(Bloomberg) — Worried? Yes. But investors have evinced few signs of panic amid a stock market drubbing that has wiped out $3 trillion, going by everything from fund flows to options trading.

One sign nerves are in check: as the S&P 500 dropped more than 3% Friday, the Cboe Volatility Index, a measure of options cost that’s also known as VIX, was stuck near 25, lower than in the six other instances this year when stocks sold off like this.

Exchange-traded fund investors, disheartened by Federal Reserve Chair Jerome Powell’s hawkish remarks at Jackson Hole, quickly pulled money out of stocks. Yet at $1.2 billion, the amount of withdrawals was roughly half the daily outflow experienced around the market’s June low.

Light positioning among professional investors has helped keep emotions in check. Mutual funds are in defensive postures, parking money in cash, while hedge funds cut exposure ahead of market catalysts such as Powell’s speech and looming data on employment and inflation. The lack of full-blown capitulation is a sign that the carnage is not over, especially when rules-based funds and pensions are expected to offload shares in coming days.

“The market traded like hedges were monetized as opposed to added during the move lower,” said Danny Kirsch, head of options at Piper Sandler & Co. “Positioning already short, meaning no need to add downside. Or investors hope this selloff will be contained.”

Stocks extended a two-week decline, with the S&P 500 losing 0.7% Monday. Traders continued to digest a flurry of hawkish remarks from the world’s top central bankers that inflation is here to stay and will require their forceful action to bring it under control. The VIX added 0.65 to 26.21.

“Friday’s sub-30 VIX close says this week could be somewhat worse,” said Nicholas Colas, co-founder of DataTrek Research. “Another down +3 percent day would not be surprising, and we suggest looking for a VIX close in the 30s before establishing new long positions.”

Sentiment was cautious heading into Powell’s Friday speech, after a two-month rally since mid-June forced short sellers to unwind wagers. During the week through Thursday, hedge funds tracked by Goldman Sachs Group Inc. were busy boosting short positions, particularly through macro bets like ETFs or index futures. Their selling in macro products over the stretch was the largest in eight weeks.

At Morgan Stanley, hedge fund clients kept their positioning light. As of Thursday, leverage among long-short funds stood at 43%, down from 48% two weeks ago and lower than 88% of the time in the past five years.

The firm’s trading desk warned about further selling pressure from computer-driven traders as well as funds that need to rebalance their asset allocation at the end of the month. Systematic macro strategies, who were buyers of an estimated $8 billion of equities last week, will now flip to sellers this week, potentially unloading $10 to $15 billion of stocks as volatility picks up, the team’s model shows. Meanwhile, pension and asset allocators are likely to sell $10 billion of shares.

Investors hoping for a friendly Fed just got a rude awakening that the central bank, laser focused on taming red-hot inflation, is no longer the market’s big ally. Bringing down prices “is likely to require a sustained period of below-trend growth” and an increase in unemployment, Powell said Friday at the Kansas City Fed’s annual policy forum.

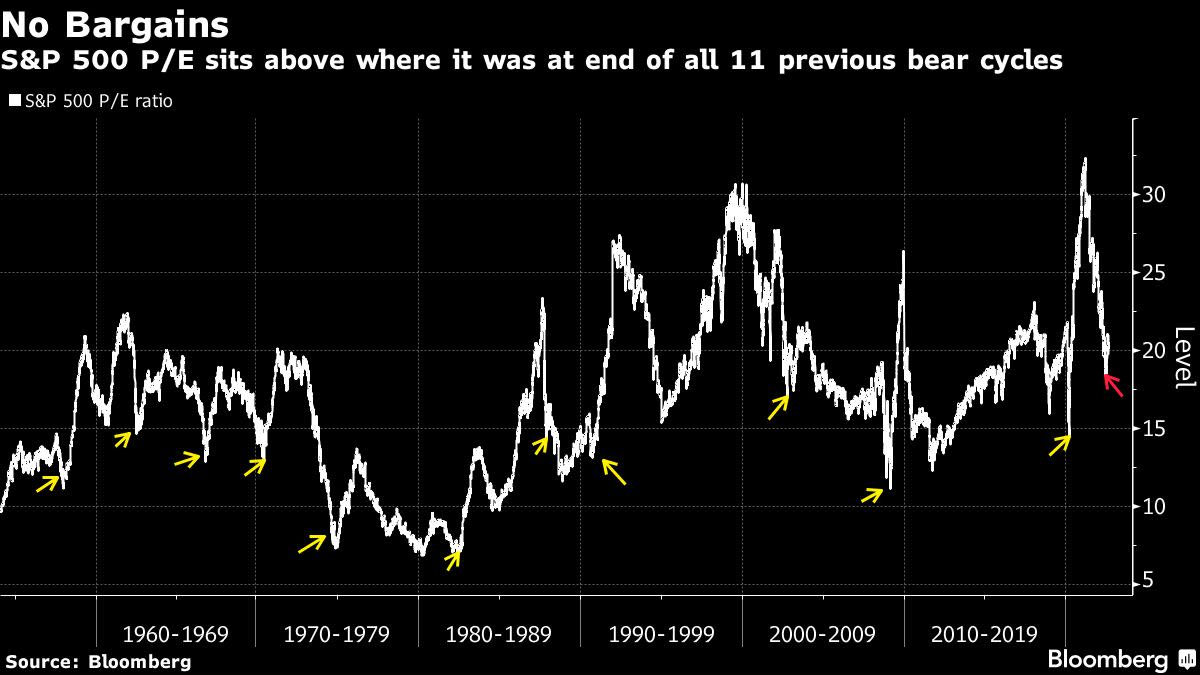

Despite a massive valuation correction, stocks are still far from being obvious bargains. At the low in June, the S&P 500 was trading at 18 times earnings, a multiple that exceeded trough valuations seen in all previous 11 bear cycles since the 1950s. Put another way, should stocks bounce from here, this bear market bottom will have been the most expensive on record.

With higher interest rates putting pressure on equity valuations while an earnings downgrade cycle is under way, more market turmoil may lie ahead, according to Jason Trennert and Ryan Grabinski, strategists at Strategas Securities.

The “greatest risk to economy and markets may be the Fed’s need to tighten more than risk markets anticipate,” they wrote in a note. “Market bottoms usually associated with lower earnings multiples, a higher VIX, and a blowout in high yield spreads. Have not seen that yet.”

©2022 Bloomberg L.P.