One of the fundamental differences between growth and value investing lies in the way that the extreme ends of price swings are interpreted and used. Where growth-focused investor view a stock at or near historical highs as a great thing, for example, a value seeker will usually shrug their shoulders and move on to something else.

The same mindset can be applied, in opposite fashion, to stocks at or near historical lows. These are situations where bargain hunters start to sit up, take notice, and begin digging in to the company’s details. Growth investors, on the other hand will usually treat the same stock as radioactive and wait for it to reverse its downward trend before thinking seriously about any new investments with that stock.

As a value seeker myself, I tend to favor stocks at or near historical lows. That’s because, given that all trends are finite, and will eventually reverse themselves, stocks in the low end of their historical ranges represent some of the highest-probability opportunities we can find. The distinction between the two investing styles is one of the things that I think makes the stock market so interesting, because no matter what anybody says, one method is not categorically better, or is guaranteed to do better than the other in the long run. The suitability of one method over another really boils down to your own individual preference, and the additional steps and strategies you employ to manage the investments you make based on that method.

Since my focus is primarily on value, my natural inclination when I see a stock nearing historical highs is to assume that there isn’t much upside left, and that any additional increase in price is really based primarily on chance rather than on any useful, fundamentally-driven logic. I have also learned, however that nothing in the market is absolute, which is why I also try to leaven any assumption on a stock, at either end of its price range, with a willingness to dive in to the same details I use for underperforming stocks to see if there might still be a useful value opportunity. Sometimes, a company’s underlying fundamental strength is such that even with the stock at or near previous highs, a reasonable fundamental argument can be made that there is value that the market hasn’t yet uncovered. The simple fact that a stock may be sitting at or near historical lows also doesn’t categorically mean the stock offers any kind of historical value if the company’s fundamentals don’t also fall into line.

One of the interesting stories of the last few years is the way that the Consumer Discretionary sector has shown its resilience in the face of difficult conditions, driven by a massive shift to e-commerce services and solutions. Among the shifts that worked in the favor of a lot of different industries in the sector, including stocks in the Textiles, Apparel & Luxury Goods industry during the worst of the pandemic, for example has been an increased focus on personal health and wellness. That is an industry that includes well-known players like Under Armour (UA), Nike (NKE), Hanesbrands Inc (HBI) and today’s highlight, Gildan Activewear (GIL). GIL doesn’t have the same cachet that comes from immediate name recognition, but is a very interesting stock because of its focus on private label apparel.

An increasing number of retailers are shifting the products they offer, increasing shelf and floor space in favor of brands offered only in their own stores. One of GIL’s strategic goals is on partnering with traditional retailers to manufacture those private label goods. It’s a trend that is expected to continue to grow, since private labels offer higher margins in the always-competitive retailing industry where margins are consistently thin and becoming even narrower. Even companies like UA and NKE are tapping in to the resources offered by companies like GIL, where production capacity can be made available closer to home than on the Asia markets these companies have traditionally relied on to produce their own products, even as they put a heavy focus on building their own direct-to-consumer marketing and distribution channels.

I also think there is an argument to be made that, as interest rates continue to increase to combat high inflation in the U.S., the value of private-label goods is likely to be even more elevated. GIL is a stock that peaked in November of 2021 at around $44, and hit a recent, long-term downward trend low at around $25.50 in July. That’s an overall decline of a little over -43% over that period, and -28% since the start of 2022. The stock staged a short-term rally in late July that peaked at about $33 in mid-August, only to see the stock drop back to start September in the $29 price range, where it sits today. Are the company’s fundamentals and value proposition attractive enough to suggest the stock should be on your watchlist for a good, potential bargain-based buy? Let’s dive in and find out.

