(Bloomberg) — Another Chinese firm is baffling investors with massive gains on its first day of trading in the US, following on from stellar debuts for AMTD Digital Inc. and Magic Empire Global Ltd.

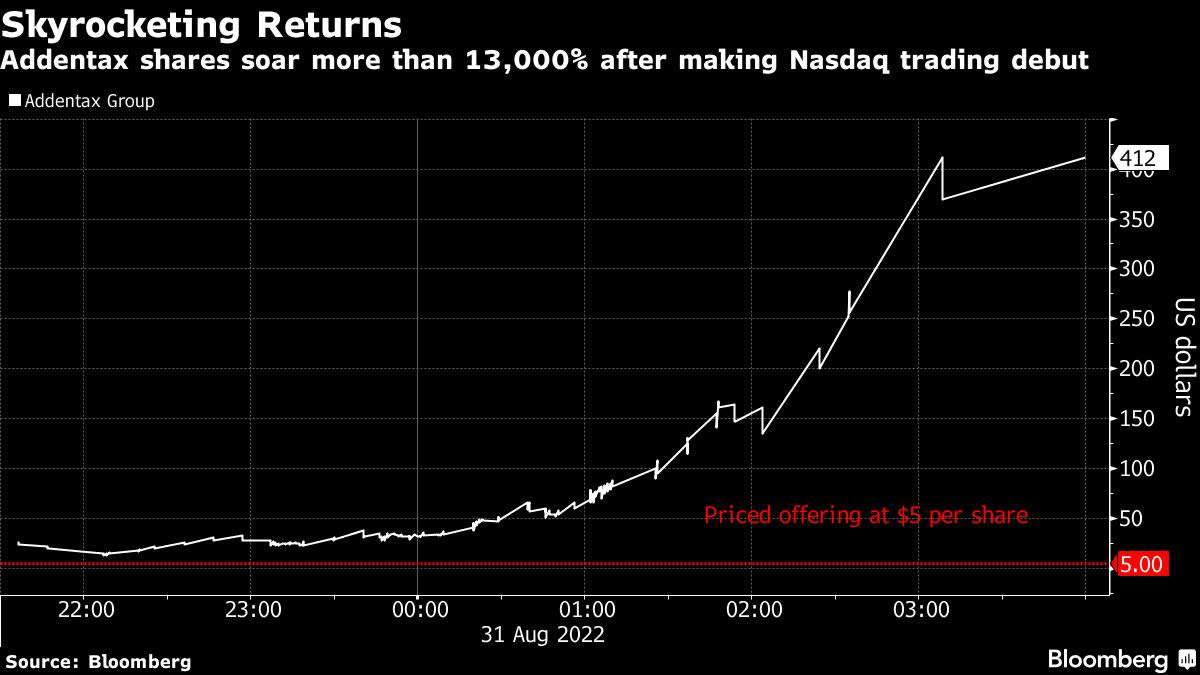

Addentax Group Corp. soared as much as 13,031% on Wednesday in its debut session, triggering more than 20 volatility halts. Its market capitalization has ballooned to $20 billion, making it bigger than about a third of S&P 500 Index members.

Addentax, which lists garment manufacturing and logistics services among its key businesses, is at least the eighth firm this year from Hong Kong or China to experience similarly surprising moves following initial public offerings in the US. The Nevada-based holding company did not immediately respond to an emailed seeking comment and calls to numbers listed on its website went unanswered.

AMTD Digital and Magic Empire, both of which are financial services companies based in Hong Kong, made headlines earlier this quarter as shares mysteriously soared by thousands of percent despite opaque fundamentals, before the rallies fizzled out. AMTD Digital Inc. at one point became bigger than Goldman Sachs Group Inc.

“The driving force behind the Addentax Group’s price seemingly deliberately duplicates the story of HKD and MEGL, which also experienced an unprecedented share-price frenzy recently,” said Hebe Chen, an analyst at IG Markets Ltd.

She said the commonality between them includes the fact that they all come from traditional industries and have not-so-stellar financials.

The rally means that the stakes of Chairman and Chief Executive Officer Hong Zhida, and his brother Hong Zhiwang — who is a director — amount to some $1.3 billion in total. CEO Hong owns 4.8% of Addentax’s common stock, while his brother has 1.6%, according to the prospectus.

Listed originally in 2015, when it identified itself as a shell company, Addentax in December 2016 acquired a key stake in its current major operating entity called Yingxi Industrial Chain Group Co. The company was trading on an over-the-counter market for US stocks called OTCQB Marketplace prior to its listing on the Nasdaq this week.

According to its prospectus, Addentax used the same underwriter — Network 1 Financial Securities Inc. — as Magic Empire.

Modest Revenues

Like Magic Empire and AMTD Digital, Addentax has modest revenues that allow for relaxed disclosure requirements under US laws. For the year ended March, revenue dropped 49% to $12.7 million but it turned a profit, according to the prospectus.

Chen from IG Markets says it is “more than likely” that the Addentax will follow the pathway of AMTD and Magic Empire soon. The latter two have lost more than 90% from their respective peaks.

©2022 Bloomberg L.P.