One of the big recovery stories over the past year or so has come from the Aerospace industry, which includes commercial airlines. From a disastrous 2020, and the first part of 2021, this is a sector that was radioactive not so long ago.

The “reopening” theme that became a part of market commentary in the second half of 2021 meant looking for pockets of the economy where the relaxation of pandemic-driven social restrictions would translate to useful increases in economic activity. A lot of economists and analysts pointed at this industry as one to watch, since many were predicting a recovery in travel demand as consumers started to exercise long-pent-up desires to get out, take vacations, and see family and friends.

There are two principle commercial airline producers in the world, which is where a proper examination of the Airline industry should start. Those companies are Boeing and Airbus. Boeing’s problems predate the pandemic; the company spent practically all of 2019 dealing with the negative impact of fatal crashes of its popular 737 MAX jet that killed all passengers on board. Those crashes were attributed to failures in the planes’ sensor system, resulting in the global grounding of the jet all over the world as the company went back to the drawing board. The MAX was formally cleared to return to service by the FDA in December of 2020, clearing the way for travel to pick up again as social and business activity gradually finds its way back, with some optimists predicting travel demand could match pre-pandemic levels sometime in 2023, but more pessimistic analysts suggesting it could take until 2025.

This year’s market volatility has been characterized by inflation, the reality of rising interest rates, and how long the Fed will maintain the aggressive pace it has followed so far in 2022. Those are current issues that can’t be dismissed, but being a contrarian by nature often means looking past current pressures and thinking about much longer-term trends. That normally means that industries that have been out of favor, but look like they could be in position to recover, start to naturally look a bit more attractive, especially in the long term. Many of the most well-known, commercial airlines in the Aerospace industry were hammered by the collapse in consumer and business travel, with modest gains since the second half of 2021 and into this year that still haven’t offset the loses they were forced to absorb in 2020. Even so, there are also bright spots that have managed to buck that broader trend. Raytheon Technologies Corp. (RTX) is an example.

In the commercial airline segment, RTX’s biggest customer isn’t Boeing – it’s Airbus, which before COVID-19 became a global issue was drawing a number of Boeing customers to its business in the wake of the MAX grounding. RTX is also a major player in the government-funded Defense space, which has historically proven to be resilient and even resistant to economic downturns. The pandemic proved the value of RTX’s Defense business, as 2021’s earnings reports demonstrated that segment backstopped the entire company, putting it in position to recover more quickly than other companies whose businesses are closely tied to Boeing.

Strength in their Defense business didn’t completely offset Commercial travel losses in 2020, but they did nonetheless help their balance sheet absorb the hit better than a lot of other businesses, in this industry and others. The company completed a merger in April of 2020 with Raytheon, which increased its defense and intelligence business to nearly 60% of annual revenues. That gives RTX a backstop of revenue and cash flow that has enabled it to exercise patience with its commercial business, and that most other companies in the industry probably don’t have. I also believe another likely, long-term tailwind lies in the grim reality of the conflict in Ukraine. Continued tension between Russia and the West implies that military spending will increase, for the U.S. and other NATO nations.

