It has become pretty normal over the last several years to see the Technology sector leading the market – after all, Technology is increasingly at the center of just about every part of our daily lives in one sense or another. Technology often acts as both a catalyst and a hindrance to broader economic health and growth.

That sounds strange; but since the sector is made up of various interrelated, but still distinct industries, it is possible for one industry to facilitate growth while another struggles. In the early stages of the pandemic, for example, much of corporate America shifted to remote work models to keep business running; that put a big emphasis not only on e-commerce but also on services and solutions that enabled remote, cloud-based collaboration, communication, and productivity. That is why a lot of the darlings of the past two and a half years have been stocks that focus on providing web-based meetings and cloud-based services that enable remote work.

While that industry in the Tech sector kept much of corporate America running and functioning, at the same time chip shortages have been pressuring the Semiconductor industry since before 2020, but continue to constraint supply in a variety of industries. These are not only affecting input costs, but have also translated to consumer price increases that are among the contributory factors that have prompted the Fed to raise rates four times so far in 2022. That has forced most of the market, including tech and semiconductor stocks, to visit bear market levels that have raised fears the economy will slip into a new, longer recession (compared to the rapid drop to recessionary conditions in 2020 that were followed by a nearly equally rapid recovery).

If you follow the Tech sector, you are probably already familiar with some of the names in that segment – but you may not be familiar with the companies that provide the services and solutions for those companies. Despite many of its current challenges, the Semiconductor industry is a good example of an industry that supplies most of what makes just about every other kind of Tech solution possible. Another is the Electronic Manufacturing Services industry.

Sub-industries can offer interesting opportunities to work with a fast-moving sector from a different angle than most can expect. Jabil Inc. (JBL) is an interesting example. This is a company that established itself by providing manufacturing services for a very narrow market segment – largely mobile phone manufacturers like Apple (AAPL), which continues to be their largest single customer. Over the last few years, however the company has worked hard to diversify its operations to reduce its reliance on that narrow segment and into cloud business as well as industrial and energy services.

Like many of the stocks in the broader sector, the stock experienced its own drop from a multiyear year late in 2021 at around $72 to a bear market-level low at around $49 to start July; since then, however the stock has picked up enough bullish momentum to suggest it could be set to reverse its downward trend. Does it also have the fundamental strength to keep rallying, and what does the current price mean for its value proposition? Let’s dive in to the numbers to find out.

Fundamental and Value Profile

Jabil Inc., formerly Jabil Circuit, Inc., provides electronic manufacturing services and solutions throughout the world. The Company operates in two segments, which include Electronics Manufacturing Services (EMS) and Diversified Manufacturing Services (DMS). The Company’s EMS segment is focused on leveraging information technology (IT), supply chain design and engineering, technologies centered on core electronics, sharing of its large scale manufacturing infrastructure and the ability to serve a range of markets. Its DMS segment is focused on providing engineering solutions and a focus on material sciences and technologies. It provides electronic design, production and product management services to companies in the automotive, capital equipment, consumer lifestyles and wearable technologies, computing and storage, defense and aerospace, digital home, emerging growth, healthcare, industrial and energy, mobility, packaging, point of sale and printing industries. JBL’s current market cap is $8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased almost 36%, while revenues increased about 15.4%. In the last quarter, earnings growth was flat, but positive, at 0.66%, while sales were 10.25% higher. JBL operates with a very narrow operating profile; over the last twelve months, Net Income was 2.69% of Revenues, and 2.62% in the last quarter.

Free Cash Flow: JBL’s free cash flow is healthy, at about $707.5 million, and translates to a Free Cash Flow Yield of 8.84%. It also marks an improvement from $362.73 million at the beginning of 2020, and $640 million a year ago.

Dividend Yield: JBL’s dividend is a modest $.32 per share, and translates to an annual yield of about 0.55% at the stock’s current price. The more interesting note is that the company pays a dividend, period, in an industry where most stocks do not. The size of the dividend is also not a reflection of pandemic-driven pressures, as JBL has historically maintained a very conservative dividend payout that has not changed from its current level for the past three years.

