(Bloomberg) — The S&P 500 Index still hasn’t bottomed yet despite its 7% plunge over the last three weeks, according to a group of strategists at Bank of America Corp. led by Savita Subramanian.

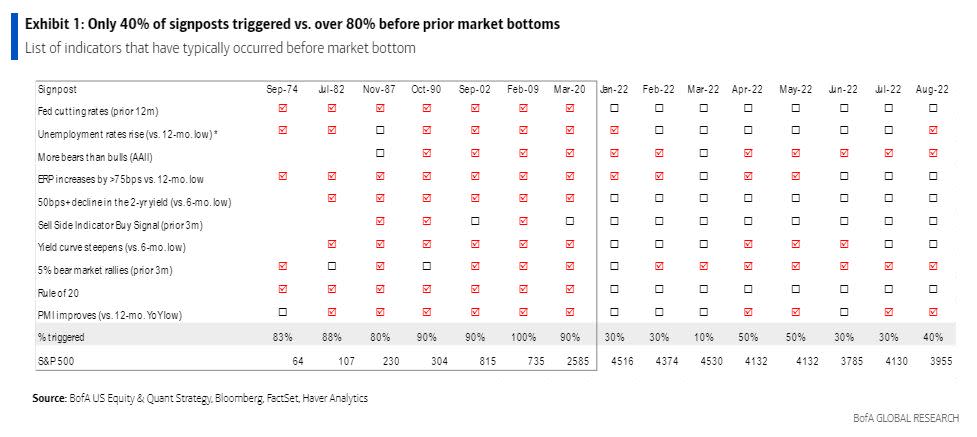

The bank’s so-called bull-market signposts suggest the broad US equities benchmark hasn’t reached full capitulation, with just 40% of BofA’s signals being triggered. US stocks still don’t look cheap enough for investors to start piling in, with the US economy still in the early stages of downturn, according to the strategists.

“History suggests it’s better to be late than early,” Subramanian, BofA’s head of US equity and quantitative strategy, wrote in a note to clients. “We recommend waiting for more bull market signals.”

The strategists analyzed different macro and bottom-up data, including Fed policy, equity valuation, economic growth, investor sentiment and technical trends to determine what typically occurs ahead of a market bottom. Of the 10 consistent triggers, only 4 have been reached. In the past seven market bottoms, at least 80% were hit.

There have been glimmers of hope, however, with sentiment and technical indicators improving and turning mostly bullish. Although corporate earnings in the second quarter were better than feared, the market remains vulnerable, Subramanian said. She reaffirmed the bank’s year-end price target of 3,600 earlier this week. That’s 9% below its close at 3,966.85 on Thursday.

Although the unemployment rate rose to 3.7% in August, which typically happens before market bottoms, the average lag between initial rise in unemployment and market bottom has been 13 months, according to the bank.

“Valuations for the S&P 500 are rich on almost every measure we track,” Subramanian said. “With no real signs of a bull market, we view the 17% rally off the June low as a bear market rally.”

©2022 Bloomberg L.P.