There are too many stocks in the marketplace for one person to pay attention to at any given time. I don’t try; instead one of the best tools I’ve found to filter through the market for fundamental strength is dividend payout.

Dividends are one of the simplest ways for a company’s management to express confidence in its long-term prospects, and to return value to its shareholders. Talking heads and a lot of analysts tend to focus on stock repurchases, but I think dividends are better, because they act as a passive income source that puts useful, periodic cash in shareholder’s accounts.

The pandemic-driven conditions of the last two and a half years have only reinforced the value of dividends as a fundamental metric in my system. That’s because a lot of companies chose to reduce or eliminate their dividend payouts altogether as a way to preserve cash to weather the difficult conditions imposed by COVID restrictions. While understandable, it also provided a refined method to filter quickly through the market and identify the stocks that are likely to provide the best fit for my preferred investing method. The fact that a lot of stocks also dropped to or near historical lows during that time also helped, as valuations across the board improved.

Over the last year or so, economic activity has begun to resume some form of normal activity. That is a big part of what has spurred economic growth to the point that in 2022 we’re talking about whether or not the Fed’s interest rate increases will push the economy back into a recession – or whether we might be there already. That uncertainty has pushed the market into its own legitimate bear market, which means that a lot of companies have dropped to levels that even the most hardened bargain hunters have to start thinking about. Along the way, some of the companies that previously suspended dividends have begun reinstating them. That’s increasing the pool of stocks to think about as useful candidates.

One recent example of a stock that announced a resumption of dividend payments last year is Cal-Maine Foods, Inc. (CALM). This is a company in the defensively positioned Food Products industry of the Consumer Staples sector that has historically followed a variable dividend payout policy, based primarily on whether it achieves a positive Net income result in a given quarter. Last year, management announced a $.034 per share dividend payout, followed by a $.13 per share payout in the first quarter of this year and $.75 after the latest earnings report. The resumption of its dividend, along with the increases implemented this year is a positive mark for the company’s generally improving fundamental picture.

This is also a stock that has been diverging from the pattern of the broad market, and even many stocks in the Food Products industry in 2022. After finding a 52-week high at the beginning of April at around $60 per share, the stock dropped back to a low at around $43 in June, then picked up bullish strength again to peak last week at around $56 and right around the last earnings report. The stock has been dropping off of that high in the days since, but could be approaching a useful level for a technical, bullish bounce to confirm and resume its short-term upward trend. Fundamentally, the company also includes an improving fundamental profile. Along with its current price action, the stock could be sitting at a level that makes it useful as a long-term, defensive investment during uncertain market conditions. Let’s dive in.

Fundamental and Value Profile

Cal-Maine Foods, Inc. is a producer and marketer of shell eggs in the United States. The Company operates through the segment of production, grading, packaging, marketing and distribution of shell eggs. It offers shell eggs, including specialty and non-specialty eggs. It classifies cage free, organic and brown eggs as specialty products. It classifies all other shell eggs as non-specialty products. The Company markets its specialty shell eggs under the brands, including Egg-Land’s Best, Land O’ Lakes, Farmhouse and 4-Grain. The Company, through Egg-Land’s Best, Inc. (EB), produces, markets and distributes Egg-Land’s Best and Land O’ Lakes branded eggs. It markets cage-free eggs under its Farmhouse brand and distributes them throughout southeast and southwest regions of the United States. It markets organic, wholesome, cage-free, vegetarian and omega-3 eggs under its 4-Grain brand. It also produces, markets and distributes private label specialty shell eggs to customers. CALM has a current market cap of about $2.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings grew by 2,600% (not a typo), while revenues increased by 69.5%. In the last quarter, earnings increased were almost 178% higher, while sales rose by a little over 24%. The company’s margin profile has recovered from a negative pattern that predated the pandemic. Net Income as a percentage of Revenues in the last quarter was 7.4%, and strengthened even more to 19% over the last twelve months.

Free Cash Flow: CALM’s free cash flow is very modest, at $62.15 million; however it also marks a reversal of negative Free Cash Flow over the past year. That does, naturally beg the question of whether management can maintain the positive momentum from one quarter to the next, but for now is a positive. The current number translates to Free Cash Flow Yield of 2.48%.

Debt to Equity: CALM’s debt to equity is .0, which means that CALM has no long-term debt. Their balance sheet shows about $174.5 million in cash and liquid assets. CALM has healthy, improving liquidity; a year ago, their balance sheet showed just a little over $85 million in cash.

Dividend: CALM’s dividend payouts so far in 2022, if followed consistently over time, work out to an annualized dividend of about $.87 per share. I qualify that metric because CALM has historically kept their dividend variable, and can be expected to continue to do so.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $62 per share. That suggests CALM is undervalued by about 22% right now.

Technical Profile

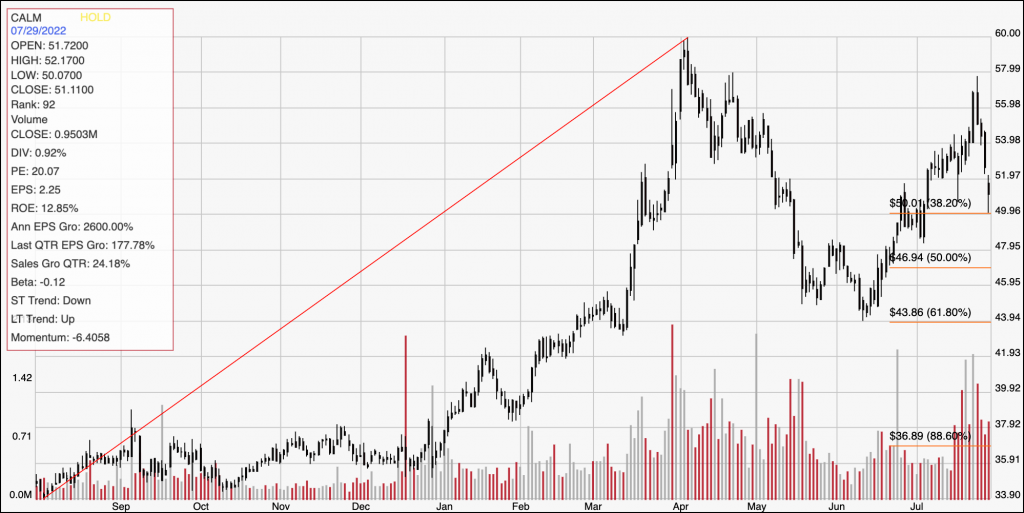

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s upward trend over the past year from a low at around 34 to its April high at $60. It also provides the reference for the Fibonacci retracement lines on the right side of the chart. The stock marked immediate resistance last week at around $56, and is approaching the 38.2% retracement line at around $49, where current support should lie. A drop below $49 should have limited downside to next support at around $48, while a push above $56 should give the stock room to retest its 52-week high at $60.

Near-term Keys: The stock’s momentum has shifted over the last month and a half, making the latest pullback an interesting study in whether the short-term upward trend can extend itself into a longer time frame. If you prefer working with short-term trading strategies, the best probabilities lie on the bullish side. A bounce off of support at $49 could be a good signal to consider buying the stock or working with call options, with immediate resistance at around $56 offering an attractive bullish target. Shorting the stock or buying put option looks like a very low-probability trade right now. The stock’s fundamentals and value proposition, however make the stock an interesting candidate to consider as a long-term investment candidate.