One of the big challenges for average investors is sifting through the mountains of information that comes from the market on a daily basis. I think that may be the biggest reason that so many investors have been conditioned over the course of decades of market activity to rely on analyst estimates or broker recommendations.

As both an analyst and an investor, I actually find the idea a little ironic, because predicting the future in any context is nothing more than pure guesswork, and any success comes by nothing but sheer luck – but we still keep trying to do it anyway. It’s one of the reasons that, a long time ago, I started studying the principles of value-based analysis.

My study led me to the writings of Benjamin Graham, who is widely credited as the father of fundamental analysis and well-known as the man who taught a young Warren Buffett the basic principles that still drive his investment philosophy today. One of the primary takeaways for me was the way that Mr. Graham didn’t use future estimates in his analysis. He preferred to boil his investment decision to a single, simple question: is the company’s book of business worth more than its stock price today? If the answer was yes, the stock was worth consideration as a long-term investment. The larger the difference between a company’s value and its actual stock price, the more compelling the argument became. Estimates about the future don’t figure into that question, or its answer, at all.

The question of how to determine the value of a company’s book of business has a lot of different possible answers. While Mr. Graham’s original data points for finding that number have become a bit dated, the basic principles he described nearly a hundred years ago still apply, and have become the foundation of the value-based system I use to identify my own investing opportunities, and that are the core of the analysis I write about every day in this space.

Now to the stock I’m using to for today’s post. Xerox Holdings Corporation (XRX) is a company that I have followed for some time, and that I have used to pretty nice effect on a number of occasions over the last few years – even during 2020 and 2021, when the entire Business Services industry this company operates in struggled as practically all of corporate America shifted to remote workforce operations and the services that support them because of COVID-19. That working model is still in place for big portions of the business wold, however there is also a push for many companies to resume some form of in-office operations. For a business that largely relies on traditional, in-office operations, that means that XRX has been focusing extensively on cost controls to survive the worst, and most persistent pandemic-driven effects in order to survive. An uptick in office activity is one of the reasons the company reported two-thirds of its business is contracted for multiple years, with a significant backlog that has already begun to unwind by more than double from a year ago. These are elements that can be expected to help drive revenue and profit growth in the quarters ahead.

XRX’s earnings reports for most of the past two years have indicated big impacts on their business that continue to be felt today. The extended effect remote work continues to have on the Business Services segment, along with the broad market’s bearish conditions this year, has pushed XRX into a strong downward trend that hit its latest low in July at around $13. The stock has since picked up a lot of bullish momentum, driving to a current level at around $17.50 that has begun to mark a new, short-term upward trend. Is the stock ready to reverse its long-term downward trend, and if it is, what does that mean for the stock value proposition right now? Let’s dive in.

Fundamental and Value Profile

Xerox Corporation is a provider of digital print technology and related solutions. The Company has capabilities in imaging and printing, data analytics, and the development of secure and automated solutions to help customers improve productivity. The Company’s primary offerings span three main areas: Managed Document Services, Workplace Solutions and Graphic Communications. Its Managed Document Services offerings help customers, ranging from small businesses to global enterprises, optimize their printing and related document workflow and business processes. Managed Document Services includes the document outsourcing business, as well as a set of communication and marketing solutions. The Company’s Workplace Solutions and Graphic Communications products and solutions support the work processes of its customers by providing them with printing and communications infrastructure. XRX’s current market cap is about $2.8 billion.

Earnings and Sales Growth: Over the last twelve months, earnings declined more than -72.3%, while sales were about -2.6% lower. In the last quarter, earnings increased dramatically, by 208.33% while revenues were about 4.75% higher. The turn to positive earnings growth in the last quarter is interesting, and may be confirmed by the company’s margin profile. Over the last twelve months, Net Income was -9.29% of Revenues, and strengthened in the last quarter to -0.23%. The positive difference is useful, however I would prefer to see Net Income in positive territory for both annual and quarterly figures to confirm the company is profitable.

