The Technology sector was a bright spot throughout 2020 and 2021, and a primary reason the economy managed to recover quickly from its initial collapse in the early stages of the COVID-19 pandemic. It has also led the market into clearly bearish territory throughout this year.

One of the reasons the sector led the market higher until 2022 is because so much of the shift to remote, work-from-home operations for corporate America, contactless sales and delivery methods now being used by a lot of retail businesses, and many of the safety protocols factories and production facilities were forced to put in place are driven or enabled by technology solutions. That drove investors to flock to stocks that specialize in remote networking, conferencing and cloud-based solutions, including digital transaction handling and CRM services. Many of these companies defied the broader economic trend and managed to post impressive results.

With persistent pressures on chip production and supply that have extended over more than the past three years, and have yet to fade, and mixed with broader concerns coming from high inflation and the increasing hawkishness of the Fed’s interest rate policy, it seems unlikely that a major market recovery is likely before 2023. The global geopolitical pressures that are also a world reality from Russia’s continued war in Ukraine have exacerbated supply constraints in the energy sector, raising the price of crude and natural gas across the world compared to pre-2022 levels, which only adds fuel to the bearish fire. While the Tech sector hasn’t been immune from broad market uncertainty, many of the stocks that make up this industry, and the companies that drove the economy’s success in 2020 and 2021 continue to show healthy bottom-line results that the market isn’t factoring into their stock price.

Cognizant Technology Solutions (CTSH) is a professional services company that works with companies in a variety of sectors with a focus on software development and digital platform engineering services for its clients. That puts CTSH in the IT Services industry, which is, at least in part, an area that has continued to see healthy demand as more companies have been forced to identify ways to use technology to shift their operational and business focus. Economists and smart investors are likewise putting a big focus on companies with healthy balance sheets to help ride through any uncertainty that may extend into a longer-term period of time, and CTSH is company that, despite experiencing its own pressures over the course of the last two years, looks to fit that bill.

From its own bear market low at around $40, the stock rallied to a peak in December 2020 at around $83. The stock pushed to as high as $93.50 in March of this year before following the rest of the market into its own bear market, hitting a low in July at around $63. From that point, the stock has stabilized and could be setting up for a new, bullish trend reversal. What about value? Are the stock’s latest fundamentals strong enough to suggest it could be a good value at its current price? Let’s find out.

Fundamental and Value Profile

Cognizant Technology Solutions Corporation is a professional services company. The Company operates through four segments: Financial Services, Healthcare, Manufacturing/Retail/Logistics, and Other. The Financial Services segment includes customers providing banking/transaction processing, capital markets and insurance services. The Healthcare segment includes healthcare providers and payers, as well as life sciences customers, including pharmaceutical, biotech and medical device companies. The Manufacturing/Retail/Logistics segment includes manufacturers, retailers, travel and other hospitality customers, as well as customers providing logistics services. The Other segment includes its information, media and entertainment services, communications and high technology operating segments. Its services include consulting and technology services and outsourcing services. Its outsourcing services include application maintenance, IT infrastructure services and business process services. CTSH has a current market cap of $35.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by a little more than 15%, while sales increased by 7%. In the last quarter, earnings improved by 5.56% while Revenues growth was 1.66%. CTSH’s Net Income versus Revenue is healthy, at 11.74% over the last twelve months, and 11.76% in the last quarter.

Free Cash Flow: CTSH’s Free Cash Flow is healthy, at about $2.33 billion. That number is roughly in line with last quarter’s mark at $2.3 billion, and above its $2.26 billion mark from a year ago. The current number translates to a Free Cash Flow Yield of 6.43%.

Debt to Equity: CTSH has a debt/equity ratio of .05, which is extremely low and a good reflection of the company’s very conservative approach to leverage. Their balance sheet shows about $2.32 billion in cash and liquid assets (down from $2.7 billion two quarters ago) against about $608 million in long-term debt. Their operating profile and high liquidity are good indications CTSH has the financial flexibility to adapt to ongoing changes in the markets it operates in. They are also using that flexibility to expand their digital services both organically, through in-house research and development, and inorganically via acquisition.

Dividend: CTSH pays an annual dividend of $1.08 per share, which at its current price translates to a dividend yield of about 1.54%. That is modest, but it is less than 25% of the stock’s earnings per share over the last twelve months – a conservative payout ratio that actually helps bolster the company’s balance sheet strength. It is also noteworthy that in the early part of 2021, CTSH’s dividend was $.88 per share, and $.96 per share prior to the first quarter of this year when management announced the last dividend increase.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at about $76.50 per share. That means that the stock is undervalued, with 11% upside from the stock’s current price. It also puts its “bargain price” at around $61 per share.

Technical Profile

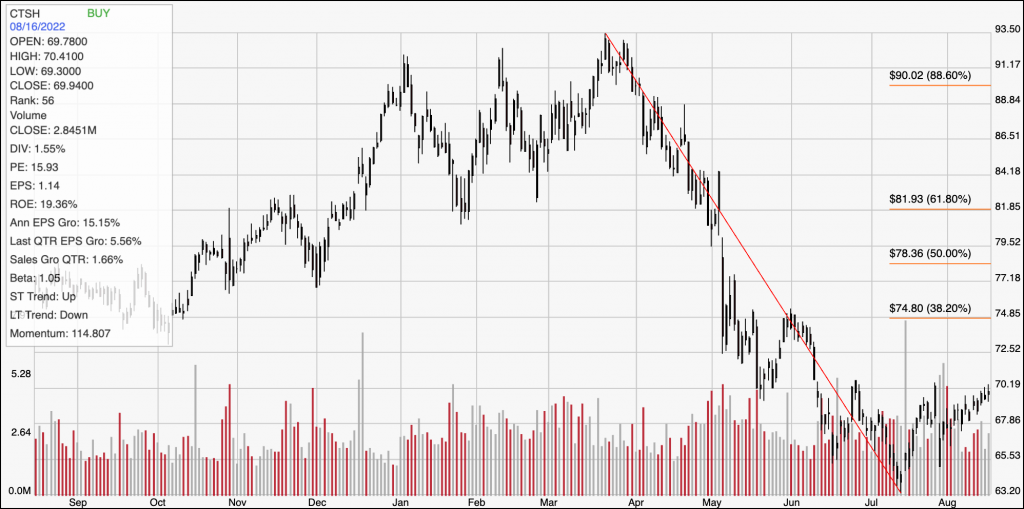

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity; the diagonal red line traces the stock’s downward slide to bear market territory from its March high at around $93.50 to its recent low at around $63. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has been rallying off of that low, marking current support at $65, with immediate resistance at around $70. A push above $70 should have short-term upside to about $74, based on a pivot high at the end of May, with additional resistance at around $75 from the 38.2% retracement line if buying activity increases. A drop below $65 should find next support at the stock’s yearly low around $63. Practically speaking, the stock would need to break above $75 to mark a confirmed bullish reversal.

Near-term Keys: The stock’s fundamentals continue to be very strong, showing that CTSH has weathered the difficulties of the past two and a half years well; but even with the stock’s drop to bear market territory over the last few months, the stock’s value proposition isn’t quite compelling. I also think that current market conditions make any kind of bullish short-term bet right nowspeculative. If you prefer to work with short-term strategies, a push above resistance at $70 could offer an interesting, albeit aggressive signal to buy the stock or to work with call options, with $74 providing a practical, quick-hit profit target on a bullish trade. A drop below $65 would offer a signal to consider shorting the stock or buying put options; in that case, next support at around $63 offers a useful profit target for a bearish trade.