No matter how tired we get of hearing about COVID-19, there is no denying that ever since the virus found its way to American shores almost three years ago, a lot of media attention has been given to the Healthcare sector – and especially to the Biotechnology industry. Besides vaccines and their booster follow-ups, anti-viral treatments also saw a significant push in development along with big demand.

Some of the names that showed early promise also received the most attention from analysts and media types, at least in the earliest stages of the pandemic. One of those companies is Gilead Sciences Inc. (GILD), a large-cap company with treatments for diseases such as HIV/AIDS, cancer, and other respiratory diseases. One of their antiviral drugs, remdesivir was originally created to combat the hepatitis C virus, but that demonstrated a significant enough benefit in clinical trials with hospitalized COVID patients to gain emergency approval from the FDA. Remdesevir (sold under the brand name Veklury) gave the company a revenue stream that in 2020 represented approximately 12.5% of sales, and more than doubled to about 26.1% of total sales in 2021.

Outside of COVID-19, the company has also been investing heavily since 2019 to bolster its drug pipeline, with its acquisition of Immunomedics providing a newly approved treatment for metastatic triple-negative breast cancer that was approved by the FDA earlier this year and is expected to generate $3.5 billion in sales by 2025. The caveat associated with Veklury as a growth driver is that its long-term benefit is less clear; analysts point to the expectation that Veklury sales will decline as pandemic concerns fade. While variants like delta and omicron prompted big spikes in infections, hospitalizations, and deaths in late 2021, generally declining numbers included a shift by most state governments in reporting and resource allocation for the virus have some wondering if we may, in fact be seeing coronavirus finally move to an endemic status. If so, those bearish forecasts about Veklury and its continued utility as a growth driver may be correct.

Some of the early news about Veklury gave investors enough enthusiasm about GILD to push the stock from a February 2020 low around $62 to a peak before the end of that year at around $86. From that point, however, the company’s following earnings reports showed that, while the company has a generally healthy balance sheet, their capital expenditures – which certainly, and appropriately included a big push to fast-track Veklury as a COVID treatment – put the company’s operating profile in net-negative territory. That was a strong enough concern to push the stock into a downward trend into the beginning of 2021 that saw it hit a trend low at around $56.50. After a rally to about $74 in late December, the stock dropped back again to 52-week low at around $57 in mid-June. The stock settled into a consolidation range between March and the end of July, but started to pick up bullish momentum last month that now has the stock a little above $63 and looking to build a new upward trend. Are the company’s fundamentals strong enough to make the bullish momentum also work as a good, value-based buying opportunity? Let’s see what we can find.

Fundamental and Value Profile

Gilead Sciences, Inc. is a research-based biopharmaceutical company that discovers, develops and commercializes medicines in areas of unmet medical need. The Company’s portfolio of products and pipeline of investigational drugs includes treatments for Human Immunodeficiency Virus/Acquired Immune Deficiency Syndrome (HIV/AIDS), liver diseases, cancer, inflammatory and respiratory diseases and cardiovascular conditions. Its products for HIV/AIDS patients include Descovy, Odefsey, Genvoya, Stribild, Complera/Eviplera, Truvada, Emtriva, Tybost and Vitekta. Its products for patients with liver diseases include Vemlidy, Epclusa, Harvoni, Sovaldi, Viread and Hepsera. It offers Zydelig to patients with hematology/oncology diseases. Its products for patients with various cardiovascular diseases include Letairis, Ranexa and Lexiscan. Its products for various inflammation/respiratory diseases include Cayston and Tamiflu. It had operations in more than 30 countries, as of December 31, 2016. GILD has a current market cap of $80.3 billion.

Earnings and Sales Growth: Over the past year, earnings decreased by -15.5%, while sales were flat, but positive by 0.69%. In the last quarter, earnings slipped about -25.5% lower, while sales showed a -5% decline. GILD’s operating profile is a sign of strength, since Net Income as a percentage of Revenues was 15.04% in the trailing twelve-month period and strengthened to 18.27% in the last quarter.