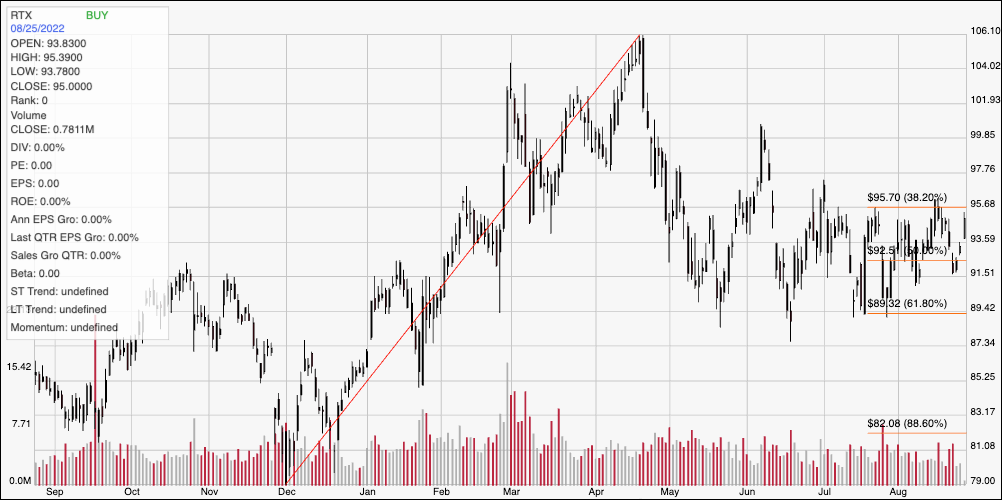

The market has recognized RTX’s strength this year, pushing its price from a November 2020 low at around $52 to a high in April at around $106. The stock dropped back sharply off of that high to a low at around $89 in May and has since established a consolidation range between $89 and $96, with the stock nearing the top end of that range as of this writing. Are the company’s fundamentals still strong enough to make the stock a useful at its current price? Let’s find out.

Fundamental and Value Profile

Raytheon Technologies Corp, formerly, United Technologies Corporation is engaged in providing high technology products and services to the building systems and aerospace industries around the world. The Company operates through segments such as Pratt & Whitney and Collins Aerospace Systems. The Pratt & Whitney segment supplies aircraft engines for the commercial, military, business jet and general aviation markets. Pratt & Whitney segment provides fleet management services and aftermarket maintenance, repair and overhaul services. The Collins Aerospace Systems segment provides aerospace products and aftermarket service solutions for aircraft manufacturers, airlines, regional, business and general aviation markets, military, space and undersea operations. RTX has a current market cap of $140 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 12.6%, while sales were 2.73% higher. In the last quarter, earnings growth was flat, but positive by about 0.87% while Revenues were 3.81% higher. RTX’s Net Income versus Revenue over the last year was 6.84%, and strengthened somewhat in the last quarter to 7.99%.

Free Cash Flow: RTX’s Free Cash Flow has been strengthening over the last year. In the last quarter, free cash flow was a little over $4.55 billion from about $3.5 billion a year ago. In the quarter prior, this number was about $4.7 billion. The current free cash flow number translates to a modest Free Cash Flow Yield of 3.3%.

Debt to Equity: RTX has a debt/equity ratio of .43, which is very conservative, and marks a drop from 1.03 in the first quarter of 2020. Their balance sheet shows about $4.7 billion (versus $7.8 billion two quarters ago) in cash and liquid assets against $31.2 billion in long-term debt (versus $45.3 billion at the end of the first quarter of 2020). Servicing their debt is no problem.

Dividend: RTX pays an annual dividend of $2.20 per share, which at its current price translates to a yield of 2.36%. 15It should be noted that early in 2020, management announced it was reducing the dividend from $2.94 to $1.90 per share, a cost-cutting measure that can be interpreted as positive or negative depending on your general view. Management raised the dividend in 2021 to $2.04, and then again to its current level at the beginning of this year, which I take as a sign of increasing strength.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $107.50 per share, which suggests that the stock is undervalued at its current price, by about 15%.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line follows the stock’s upward trend from its February 2021 low to its peak, reached in April at around $106 per share. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. After falling to a low at around $89 in May, the stock settled into a consolidation range, with top=end, immediate resistance at around $96, and current support sitting at the stock’s most recent pivot low around $92. A drop below $92 should find next support at the bottom of the consolidation range and inline with the 61.8% retracement line at around $89, while a push above $96 could have short-term upside to about $100 before finding next support at a pivot high that was reached in early June in that range.

Near-term Keys: RTX’s balance sheet has remained solid throughout the past year, despite the sizable headwinds in its commercial business, and the inevitable impact they’ve carried since the start of the pandemic. I think that resilience is largely a reflection of the company’s operations in the Defense space along with aggressive cost-cutting measures it took during the early stages of the pandemic in its commercial business. It is also interesting that, despite the stock’s increase in price since 2020, the value proposition is still useful. Remember that Aerospace – and airlines in particular – is an economically-sensitive industry, which means that these stocks can continue to be volatile depending on the state of current economic conditions. That means that if you decide to use RTX as a long-term investment, you need to be willing to accept some additional volatility in this stock as long broader economic questions persist. If you prefer to focus on short-term trading strategies, a drop below $92 could be a good signal to consider shorting the stock or buying put options, using $89 as an practical bearish trade target, while a push above $96 could be a good signal to buy the stock or work with call options, with upside to about $100 on a bullish trade, and possibly $102 if buying momentum accelerates.