Over the course of my investing career, I have learned to rely on a lot of fundamental data to paint a picture about the underlying strength of any stock I might consider using for a value-based investment. While some fundamental investors prefer to work with easy-to-reference, quick-glance data like earnings per share and price-to-earnings ratios, I prefer to expand my view of a company’s profitability by also looking at the company’s pattern of Net Income and Free Cash Flow growth.

Earnings per share is a useful, standardized method of describing a company’s profit in a given period on a per-share basis; but it is also a number that can be calculated a number of different ways, which means that there is quite a bit of subjectivity a creative financial manager can inject into a company’s earnings numbers. On the other hand, Net Income (income remaining after expenses) and Free Cash Flow (the cash left after operating expenses and capital expenditures) are generally more straightforward measurements with less malleability, which is why I find them generally more reliable. That doesn’t mean earnings don’t have a place in my process – instead, I like to use all three measurements together. A pattern of growth in all three metrics is ideal, while divergences in one or more of these data points relative to the others can signal problems that need to be examined in more detail.

One of the stocks that has become like an old, familiar friend for me over the last couple of years is Bristol-Myers Squibb Company (BMY). This is a stock that I had already followed for about two years and used a few times to nice overall effect in 2020, but that hasn’t drawn a ton of attention this year has focused on inflation, interest rate increases, and the long-term impact of the conflict in Ukraine, along with Russia’a increasing, global isolation as a result.

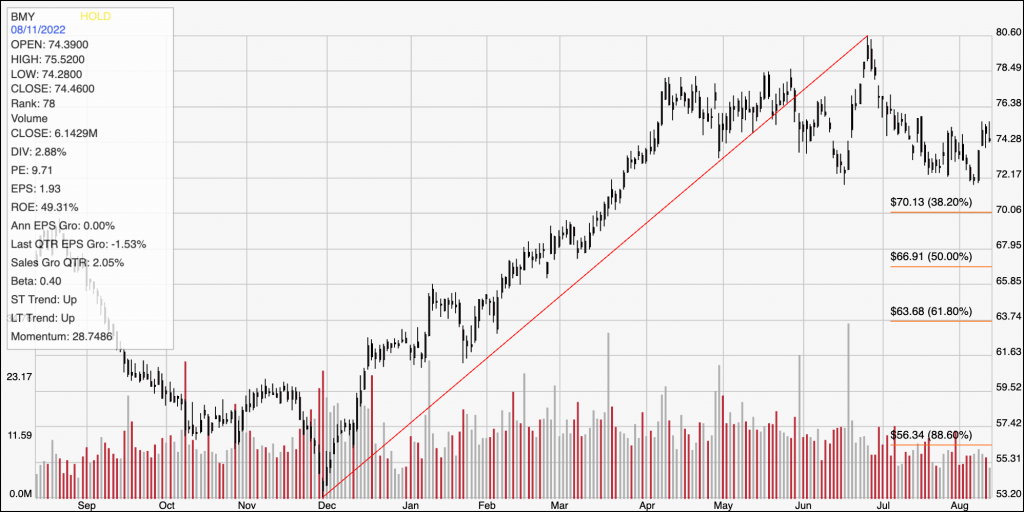

The simple fact is that while many want to push the pandemic into the background, COVID continues to push health care facilities and medical professionals to their limits. I think part of that is a reflection of the reality that, besides COVID, there is still a need for other, “normal” types of health care as well. I think that is where BMY has an important role to play not only in society but in a smart investor’s watchlist right now. This is a stock that has been following a strong, sustained upward trend since the end of 2021, rising from about $53 per share in early December 2021 and reaching a peak at around $81 in late June. The stock has tapered lower since then, hitting major support at around $72 earlier this week.

My read on the stock’s latest technical pattern is that it could be an opportunity – a breakout above the top of the range – possibly above the stock’s yearly high – would be considered a continuation of the longer-term upward trend, while a drop below recent support could signal a bearish trend reversal – for growth-oriented traders who like to focus on swing and momentum-driven trading strategies. From the standpoint of value, it’s tough to draw a single conclusion. The company’s fundamental strengths include healthy Free Cash Flow and ample liquidity, counterbalanced by some recent drawdowns in operating margins that can broadly be attributed to rising input costs that have affected every sector of the economy and have forced multiple interest rate increases this year, with a high likelihood of additional increases through the rest of the year.

