Every year, market watchers and talking heads look for a central narrative that can weave the market and economy’s movements into a single cohesive thread. That storyline often focuses on one of any number of factors – economic, political, or social – that history has proved can impact the market in a material way.

Through the latter part of 2021 and into this year, the pandemic has consistently defied attempts to look past its effects and global impact. Variants of the virus sparked multiple infection waves through 2021 that kept hospitalizations high and strained the health care system in general. As 2022 started, some of those effects seemed to have tapered enough that the narrative began to shift its focus to questions about the pace of inflation and the increases in interest rates that have come as a result.

For most of this year, the COVID discussion has taken a back seat to questions about inflation, interest rates, and the global issues that are constraining supply and keeping prices high. While news and global attention is focused elsewhere, the pandemic isn’t going away. Even while local and national governments are moving to endemic-phase monitoring and management, the fact remains that the risk of new variants can’t be entirely dismissed as we’ve seen at least two new virulent strains this year alone. I believe that means that research into the long-term efficacy of current vaccines will be an ongoing concern, with continued emphasis on encouraging vaccinations and booster shots. The good news is that for the nRNA vaccines available in the U.S., updates to vaccines, if needed, are easier and less time-consuming than for other vaccine types.

For pharmaceutical companies like Pflizer Inc. (PFE) that have led the global effort to development, deliver and administer vaccines around the globe, I think vaccines will remain relevant well into the next year. This week seems to have confirmed that idea after the FDA approved booster shots of the Pfizer vaccine for children between the ages of 5 and 11. After accounting for an even split of those proceeds with its partner, PFE predicted their COVID mRNA vaccine – the first to be approved in the U.S. – would contribute $15 billion in sales for 2021 in their first quarter earnings report. The actual numbers came in even better; for PFE’s second fiscal quarter, COVID sales were 41% of total sales, amounting to a reported $7.8 billion in that period alone.

Even more appropriate to what all hope becomes and endemic-phase condition, is the fact that vaccines are just one part of a diversified pharmaceutical company’s development pipeline. PFE’s dominant position for COVID vaccines (Pfizer vaccines are estimated to account for about 70% of all vaccinated individuals, of any age, in the U.S.) gives it additional resources to invest in its robust pipeline of drugs in other important segments, including oncology. Oncology, in fact is expected to remain solid as growth in new, emerging drugs should offset declines in known names like Lyrica and Enbrel.

As one of the leading pharmaceutical companies in the industry, PFE boasts a broad portfolio with eight separate drug brands that each account for more than $1 billion in annual sales, but none that contribute more than 14% of total revenue (not counting its COVID vaccine). They also have a large development pipeline, especially as already mentioned in oncology drugs where most analysts see strong long-term growth that should offset the effect of increased competition in existing brands as patent protections expire and biosimilar and generic drugs start to take up market share.

PFE’s stock price hasn’t dropped as much as a lot of other stocks this year, but it is -15% below its starting point for the year, with indications that many of the broad economic concerns, including rising inputs are having an impact on its bottom line. Even so, the company’s leading position in its industry and continued, positive results from sales of its COVID vaccine have it on solid fundamental footing. Does that suggest that the stock’s underperformance in 2022 could translate to a useful opportunity for long-term oriented investors? Let’s find out.

Fundamental and Value Profile

Pfizer Inc. (Pfizer) is a research-based global biopharmaceutical company. The Company is engaged in the discovery, development and manufacture of healthcare products. Its global portfolio includes medicines and vaccines, as well as consumer healthcare products. The Company manages its commercial operations through two business segments: Pfizer Innovative Health (IH) and Pfizer Essential Health (EH). IH focuses on developing and commercializing medicines and vaccines, as well as products for consumer healthcare. IH therapeutic areas include internal medicine, vaccines, oncology, inflammation and immunology, rare diseases and consumer healthcare. EH includes legacy brands, branded generics, generic sterile injectable products, biosimilars and infusion systems. EH also includes a research and development (R&D) organization, as well as its contract manufacturing business. Its brands include Prevnar 13, Xeljanz, Eliquis, Lipitor, Celebrex, Pristiq and Viagra. PFE has a current market cap of $277.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 90.65%, while revenues grew by about 46%. In the last quarter, earnings rose by almost 26% while sales were a little more than 8% higher. The company’s margin profile is healthy, and strengthening; over the last twelve months, Net Income as a percentage of Revenues was 28.92%, and increased to 35.7% in the last quarter.

