(Bloomberg) — US equity futures slid along with Asian stocks on Monday and the two-year Treasury yield reached the highest since 2007 after Federal Reserve Chair Jerome Powell signaled higher-for-longer interest rates.

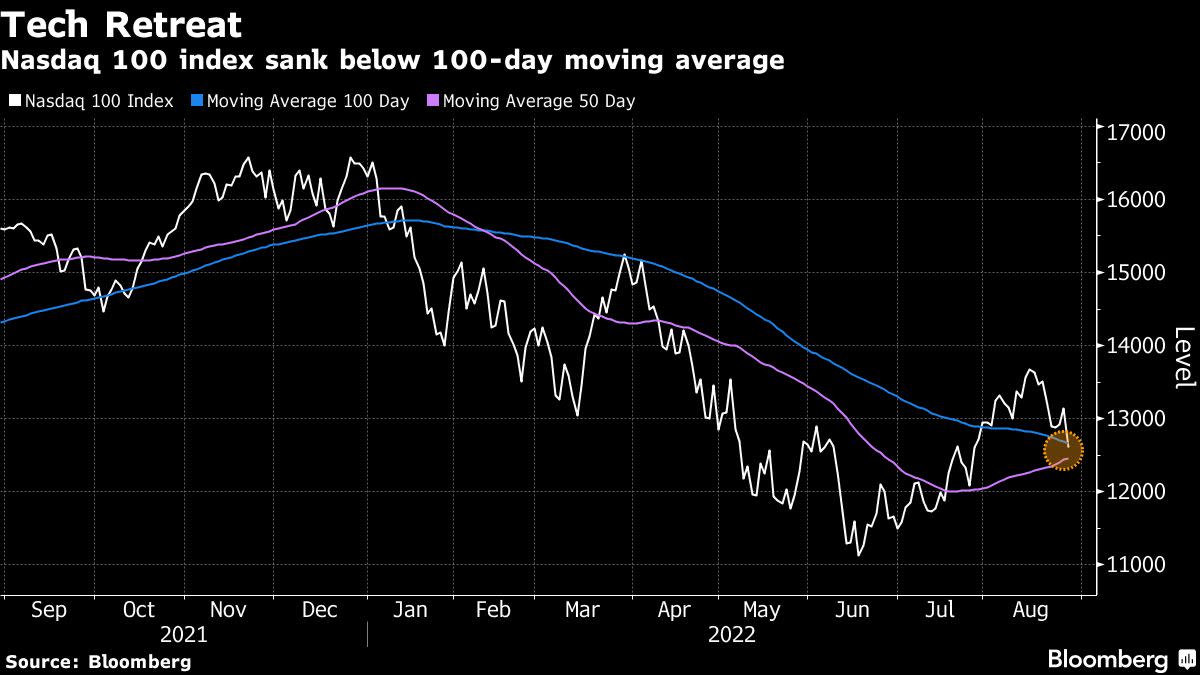

Contracts for the tech-heavy Nasdaq 100 and the S&P 500 fell 1% or more, while bourses in Japan, South Korea and Australia shed about 2%.

The dollar pushed toward a more than one-month high with commodity-linked currencies, the yen, the pound and the offshore yuan all under some pressure.

Bonds sold off amid a deepening inversion of the US yield curve that underscores expectations of a recession under tightening monetary policy.

Powell in his address last week at the Fed’s Jackson Hole symposium flagged the likely need for restrictive monetary policy for some time to curb high inflation and cautioned against loosening monetary conditions prematurely. He also warned of the potential for economic pain for households and businesses.

Those comments contrast with market bets for reductions in borrowing costs next year as growth slows. The locus for much of the investor angst is the equities market, further undoing a bounce in global shares from the bear-market lows of mid-June.

Powell signaled “once they get to whatever the final hike is, they’re going to stay there for a while,” Charles Schwab & Co. Chief Investment Strategist Liz Ann Sonders said on Bloomberg Television. “The market had trouble digesting that.”

Bitcoin broke below the $20,000 level some view as a marker of a deeper slide in investor sentiment. Gold wavered but crude oil made modest gains.

Futures for Hong Kong’s bourse edged up earlier after a gauge of US-listed Chinese shares weathered much of Friday’s equity market rout.

That may reflect optimism about a preliminary deal between Beijing and Washington to ease a dispute over reviewing audits of Chinese firms. An agreement is needed to avert the delisting of about 200 Chinese companies from US exchanges.

Here are some key events to watch this week:

- US Conf. Board consumer confidence, Tuesday

- New York Fed President John Williams speaks with the Wall Street Journal about the US economic outlook, Tuesday

- ECB Governing Council members Robert Holzmann, Yannis Stournaras, Madis Muller and Pierre Wunsch speak about “Inflation: Can Central Banks Cope?” at event Tuesday through Sept. 2

- China PMI, Wednesday

- Euro zone CPI, Wednesday

- Russia’s Gazprom is set to halt gas flows through the key Nord Stream pipeline for three days of maintenance, Wednesday

- Cleveland Fed President Loretta Mester discusses the outlook for the economy and monetary policy at an event Wednesday

- China Caixin manufacturing PMI, Thursday

- US nonfarm payrolls, Friday

- UK leadership ballot closes Friday. Winner announced Sept. 5

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 1% as of 9:37 a.m. in Tokyo. The S&P 500 fell 3.4%

- Nasdaq 100 futures dropped 1.4%. The Nasdaq 100 shed 4.1%

- Japan’s Topix index fell 2%

- Australia’s S&P/ASX 200 index lost 1.7%

- South Korea’s Kospi dropped 2.3%

Currencies

- The Bloomberg Dollar Spot Index rose 0.3%

- The euro was at $0.9937, down 0.3%

- The Japanese yen was at 138.27 per dollar, down 0.5%

- The offshore yuan was at 6.9138 per dollar, down 0.3%

Bonds

Commodities

- West Texas Intermediate crude was at $93.30 a barrel, up 0.3%

- Gold was at $1,735.25 an ounce, down 0.2%

©2022 Bloomberg L.P.