A lot of the various concepts about different investing methods can be summarized into cute little sound bites that make them easier to remember and work with. One of the first ones I learned more than two decades ago has become a primary reference point for helping me think about the likelihood a stock will move the way I want: “the trend is your friend.”

For bullish traders, this saying means that if you can find a stock that is already going up, it is likely to keep going up – especially if the stock has broken above previous highs. It can also be applied to stocks in downward trend for the same kinds of traders, because downward trends generally act as warning flags for momentum-based, trend-driven investors to stay away, at least for the time being.

All of the logic I just outlined gets turned on its head a bit when you start talking about principles that drive other, longer-term investing methods and approaches. The longer my investing career has lasted, the more I’ve gravitated to value-driven strategies. Being a value investor doesn’t automatically dismiss the idea of using trends, but it is a bit counter-intuitive to some at first, because it doesn’t shy away from stocks in downward trends.

I’ve learned that those same downward trends often provide the basis for many of the best value-based investments I’ve made. That’s because even as the market tends to overprice good news and its positive expectations into stocks, it also often over-punishes bad news or less-than-rosy expectations. In the negative case, that means downward trends often push stock prices further below the “fair” values the market generally tends to give them. If the company’s core fundamental strength is still in place, the downward trend can simply be attributed to current market action. That implies the market will eventually recognize the stock’s deeply discounted status as well.

Value-driven analysis provides investors like me an opportunity to identify where those opportunities may lie before the rest of the market starts to jump onboard. Even better in my view are the cases where the stock has been following a downward trend, but begins to show strong technical signs of a reversal of that trend to bullish conditions. The early stages of that reversal can be thought of as the “sweet spot” for people like me that try to combine value-driven discipline with technical techniques.

The caveat for any long-term investing method, however, lies in the fundamental data. If the company’s fundamentals are showing deterioration, over time or across multiple metrics, there is a stronger case to make for another common idiom technicians love to quote: “the market is always right.” That’s why using value investing concepts to drive investment decisions can sometimes be challenging.

Westrock Company (WRK) is a stock in the Basic Materials sector that followed a downward trend from a 52-week high in May 2021 at around $61.50 last year, but saw the trend bottom in March of this year and then drive to its highest point in the last year at around $55 at the start of May. The stock then followed the rest of its sector sharply lower, finding a new yearly low last month at around $38 before stabilizing through the rest of the month. the stock seems to be picking up bullish momentum again, which could provide a useful momentum-based signal to think about buying the stock. Despite increasing input costs that have affected every sector of the economy, WRK is also a company that has weathered the storm of the past couple of years better than most, including many of the stocks in its sector. The question now, of course is how current conditions have impacted WRK’s value proposition. Could it offer a useful bargain-driven opportunity along with its bullish technical signs? Let’s dig in.

Fundamental and Value Profile

WestRock Company, incorporated on March 6, 2015, is a multinational provider of paper and packaging solutions for consumer and corrugated packaging markets. The Company also develops real estate in the Charleston, South Carolina region. The Company’s segments include Corrugated Packaging, Consumer Packaging, and Land and Development. The Corrugated Packaging segment consists of its containerboard mill and corrugated packaging operations, as well as its recycling operations. The Consumer Packaging segment consists of consumer mills, folding carton, beverage, merchandising displays, and partition operations. The Land and Development segment is engaged in the development and sale of real estate primarily in Charleston, South Carolina. WRK has a current market cap of $10.8 billion.

Earnings and Sales Growth: Over the past year, earnings increased 54%, while sales rose 14.6%. In the last quarter, earnings were 31.62% higher, while sales increased by about 2.56%. That positive pattern is confirmed by the company’s operating profile; over the last twelve months, Net Income was 4.41% of Revenues, and strengthened to 6.85% in the last quarter. It’s also worth noting that a quarter ago, the company’s Net Income pattern signaled potentially deteriorating conditions that this quarter’s figures show have been reversed.

