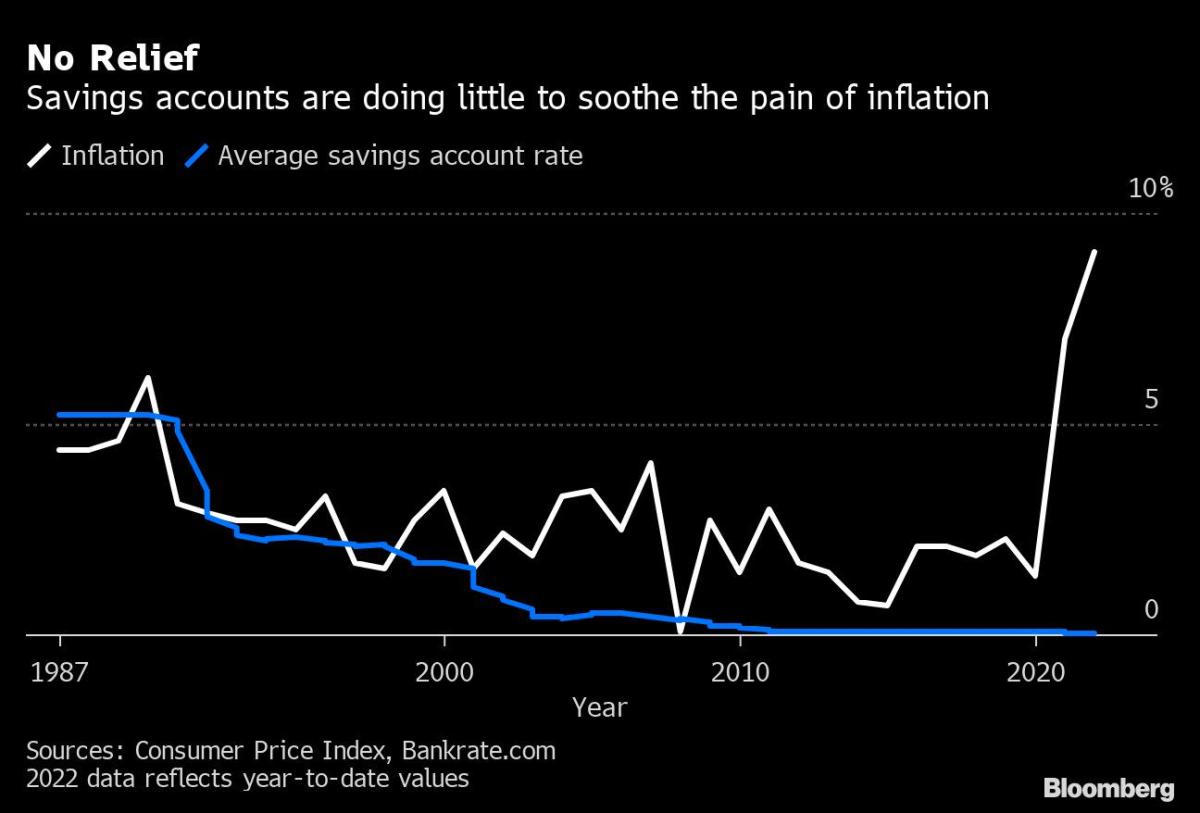

(Bloomberg) — The last time inflation burned hot, consumers could put money in the bank and watch it grow like the prices on store shelves, easing much of the pain.

Not this time — and that’s stoking profits for US lenders.

The gap between what banks pay depositors and what they earn from lending money to borrowers hasn’t been so wide in the past half-century, with the average savings account paying a skimpy 0.06%. Many banks are telling shareholders that so-called deposit betas — measuring how quickly deposit rates rise in the wake of Fed hikes — will remain advantageous for banks in the months ahead, as they’re not yet feeling much pressure to pay savers more.

Betas are now the buzziest bit of jargon across the financial industry. The phrase was invoked more times during Bank of America Corp.’s analyst briefings in the past two months than in the prior two years combined. This month, the lender’s executives predicted interest income may climb by as much as $1 billion in the third quarter from the second as they stay “disciplined” in what they pay customers.

“Our consumer-banking segment continues to see good momentum,” Chief Executive Officer Brian Moynihan told analysts July 18. “We grew loans at the fastest quarterly pace in nearly three years.”

The reasons that savers are getting so little relief are myriad, starting with the Federal Reserve, which waited until inflation was strong before it began raising interest rates from longtime lows. From there, it takes time for deposit rates to rise too. The result is pain: The consumer price index jumped 9.1% in June, while banks including JPMorgan Chase & Co., Bank of America and Wells Fargo & Co. offered deposit rates as low as 0.01%, according to their websites.

While deposit rates are widely expected to tick incrementally higher as the Fed’s rate hikes for borrowers take hold, there’s ample evidence that the benefits for savers will come slowly. That’s because many banks face little competitive pressure to pay more. Many are flush with cash, thanks in part to a surge in deposits that piled up during Covid-era lockdowns and stimulus programs.

Even big clients that aren’t doing a lot of business with a bank aside from parking their money will have little leverage to push for a higher interest rate on their deposits.

“Banks have plenty of room on the funding side,” said Erika Najarian, a banking analyst at UBS Group AG. That means they can allow “more rate-sensitive deposit-only relationships to walk because they don’t necessarily need that funding.

While deposits have been slipping somewhat at many banks, it’s unlikely that enough consumers will switch lenders to ratchet up pressure quickly, even as online and community-based institutions burnish rates to attract inflows. Synchrony Financial and American Express Co., for example, each offer rates of at least 1.5%.

One reason for that inertia is that only people of a certain age can remember an era when banks routinely paid much more interest on deposits, blunting the impact of inflation. Another is that accounts aren’t as portable as they were decades ago. Many customers have their paychecks deposited directly and arrange for bills to be paid automatically, making switching to a new bank a hassle.

To be sure, the more generous rates banks paid for deposits in the 1980s were a result of longstanding inflation and the Fed’s efforts to tame that with much higher interest rates for borrowing.

This time, both interest and deposit rates are coming off ultra-low levels, said Greg McBride, chief financial analyst at Bankrate.com, which tracks the deposit rates banks offer. Banks will want to see the benefit from higher borrowing rates before they start to pass that along to savers, he said.

Getting to higher deposit rates will also depend on how long the Fed keeps borrowing rates elevated, Najarian said. She suggests deposit rates might reach 1.2% before the Fed starts to ease again.

©2022 Bloomberg L.P.