(Bloomberg) — Among the many superlatives attaching to markets in July, one that could come back to haunt the Federal Open Market Committee is Wednesday and Thursday’s, when the stocks posted their biggest post-meeting rally on record.

Believing they heard a dovish tilt from Jerome Powell, traders pushed the S&P 500 up nearly 4% over two days — and kept on buying Friday. Welcome as it was by bulls, the spike raises the question of when the rebound itself starts to work against the goal of draining bloat from the economy. It’s an issue investors must weigh in calculating the recovery’s staying power.

A dynamic in which surging stocks complicate the goal of subduing inflation is one reason giant rallies are rare in times of tightening. While the Fed may be ambivalent about equities in general, the role of markets in mediating a real-world economic lever — financial conditions — means they are never completely out of mind. Right now, those conditions are loosening in proportion to the S&P 500’s gains. Could that be a concern for Powell?

The Fed chief said Wednesday that policy makers will be monitoring whether financial conditions — a cross-asset measure of market stress — are “appropriately tight.” But in the days since the central bank’s second straight 75 basis point hike, the measure is now at a level looser than before the first rate hike in March.

“They don’t want easier financial conditions, because they want lower demand,” Bespoke Investment Group global macro strategist George Pearkes said. “Basically, markets are assuming we’ve hit peak hawkishness and we’ll be easing sooner than expected. I’m skeptical the Fed is going to endorse that.”

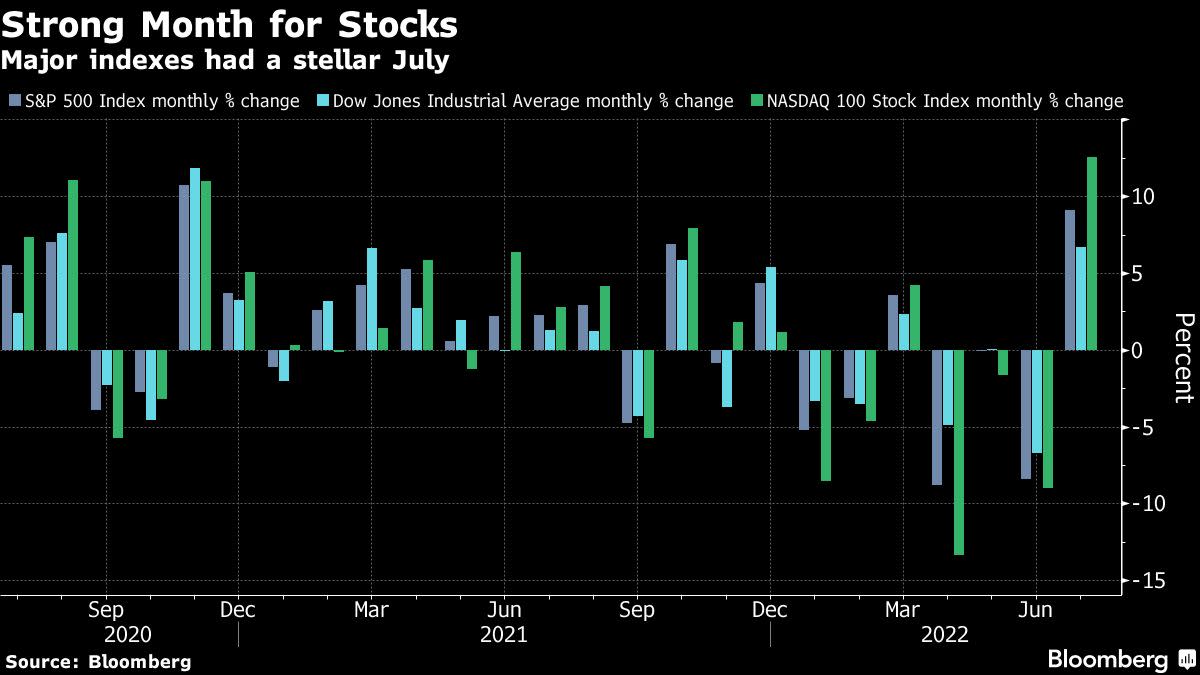

The S&P 500 soared 4.3% for the week and 9.1% in July, the best monthly advance since November 2020. Its gains snowballed after Powell raised rates three-quarters of a percentage point and suggested the pace of hikes might slow later this year. The nearly 4% jump on Wednesday and Thursday alone was the biggest two-day gain on record following Fed tightening.

The risk-on impulse spread to corporate bonds, with both investment-grade and high-yield spreads narrowing from peaks earlier in the month as traders trimmed wagers on an ultra-aggressive Fed. Treasury yields dropped across the curve as well, with 10-year Treasury yields dropping to 2.65% after reaching 3.5% in June.

Taken together, the equity and bond rallies helped loosen US financial conditions, which clocked in at -0.46 compared to a -0.79 reading in March, according to a Bloomberg measure. The easing of that key metric could be setting up for disappointment traders who have gone all-in on the idea of a friendlier Fed, Nuveen’s Brian Nick.

“If the Fed’s goal by raising interest rates is to slow the economy by tightening financial conditions, then that hasn’t happened since they started to get more serious about rate hikes,” said Nick, chief investment strategist at Nuveen. “I’m afraid we’re in for another instance of what’s become very familiar, which is the Fed has to bring the party to a halt at its next meeting or before that.”

That fear isn’t reflected in market pricing. Swaps show that traders expect the fed funds rate to peak around 3.3% before the end of 2022, less than a percentage point above its current level. At one point in recent months, that level was approaching 4%.

While the Fed would likely prefer to see continued tightening, conditions have still compressed “significantly” in recent months, said iCapital’s Anastasia Amoroso.

“Financial conditions have tightened a whole lot since the beginning of the year,” Amoroso, chief investment strategist at iCapital, said in an interview at Bloomberg’s New York headquarters. “The fact that credit spreads have been tighter, the fact that equity prices have been lower, the fact that rates across the curve have been much higher, this is going to exert still downward pressure on the economy in the coming months.”

©2022 Bloomberg L.P.