Free Cash Flow: WRK’s Free Cash Flow is healthy, at $1.3 billion, and which translates to a healthy Free Cash Flow Yield of 12.54%. It does mark a decline over the last year, when Free Cash Flow was $1.47 billion, but did increase from $1.2 billion in the quarter prior. The last quarter’s increase also confirms the positive Net Income pattern described above.

Debt to Equity: WRK has a debt/equity ratio of .67, which is pretty conservative. The company’s balance sheet shows limited liquidity, with cash and liquid assets of about $360.2 million in the last quarter versus long-term debt of about $7.6 billion. The company focused for most of 2020 and 2021 on debt reduction, most of which came from the 2018 acquisition of KapStone Packaging. As of the second quarter of this year, they had retired enough of that debt to reinstate stock buybacks.

Dividend: WRK pays an annual dividend of $1.00 per share, which at its current price translates to a dividend yield of about 2.45%. After cutting their dividend by 57% in 2020 to preserve cash during the early stages of the pandemic, management increased the dividend by 20% in May of 2021 and again from $.96 at the start of this year. These are moves that signal management’s increasing confidence in the underlying strength of their business.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $50.50 per share. That suggests that WRK is undervalued by about 24% from its current price.

Technical Profile

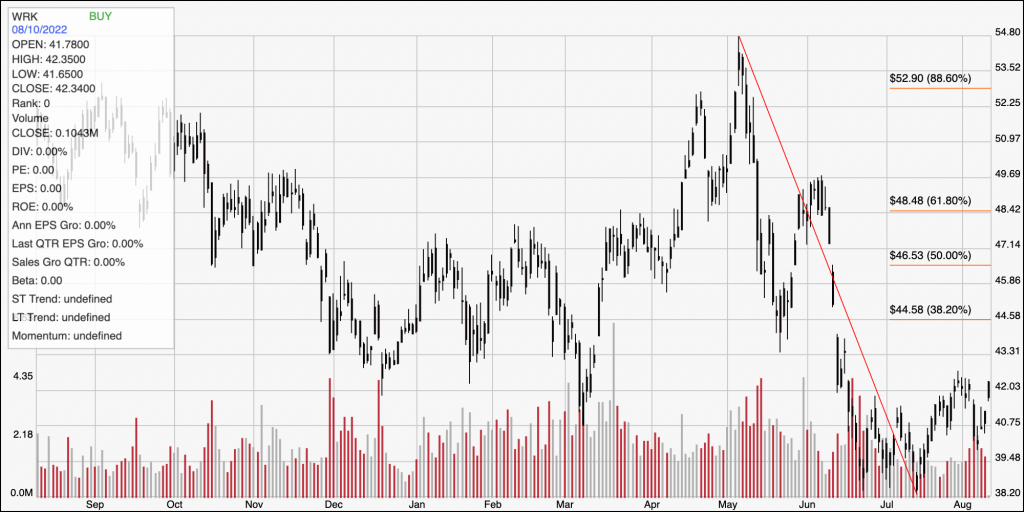

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for WRK. The diagonal red line marks the stock’s drop from its yearly high, reached in May of this year at around $55, to its 52-week, July bottom at around $38 per share. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock staged a temporary rally to its last pivot night at around $42.50, marking immediate resistance at that level, with current support at a pivot low seen last week at around $40. A drop below $40 should see the stock retest its 52-week low at around $38, while a push above $42.50 could see the stock rally to about $44.50 before finding next resistance right around the 38.2% retracement line.

Near-term Keys: WRK’s recent push off its 52-week low could be building some useful bullish momentum to support the company’s useful value proposition. I think that makes WRK a stock that is worth paying significant attention to right now. If you prefer to focus on short-term strategies, a push above $42.50 could provide an opportunity to think about buying the stock or working with call options, with $44.50 offering a reasonable profit target for a bullish trade. A drop below $40 could be a reason to consider shorting the stock or buying put options, so long as you’re ready to take profits quickly once the stock approaches $38 per share on a bearish trade.