Free Cash Flow: XRX’s free cash flow is generally healthy, at about $215 million over the last twelve months but it has declined over the past year, from $600 million a year ago and $511 in the quarter prior. The decline isn’t surprising against the backdrop of of the impact the pandemic has had, along with the drop in Net Income to negative territory. The current Free Cash Flow number also translates to a Free Cash Flow Yield of 7.91%. It is also worth noting that XRX’s Free Cash Flow was $0 in June of 2018, with the company showing consistent improvement in this critical metric from that point until 2020. When XRX can be expected to see its Free Cash Flow regain pre-pandemic levels is an open question that many industry experts aren’t expecting to see answered until sometime in 2023.

Debt to Equity: XRX has a debt/equity ratio of .71. That’s a conservative number that reflects management’s careful approach to debt management. Since the beginning of 2018, the company’s long-term debt has decreased from a little more than $5.2 billion to its current level of $2.76 billion (down from $3.5 billion at the end of 2021). Their balance sheet also shows more than $1.15 billion in cash and liquid assets, which means that servicing their debt isn’t a problem, and for now provides an important buffer, especially since operating profits indicate the company has been spending more than they have brought in.

Dividend: XRX pays a dividend of $1.00 per share, which translates to an annual yield of 5.69% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $14 per share, suggesting that the stock is overvalued, by -20% from its current price, with a practical discount price at around $11. An interesting side note is the fact that XRX has a current Book Value of $26.43 per share – which is about 50% above the stock’s current price.

Technical Profile

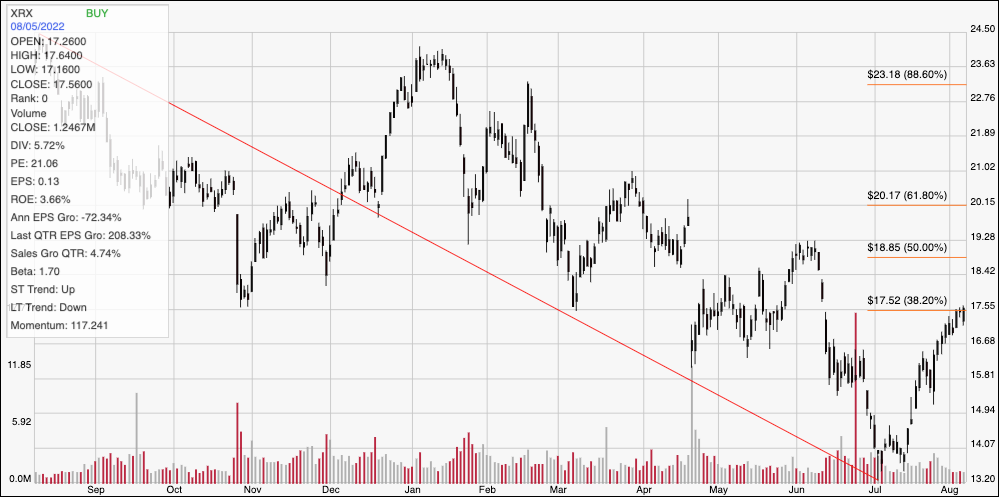

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The diagonal red line traces the stock’s downward trend from its 52-week high at around $24.50 a year ago to its July low at around $13. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that low point, the stock has picked up a significant amount of bullish momentum, driving near to the 38.2% retracement line where $17.50 appears to be providing immediate resistance, with $16.50 expected to be current support. A push above $17.50 should have room to run to about $19 before finding next resistance based on a pivot high in that area in June, along with the 50% retracement in that area. A drop below $16.50 could see the stock retest its 52-week low at around $13.

Near-term Keys: XRX’s value proposition has eroded while some of its most important fundamental metrics, like Net Income and Free Cash Flow have been seeing significant declines. Taking a long-term position in this stock given those declines right now means that you must be willing to accept the possibility of continued, long-term downside as the stock can really only be expected to stage a legitimate, long-term reversal on the back of improvements in these metrics. If you prefer to use momentum-driven trading strategies, you could consider using a drop below $16.50 to short the stock or buy put options, with a practical target price at around $13 per share. A push above $17.50 could provide an aggressive signal to think about buying the stock or working with call options, with $19 providing a practical, quick-hit profit target for a bullish trade.