(Bloomberg) — US shale drillers are expected to post record second-quarter profits in coming days, reversing nearly a decade of debt-fueled losses.

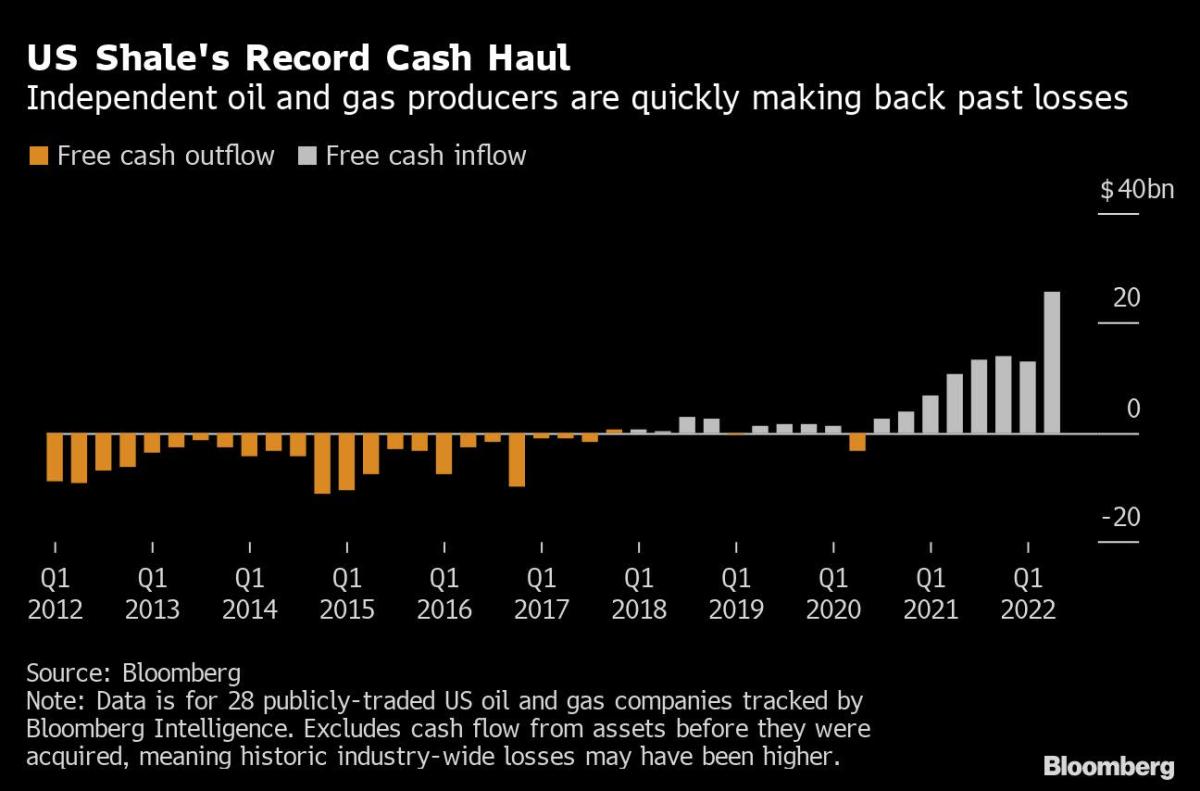

The top 28 publicly traded US independent oil producers generated $25.5 billion in free cash flow in the three months to June 30, according to estimates compiled by Bloomberg. In that space of time they’ll have made enough cash to erase one-fourth of what they lost over the previous decade.

Fracking revolutionized global energy markets by enabling American drillers to harvest shale resources that had previously been untouchable. In the space of just over 10 years, the US went from a declining crude producer to the world’s dominant oil and gas source, but at an astronomical cost: the 28 companies lost about $115 billion in the decade leading up to the Covid-19 pandemic.

For the year, free cash flow for the sector is expected to top $100 billion, more than double 2021’s bounty and and nine times larger than the combined annual takes from 2018-2020, according to Bloomberg Intelligence.

From 2020 to the end of the second quarter, they’ll have reaped more than $85 billion, according to estimates, and the gains are forecast to continue at least through the rest of this year.

It’s a vindication of the sector’s new business model that prizes profits over production growth. For consumers, it’s a sign that shale is no longer willing to fund money-losing drilling projects that ensured years of ample crude and natural gas supplies.

Sign up here for Elements, Bloomberg’s daily energy and commodities newsletter.

“Almost every single company will report record earnings and record free cash flow,” said Paul Cheng, a New York-based analyst at Scotiabank. “Even if the cost structure is trending higher, the amount of free cash flow generated will be phenomenal. This will remain even if prices pull back to $80 or $90” a barrel.

West Texas Intermediate crude, the US benchmark, is trading around $95 a barrel after touching $122 in June. Seven of the top ten stocks in the S&P 500 Index this year are oil companies or refiners. Occidental Petroleum Corp., in which Warren Buffett’s Berkshire Hathaway Inc. has been investing heavily, leads with a 117% return.

Even so, some analysts contend energy stocks are undervalued. Independent oil equities are priced as if oil will trade around $55 to $60 in the long term, even though prices may hover near $100 for years, according to Matthew Portillo, an analyst at Tudor, Pickering, Holt & Co.

Tight Fundamentals

“Stocks are discounting a recession similar to 2008 but there’s a disconnect because the crude fundamentals remain very tight,” he said. Executives will “aggressively lean into buybacks given the recent selloffs in the stocks.”

Matador Resources Co., a Permian Basin shale driller, provided an early glimpse of strong results by posting a fourfold increase in net income and doubling its dividend. But it came with a warning in the form of a 17% jump in projected capital spending due to cost inflation and plans to deploy another rig.

The hired hands of the oil patch finally have the leverage they need to boost the fees they charge to drill and frack wells for clients like Matador, far beyond what it takes to cope with inflation.

“It’s different now,” Chris Wright, chief executive officer at No. 2 frack provider Liberty Energy Inc., said in a phone interview. “The cards have generally been in our customers’ hands, not so much in our hands.”

‘Fantastic’ Returns

Halliburton Co., the world’s biggest fracker, has said the market for all the gear needed to complete new wells is almost sold out for the rest of this year and customers are already talking about plans for 2023, far earlier than expected.

Hess Corp., which estimates industry-wide inflation is running at 20%, is feeling the effects of higher costs. The New York-based explorer is holding spending relatively flat while trimming its output forecast. Drilling and fracking costs are going up by $100,000 per well in the Bakken region of North Dakota, the company’s primary theater of operations.

That burden is manageable because even at $60 oil Hess said its Bakken wells generate more than $1 billion in free cash flow.

“At current prices, those returns are fantastic,” Chief Operating Officer Greg Hill told analysts and investors during a July 27 conference call. “Certainly the movement in the oil price from a returns standpoint is outstripping any inflationary effects.”

©2022 Bloomberg L.P.