Debt to Equity: JBL has a debt/equity ratio of 1.22. This is a high number, and usually reflects a high degree of leverage. In JBL’s case, however their balance sheet shows healthy liquidity, with cash and liquid assets of $874.5 billion in the last quarter versus about $2.9 billion of long-term debt. It is noteworthy that the company’s cash dropped from around $1 million in the previous quarter and $1.2 billion about a year ago; I take this as a reflection of the rising input costs and other inflationary pressures. Their healthy liquidity and Free Cash Flow, for now are effective counters to their narrow margin profile, and strongly suggest they should have no problem servicing their debt; however any kind of reversal of Net Income could create problems on that front.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $52 per share. That suggests JBL is overvalued by about -10% right now, with a useful discount price at around $42 per share. It is also worth noting that a year ago, this measurement yielded a fair value target at around $49 per share.

Technical Profile

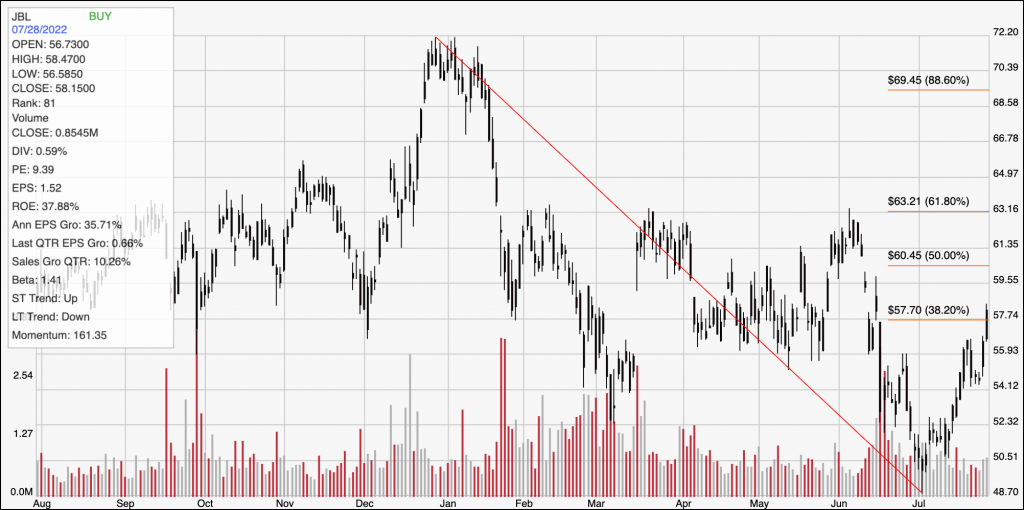

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last year. The red diagonal line marks the stock’s downward trend from its late 2021 high at around $72 to its low earlier this month at about $49; it also provides the baseline for the Fibonacci retracement lines on the right side of the chart. The stock has picked up a significant amount of bullish momentum from that low, pushing yesterday above the 38.2% retracement line to mark current support at around $58 per share, with immediate resistance expected at around $60. A push above $60 could see additional upside to about $63 where the 61.8% retracement line waits, while a drop below $58 should find next support at around $54 based on previous pivot lows in that range.

Near-term Keys: If you’re looking for a short-term, bullish trade, the stock’s recent push above $58 could offer a useful signal to buy the stock or work with call options, with an eye on a useful exit target at around $60, or $62 if buying activity increases. A drop below $58, on the other hand, could offer a useful signal to consider shorting the stock or working with put options, with an eye on $54 as a practical bearish profit target. At its current price, however, there isn’t a value-based case to be made for JBL. Despite other fundamental strengths, I see the company’s narrow operating profile – which is also far more marginal than is typical for the industry – as a significant risk factor in its operations, since that any operational misstep could be costly. I would prefer to see margins improving, with a useful value price for the stock at around $42 per share.