Free Cash Flow: GILD’s Free Cash Flow is healthy, at about $9.4 billion. On a Free Cash Flow Yield basis, that translates to 11.77%. It should be noted that this number has declined steadily since the beginning of 2016, when Free Cash Flow peaked at $19.5 billion, but has also improved from late 2019, when Free Cash Flow was about $6.6 billion. It does mark a drop from $9.95 billion in the quarter prior, and $10.8 billion three quarters ago.

Debt to Equity: GILD has a debt/equity ratio of 1.3, which is high, and also reflects increasing debt the company has taken on, in part to complete its acquisition of Immunomedics; but by itself this number doesn’t really tell the whole story. Their balance sheet shows $5.66 billion in cash in the last quarter (down from $23.9 billion at the end of 2020) against roughly $26 billion in long-term debt. The company’s operating profile suggests there should be no problem servicing its debt. I think it is also worth noting that earlier this year, long-term was about $34.6 billion.

Dividend: GILD pays a dividend of $2.92 per share (up from $2.52 in 2019, $2.72 in 2020, and $2.84 last year), which translates to an annual yield of about 4.61% at the stock’s current price. Management’s ability to increase the dividend is a positive sign.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $63 per share, which means that GILD is fairly valued, with a useful bargain price at around $50.50.

Technical Profile

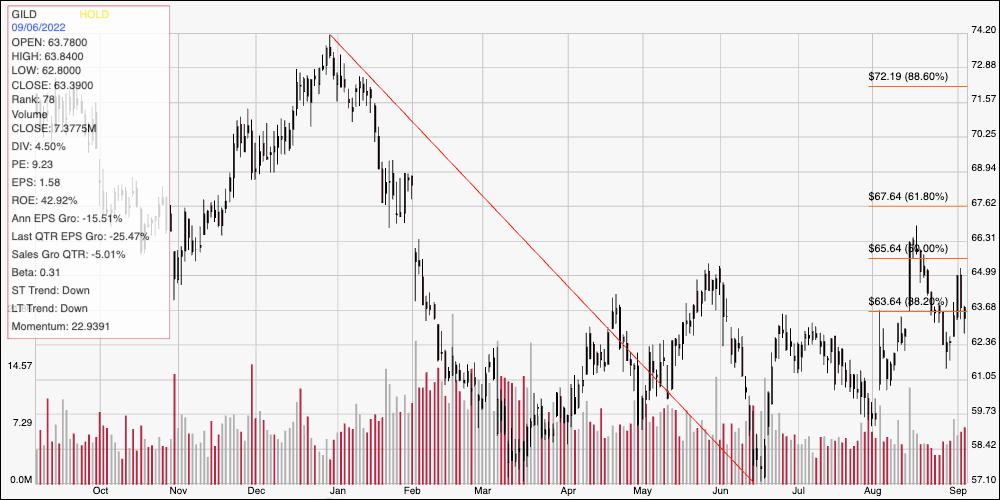

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: the chart above covers the last year of price activity for GILD. The diagonal red line traces the stock’s plunge from its late December high at around $74 to its mid-June low at around $57; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock picked up bullish momentum at the start of August, driving above the 50% retracement to a mid-month peak at around $66 before briefly dropping back below the 38.2% retracement line. The stock has seen a pickup in daily volatility since then but appears to be sitting right around current support at about $63 per share, with immediate resistance at around $65. A push above $65 will find next resistance at around $66, with roughly $67.50 possible if buying activity increases, while a drop below $63 could see downside to about $62, or possibly $60 to next support is bearish momentum accelerates.

Near-term Keys: Given the limited upside given GILD’s current valuation, the stock doesn’t work as a useful value right now. That also means that the best probabilities in working with this stock lie in short-term trading strategies. You could use a break above $65 as an opportunity to buy the stock or work with call options, with $66 to $67.50 offering a practical profit target on a short-term, bullish trade. A drop below $63 would be a strong signal to consider shorting the stock or buying put options, with $60 offering a practical profit target level on a bearish trade provided selling pressure starts to accelerate.