(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The world’s largest economy remained in a precarious position in the second quarter, a government report is projected to show, adding to mounting recessionary angst just as the Federal Reserve leans in harder against inflation.

US gross domestic product — the sum of goods and services produced — is forecast to have risen an annualized 0.5% during the April-June period, according to the median estimate in a Bloomberg survey of economists.

Following the 1.6% rate of decline in the prior quarter, the economy’s first-half performance would be the worst of the pandemic recovery.

While inventories probably weighed heavily on the second-quarter results, the demand picture also darkened as consumer spending, business investment and housing may have all taken a step back.

The advance GDP estimate will be released on Thursday, a day after Fed policy makers — led by Chair Jerome Powell — are expected to pull the trigger on another 75 basis-point increase in their benchmark interest rate as they try to arrest persistent inflation.

Their challenge in tightening policy is to avoid overdoing it and nudging the economy into a downturn. A number of economists, in addition to the Atlanta Fed’s GDPNow estimate, forecast a second quarterly decline in GDP that would fit the technical definition of a recession.

What Bloomberg Economics Says:

“Powell faces a herculean task at the press conference: He’ll need to affirm the Fed’s commitment to its 2% inflation target while acknowledging the economy’s recent loss of momentum, as the 2Q GDP print (due the following day) will likely be negative. It’s harder to sound hawkish when economic activity is slowing than when it was robust.”

–Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger, economists. For full analysis, click here

The GDP figures highlight a busy week on the US economic calendar that includes figures on June personal spending, income, and a key inflation metric. Second-quarter employment costs, July consumer confidence and June durable goods orders are also slated for release.

Elsewhere, the International Monetary Fund presents updated forecasts on Tuesday that are set to see the global economic growth outlook cut “substantially.” Meanwhile, more evidence of surging price pressures in the euro region, and a possible meeting of China’s Politburo, will also draw investor attention. Colombia, Ghana, Kenya and Hungary are among the central banks predicted to hike rates.

Click here for what happened last week and below is our wrap of what’s coming up in the global economy.

Asia

The Bank of Japan — determined to retain its ultra-easy policy settings even as global peers tighten — welcomes two new board members this week.

Markets will watch closely for whether any comments from the latest recruits signal a shift from the dovish stance as the yen trades around 24-year lows and bond traders test the BOJ’s yield targets.

In the Philippines, President Ferdinand Marcos Jr. will lay down his agenda before Congress, with economic challenges looming large.

In Australia, data Wednesday will likely show that inflation accelerated in the second quarter as criticism of Reserve Bank Governor Philip Lowe’s tardy policy response swells ahead of the Aug. 2 rates decision.

The Fed’s widely-anticipated Wednesday hike will shape markets in Asia on Thursday, with any surprise hawkishness from Powell likely to add to currency weakness and strains for Asia’s policy makers.

China’s Politburo is likely to meet some time later in the week. With the property market tanking, its Covid Zero policy tested by a fresh uptick in cases, and the global growth outlook dimming, investors are watching for any signals that more monetary and fiscal stimulus is on the way and whether officials acknowledge that their 2022 growth target is unachievable.

Europe, Middle East, Africa

After the European Central Bank’s abrupt half-point rate increase, fresh evidence of the price pressures that motivated that move will be revealed. Euro-zone inflation on Friday is expected by economists to accelerate to a record 8.7%, while a core measure is seen reaching a new high of 3.9%.

Other evidence on the health of the economy will emerge at a time when fears of a possible recession are mounting and the flow of Russian gas remains uncertain.

Among survey indicators this week, German business sentiment on Monday is expected by economists to have touched a two-year low. Meanwhile, euro-area economic confidence on Thursday is anticipated to drop to the lowest since February 2021.

On Friday, the region’s GDP report is forecast to show a bare minimum of growth in the second quarter. Nine countries will also report their own data.

Based on a recent estimate by Italy’s central bank of about 0.5% expansion, it’s conceivable growth there may have outperformed every other euro member, although economists are less convinced.

Elsewhere in Europe, Czech GDP data on Thursday may show a sharp contraction, while Sweden’s the same day might even show the largest Nordic economy is in a recession.

Looking south, Ghana’s Finance Minister Ken Ofori-Atta will on Monday deliver his mid-term budget statement that’s expected to outline plans to return public finances to a sustainable path. He’s also expected to provide an update on talks with the IMF for a three-year economic program.

On Wednesday, mounting price pressures and currency weakness in Kenya will probably spur a second straight interest-rate hike. In contrast, policy makers in Angola — one of the few global outliers with slowing inflation — are expected to leave rates unchanged on Friday.