Free Cash Flow: PFE’s free cash flow is very strong, at more than $28.4 billion over the last twelve months. That does mark a decline from about $29.8 billion a year ago, and $31.8 billion in the last quarter. The current number translates to a Free Cash Flow Yield of 10.12%.

Debt to Equity: PFE’s debt to equity is .39, which is a conservative number. The company’s balance sheet indicates that operating profits are more than adequate to service their debt, with healthy liquidity to provide additional flexibility. Cash and liquid assets were about $28.4 billion in the last quarter, while long-term debt was $34.3 billion – down from $49.7 billion at the beginning of 2021. I don’t see the high debt number as a major red flag, given that the company has been directing a major portion of its focus to COVID-19 vaccine development and distribution, and to debt reduction. It is worth noting that the real profit opportunity in the vaccine wasn’t seen in the initial implementation and distribution. Profitability comes, as anticipated by management and many industry analysts, from the ongoing need for boosters, in similar fashion to the yearly flu or pneumonia booster that doctors generally recommend for just about everybody.

Dividend: PFE’s annual divided is $1.60 per share, and which translates to a yield of about 3.19% at the stock’s current price. It is also noteworthy that the dividend increased at the beginning of 2020 from $1.52 per share, and from $1.56 in mid-2021, and which I think provides a useful indication of management’s confidence in their approach.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $53.50 per share. That means that PFE is modestly undervalued right now, by about 8%.

Technical Profile

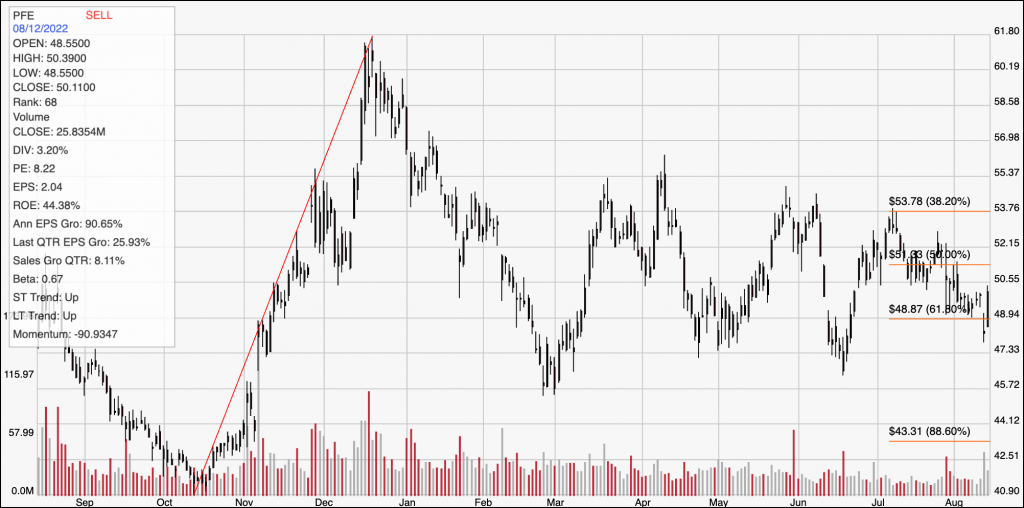

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s upward trend from a 52-week low at around $41 per share in October of 2021 to its peak in December at around $62. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. After dropping back to a low in March at around $45.50, the stock has settled into a mostly sideways trend, with a trading range between support and resistance that appears to be narrowing. Current support is at around $48, a little below the 61.8% retracement line, with immediate resistance at around $51.50 and around the 50% retracement line. A push above $51.50 should see next resistance at around $54, a little above the 38.2% line, while a drop below $48.50 should find next support at around $46, based on pivot low activity in that price range in June and February of this year.

Near-term Keys: PFE’s balance sheet has nearly “fortress”-level strength, with robust free cash flow to provide additional stability and growth potential along with improving profitability. The current decline in free cash flow and cash is a concern, as they do reflect what I attribute as rising input costs that are rippling into every sector of the economy; however PFE has a lot of flexibility to work with and better ability than most companies to ride through what could simply be a cyclical concern. PFE’s value proposition is modest, falling short of interesting enough to make the stock something to consider using right now for a long-term investing opportunity. If you prefer to focus on short-term trading strategies, you could use a push above $51.50 as a signal to consider buying the stock or working with call options, using a bullish near-term target price at around $54 to take profits. You could also use a drop below $48.50 as an opportunity to think about shorting the stock or buying put options, using $46 as a practical bearish target.