On any industry level, BMY boasts one of the strongest, long-term development pipelines in the Pharmaceutical industry that became even less concentrated and more diversified with the completion of its 2018 Celgene acquisition. I think the new, combined company dovetails nicely with what I believe will inevitably be an increased level of scrutiny and attention – appropriately so, and in the long run, to our collective benefit – on proper health and care on an individual level. Is that enough to make the stock a useful value near a historical high price? Let’s dive in to the numbers.

Fundamental and Value Profile

Bristol-Myers Squibb Company is engaged in the discovery, development, licensing, manufacturing, marketing, distribution and sale of biopharmaceutical products. The Company’s pharmaceutical products include chemically synthesized drugs, or small molecules, and products produced from biological processes called biologics. Small molecule drugs are administered orally in the form of a pill or tablet. Biologics are administered to patients through injections or by infusion. The Company’s products include Empliciti, Opdivo, Sprycel, Yervoy, Eliquis, Orencia, Baraclude, Hepatitis C Franchise, Reyataz Franchise and Sustiva Franchise. It offers products for a range of therapeutic classes, which include virology, including human immunodeficiency virus (HIV) infection; oncology; immunoscience, and cardiovascular. Its products are sold to wholesalers, retail pharmacies, hospitals, government entities and the medical profession across the world. BMY has a current market cap of $159 billion.

Earnings and Sales Growth: Over the last twelve months, earnings growth was flat, at exactly 0%, while sales increased about 1.6%. In the last quarter, earnings were -1.5% lower while sales increased by a little over by 2%. BMY’s Net Income versus Revenue over the last twelve months was 14.04%, and weakened to 11.95% in the last quarter. I take this as an indication that, like just about every business right now, BMY is struggling with an inflationary environment that is increasing costs on a broad basis.

Free Cash Flow: BMY’s Free Cash Flow is healthy, at a little over $14.2 billion. That marks a decline from about $14.8 billion a year ago and $15.1 billion in the prior quarter. It also translates to a Free Cash Flow Yield of 8.93%. The strength in this number implies that the company’s ability to service its debt, maintain its dividend and keep its business growing remains intact.

Debt to Equity: BMY has a debt/equity ratio of 1.14 – a high number that is primarily attributed to the debt assumed during the completion of the Celgene deal. As of the last quarter, cash and liquid assets were about $13.3 billion versus $37.1 billion in long-term debt. Pre-merger, BMY had just $5.3 billion in debt versus more than $8 billion in cash; however management as well as most analysts predicted the deal would be immediately accretive. So far that appears to be the case, which means the high debt level continues to be more than serviceable. I think it is also worth noting that long-term has declined by about $2.8 billion since the beginning of 2022.

Dividend: BMY pays an annual dividend of $2.16 per share (increased at the beginning of 2022 from $1.96 per share), which at its current price translates to a dividend yield of about 2.9%. Management also increased the dividend from $1.80 per share, per annum in mid-2020. An increasing dividend is a strong signal of management’s confidence in its business strategy and overall financial strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $76 per share. That suggests that BMY is close to its fair value, with 2% upside from its current price and a practical discount price at around $61. This metric has decreased from its $83.50 fair value target in February of this year.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the last year of price activity for BMY. The red diagonal line traces the stock’s upward trend from its December 2021 low at about $53 to its latest high at about $81; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From that high, the stock slid back to find current, major support at around $72 last week, with immediate resistance at around $76.50. A push above $76.50 should give the stock room to test the stock’s 52-week high at around $81, while a drop below $72 could have somewhat limited downside, with the 382.% retracement line providing next support at about $70 per share.

Near-term Keys: BMY’s fundamental profile is healthy in many respects, with a useful decrease in long-term debt helping to keep the company’s financial flexibility strong. That said, the current decline in Net Income has extended over the last two quarters, and is reason enough to accept the fact that the stock doesn’t offer a useful value at its current price. I would look for the stock to either break down into the low $60 range, or show more material improvements in its fundamental metrics that improve the argument for a higher value-driven price first. If you prefer to work with short-term trading strategies, a push above resistance at $76.50 could offer an opportunity to buy the stock or work with call options, with about $4.50 of immediate upside to $81 as a good bullish profit target. A drop below $72 could be a signal to think about shorting the stock or buying put options, using $70 as a practical profit target on a bearish trade.