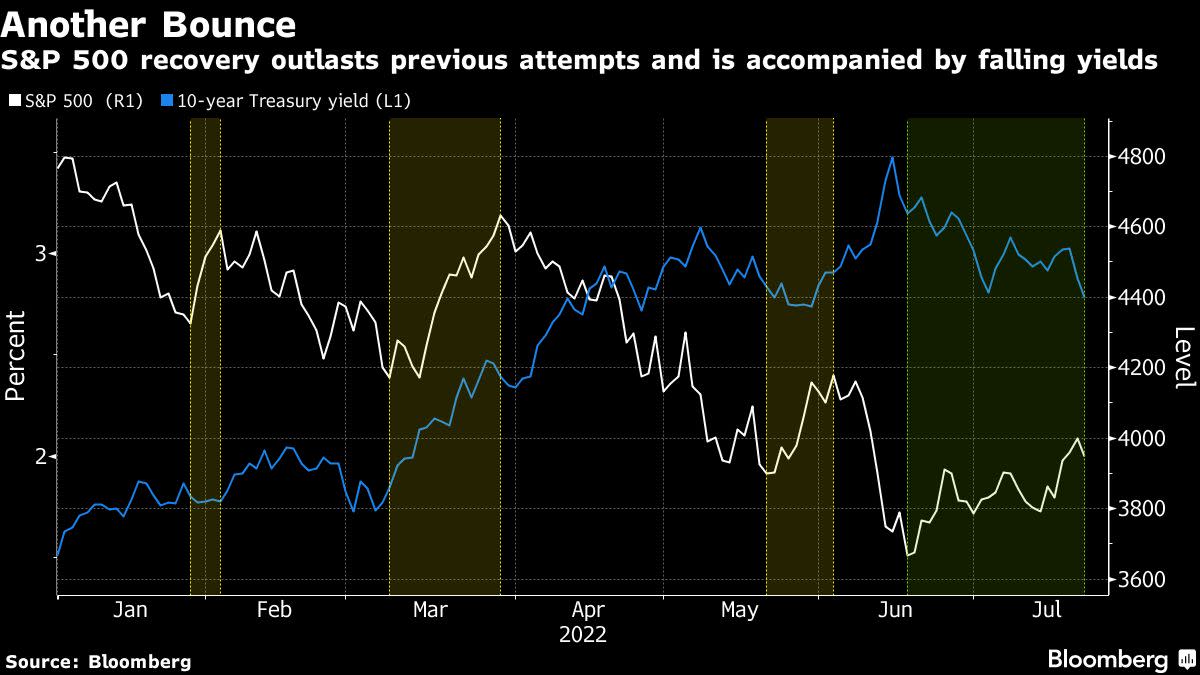

The data in the bull camp are as follows: a third big week in five for small caps, signs exchange-traded fund buyers have become healthily demoralized, and measures of market breadth expanding in ways that have signaled further gains in the past. While roughly as many features of the latest rally were present in those that fizzled earlier in the year, this one has now outlasted all of those, even with Friday’s hammering.

Easily the most debated topic for traders remains the state of corporate earnings, uncertainty over which put prices in a frenzy all year. Straightforwardly, the news this week was bad, with estimates for future profits taking lumps as companies disclosed results. But even that trend can be claimed as a victory by a certain type of bull who has viewed over-optimistic forecasts as a barrier to volatility winding down.

“I’m still sleeping with one eye open because just one or two big selloffs could easily negate all of this and lead us back into violent bear-market selling,” said Adam Sarhan, founder and chief executive officer at 50 Park Investments, who nevertheless describes himself as increasingly bullish. “This is still a fragile rally.”

Stocks survived a bruising final session to advance this week, overcoming a slew of disappointing corporate earnings and weak data on business activity worldwide. Tuesday marked the second session in three that the market volume on rising stocks topped falling ones by a ratio of at least 10-to-1. A cluster of breadth thrusts like this was last fired in May 2021.