Turkey’s central bank releases its quarterly inflation report on Thursday, a week after holding rates steady for a seventh straight month even as inflation soars to nearly 80%.

Meanwhile in the UK, all eyes are on the battle between Liz Truss and Rishi Sunak to replace Boris Johnson as prime minister, with economics the primary battle ground so far.

Latin America

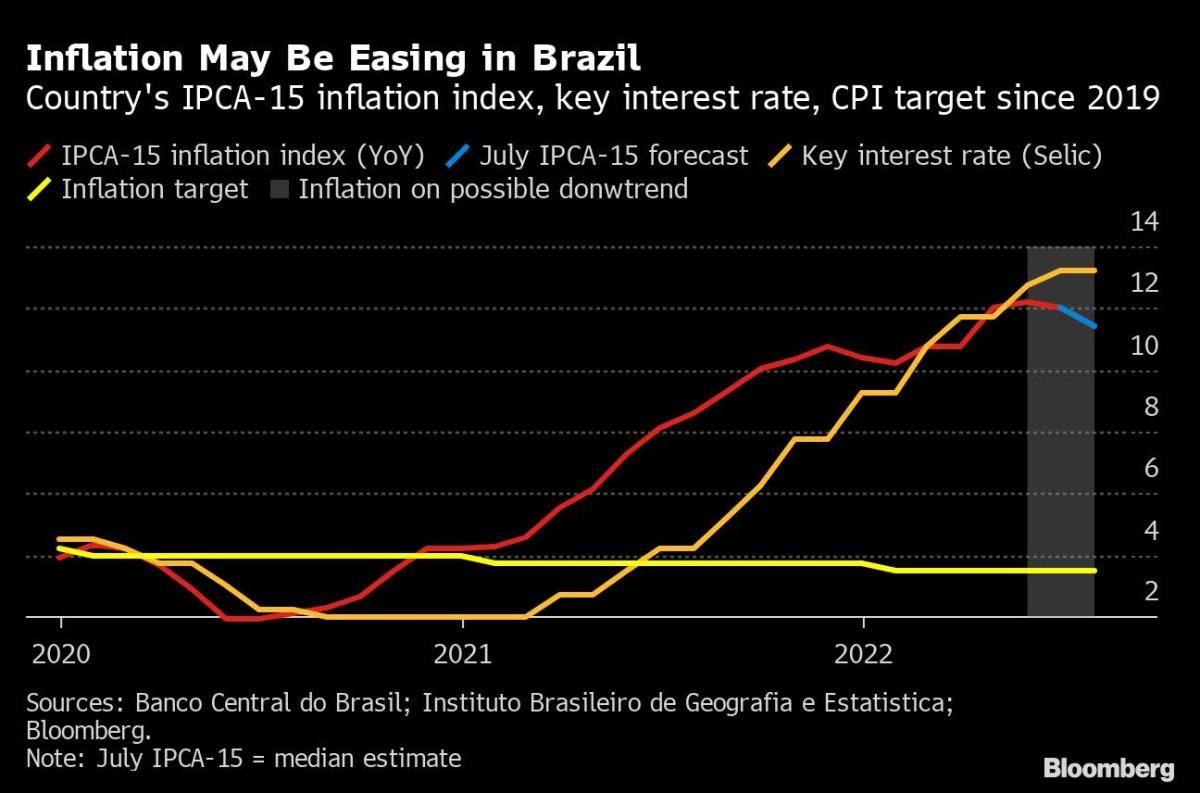

Two inflation readings out of Brazil, Latin America’s biggest economy, may drift lower. That includes the mid-month print of the benchmark consumer price index and the broadest measure of inflation for July.

Brazil is also scheduled to post its June unemployment data after joblessness fell to a six-year low in May.

Mexico’s second-quarter flash output readings are expected to show the economy decelerated under the weight of rising rates and slower growth in the US, the country’s No. 1 trading partner.

Of the region’s big six, only Mexico’s economy remains below its pre-pandemic level, and with growth ebbing, June’s unemployment rate may have climbed for a third month.

Chile’s central bank posts the minutes of its July 13 meeting, where policy makers raised the key rate for a ninth straight meeting to a record-high 9.75% and flagged additional increases to come after the peso slumped to a record low. The June unemployment data may continue 2022’s upward trend.

Analysts expect Colombia’s central bank to extend a record tightening cycle and raise the key rate 150 basis-points to 9%. With consumer price increases poised to hit double-digits, inflation expectations coming unanchored and the peso trading near record lows, most analysts see further hikes ahead.

©2022 Bloomberg L.P.