Increasing inflation causes all kinds of stress for just about everybody, in every sector of the economy. On the consumer level, rising interest rates raise prices for just about any good or service we may use, which eventually suppresses demand for those goods and services.

“Consumer goods” is a term that covers a big swath of products, but that most of us tend to associate with items where new purchases can be deferred relatively easily when budgets get tight. Pantries, fridges, and freezers have to be kept stocked as much as possible, which is why food usually gets grouped into the “Consumer Staples” category. Consumer goods, then usually include items like apparel, shoes, televisions, and so on, which is why the companies that produce them are usually grouped into the “Consumer Discretionary” category.

While consumer prices continue to increase across the board, there are usually other signs that increasing interest rates are having an immediate impact; recent reports on monthly, pending home sales, for example, show that in most of the U.S., demand has softened, and in some cases begun to drop as the Fed has raised rates on an accelerated basis. Price increases in everything from staples to discretionary items have also been a symptom of a longer-term, supply chain problem that pre-dates the pandemic and that has only been extended by it and compounded by geopolitical (the ongoing war in Ukraine, for example) as well as the still-present coronavirus pandemic that still isn’t going away, no matter how much we want it to.

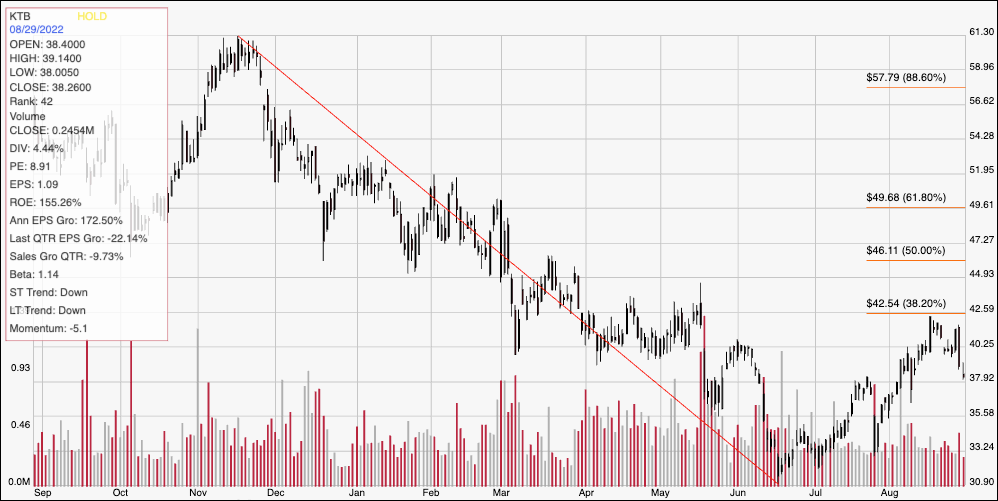

Those issues, along with healthy consumer demand combined to start increasing consumer prices in 2021, and even as rising rates are starting to blunt some economic metrics, the fact is that rising prices haven’t entirely muted economic activity, which is why the Fed last week struck what many perceive as an increasingly hawkish tone in advance of their September meeting. What does that mean for consumer goods? Let’s turn our focus to a company, Kontoor Brands Inc. (KTB) that was spun off in 2019 using recognizable apparel brands Wrangler, Lee and Rock & Republic. This is a stock that dropped from a November 2021 peak at around $61 to a low in mid-June of this year at around $31. It’s picked up bullish momentum since then, however, driving to a peak about a week ago at around $42.50 before dropping back to its current price at around $38. Is that short-term upward trend, against its longer downward trend, an indication that the stock could be setting up for a bigger push to the upside? The company’s fundamental profile shows generally healthy free cash flow, manageable debt with good liquidity, and an attractive dividend. Are those elements enough, with the stock’s latest momentum, enough to a provide a value proposition that you should be paying attention to, or is the larger economic climate such that KTB is a risky bet right now? Let’s find out.

Fundamental and Value Profile

Kontoor Brands, Inc. is a global apparel company. The Company is focused on the design, manufacturing, sourcing, marketing, and distribution of its portfolio of brands, including Wrangler, Lee and and Rock & Republic. It sells its products primarily through its wholesale and digital channels. Its distribution channels include United States (U.S.) Wholesale, Non-U.S. Wholesale, Branded Direct-to-Consumer and Others. Wrangler offers denim, apparel, and accessories for men and women. Lee is a denim and apparel brand. Lee product collections include a range of jeans, pants, shirts, shorts, and jackets for men, women, boys and girls. Rock & Republic is a premium apparel brand. Rock & Republic products are sold in the United States exclusively through Kohl’s. It also owns and operates other various brands worldwide, which include Gitano and Chic. KTB has a current market cap of about $2.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased 172.5%, while revenues grew by a little more than 25%. In the last quarter, earnings slipped -22 lower, while sales were also declined by about -9.75%. KTB’s operating profile is healthy, and is showing signs of improvement; over the last twelve months, Net Income was 9.52% of Revenues and increased to 10.1% in the last quarter.

Free Cash Flow: KTB’s free cash flow is $235 million over the last twelve months. That marks an increase from $210 million in the quarter prior, but is still below the $275.6 million mark of a year ago. The current number also translates to a Free Cash Flow yield of 10.88%.

Debt to Equity: KTB’s debt/equity ratio is high, at 4.39. That sounds alarming, but it is also misleading. As of the last quarter, the company reported $145.3 million in cash and liquid assets against $787 million in long-term debt. The company’s operating profile, along with generally healthy free cash flow suggest that servicing their debt isn’t a problem.

Dividend: KTB’s annual dividend is $1.84 per share, which translates to a yield of 4.72% at the stock’s current price. This is a bit unusual when you consider that the company has only existed as a public entity for about two years; I take the dividend as a positively inherited characteristic from parent company VFC, which has a long history of returning value to shareholders via consistent dividend distributions. The current annual payout also marks an increase from $1.60 per share, announced by management at the beginning of this year and, despite its healthy yield, is less than 40% of the company’s earning per share over the last twelve months. That is a good sign their dividend payout is conservative and stable.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $39 per share. That suggests that the stock is only slightly undervalued, with just about 3% upside from its current price.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line traces the stock’s downward trend from a high at around $61 in November of last year to its low in mid-June at around $31. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. From its June bottom, the stock rallied into a short-term upward trend that peaked a little over a week ago at about $42.50, right around the 38.2% retracement line, with the stock marking immediate resistance there and dropping from that point to approach current support at around $38. A drop below $38 could see the stock find next support between $34 and $33, while a break above $42.50 should give the stock room and momentum to text next resistance at around $47, a little above the 50% retracement line.

Near-term Keys: I think KTB’s fundamental profile, like its parent company in the face of the economic conditions of the last two and half years is a very interesting story. Unfortunately, the stock’s recent rally has already pushed it past the point of useful value. I also think the broader economic and market climate make this a stock that will continue to be sensitive to inflationary pressures, so a long-term investor may be smarter to wait before considering a new, value-based position. The stock’s current activity could offer some interesting signals to work with short-term trades. A drop below $38 could offer a useful signal to consider shorting the stock or buying put options, with a useful bearish profit target at around $34 per share. A push above $42.50 would be a good signal to think about buying the stock or working with call options, with a practical bullish target at around $47 per share.