Double breadth thrusts, as the phenomenon is described by Ned Davis Research, tend to herald outsized gains. Since 1950, the S&P 500 has risen more than twice its historic pace following such signals, jumping 10% six months later.

“The double 10:1 up day supports the argument that the second-half rally is underway,” said Ed Clissold, chief US strategist at Ned Davis who forecasts the S&P 500 to end the year at 4,400, about 11% higher than it is now. “How sustainable the rally is will likely depend on monetary policy and earnings, but technical indicators will likely provide the information before Fed officials or management teams.”

Since hitting the 2022 low in mid-June, the S&P 500 has climbed 8%, reclaiming its 50-day moving average, a level widely watched by traders for a view of momentum. At 36 days, this bounce is the first one this year that lasted more than a month.

As happened with the last three recovery attempts, economically sensitive stocks such as automakers, retailers and chipmakers have led the way this time around. Of course, past endeavors didn’t end well, all succumbing to fresh market lows.

One notable difference is the performance in small-cap stocks. While the Russell 2000 trailed the market previously, it’s now edging ahead. Since 1978, small-caps have always outperformed coming out of bear markets, according to Sam Stovall, chief investment strategist at investment research firm CFRA.

“Markets always trade with at least a six-month look ahead. So when small caps bottom, it historically bodes well for broader US markets because they tend to lead the way higher as the economy strengthens,” said Scott Colyer, chief executive officer at Advisors Asset Management. “But investors still have to be cautious because they can be faked out by this easily. I still see nothing that gets me excited to take on risk right now.”

Earnings sentiment is souring during this reporting season. After holding on to their rosy outlooks while stocks fell into a bear market in the first half, analysts are now rushing to revise numbers. Forecast earnings for 2023 have fallen five straight weeks, though not by a lot. They’re down 2% to $244 a share, data compiled by Bloomberg Intelligence show.

The reset in earnings expectations is actually good because it suggests a capitulation that JPMorgan strategists including Marko Kolanovic say may prompt investors to seek an inflection point in the market.

Reasons for caution abound. Chief among them: an aggressive Federal Reserve that’s committed to fighting spiraling inflation at the risk of thrusting the economy into a recession.

Yet speculation has grown that with the Fed front-loading jumbo rate hikes, this tightening cycle could end earlier than previously anticipated. In a sign that the Fed’s policy may be working as planned, expectations for future pricing pressure have eased in the bond market.

That sets up a different rates backdrop for stocks. In each of the last three instances this year when equities staged a rebound, 10-year Treasury yields either jumped or barely budged. This time, yields peaked at 3.5% on June 14, two days ahead of the S&P 500’s low, and have since fallen below 2.8%.

Tom Hainlin, national investment strategist at US Bank Wealth Management, isn’t convinced that the worst is over.

“The markets themselves are moving based on viewpoints that maybe inflation is coming under control or maybe the Federal Reserve will pause on interest rate hike,” he said. “But there’s not real true visibility into what they may or may not do in September.”

Among investors, sentiment is decidedly more negative. All year, professional investors have cut risk, with Bank of America Corp.’s latest survey of money managers pointing to the lowest equity allocation since October 2008.

Now, even the staunchest bulls are showing signs of trepidation. ETF investors, who have poured in more than $200 billion into equities this year, are backpedaling. Since mid-June, they’ve added only $1 billion to equity ETFs, data compiled by Bloomberg show. That’s a fraction of the average $26 billion seen during the last three market recoveries.

To Quincy Krosby, chief global strategist at LPL Financial, all the skepticism is one reason why the market could be seen as being close to a bottom.

“You see the portfolio managers decisively risk-averse, where perhaps they were put under pressure to come in and take advantage of this move in the market,” she said. “In a bear market, the bottom process is just that, it’s a process.”

©2022 Bloomberg L.P.