Fundamental and Value Profile

Gildan Activewear Inc. is a manufacturer and marketer of branded basic family apparel, including T-shirts, fleece, sport shirts, underwear, socks, hosiery and shapewear. The Company operates through two segments: Printwear and Branded Apparel. The Printwear segment designs, manufactures, sources, markets, and distributes undecorated activewear products. The Branded Apparel segment designs, manufactures, sources, markets, and distributes branded family apparel, which includes athletic, casual and dress socks, underwear, activewear, sheer hosiery, legwear, and shapewear products, which are sold to retailers in the United States and Canada. The Company sells its products under various brands, including the Gildan, Gold Toe, Anvil, Comfort Colors, American Apparel, Alstyle, Secret, Silks, Kushyfoot, Secret Silky, Therapy Plus, Peds, and MediPeds brands. The Company distributes its products in printwear markets in the United States, Canada, Mexico, Europe, Asia-Pacific and Latin America. GIL’s current market cap is $5.6 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 26.5%, while revenues were almost 20% higher. In the last quarter, earnings growth was a little over 13%, while sales increased by about 15.6%. GIL operates with a margin profile that suffered during the pandemic – which isn’t a big surprise given the conditions – but improved significantly in 2021. Inflationary conditions, however that include supply chain issues that have raised input costs are showing an effect more recently. Over the last twelve months, Net Income as a percentage of Revenues was 20.48%, but decreased in the last quarter to 17.67%.

Free Cash Flow: GIL’s free cash flow is a little more than $320 million, and translates to a Free Cash Flow Yield of 5.87%. The current number does mark a decline over the past year from about $758.4 million, and $490 million six months ago.

Dividend Yield: GIL’s dividend is $.676 per share, which translates to an annual yield of about 2.21% at the stock’s current price. Management suspended its dividend at the beginning of the pandemic, but reinstated it in 2021 and raised it at the beginning of this year.

Debt to Equity: GIL has a debt/equity ratio of .49. This is a conservative number that generally implies management takes a careful approach to leverage. GIL’s balance sheet shows a little over $146 million in cash and liquid assets (down from $191 million in the quarter prior and $249 million six months ago) against about $815 million in long-term debt (up from about $600 million six months ago). GIL’s margin profile indicates operating profits are more than adequate to service their manageable debt, however declining liquidity and net income are concerns.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. All together, these measurements provide a long-term, fair value target around $29.50 per share. That means that despite stock’s long-term downward trend, it is somewhat overvalued right now, with -3% upside from its current price, and a practical discount price at around $24. It’s also worth noting that earlier this year, this same analysis yielded a fair value target at around $31.50 per share.

Technical Profile

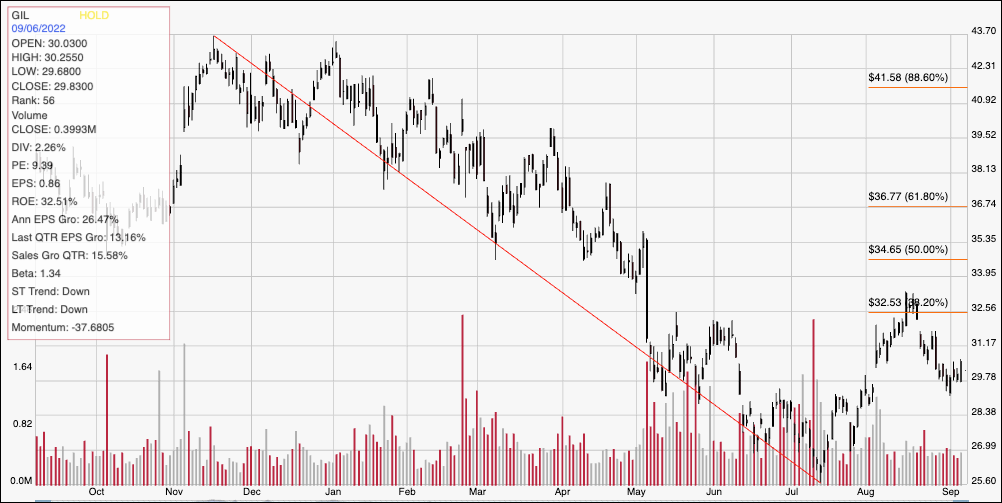

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: This chart traces the stock’s movement over the last year. The red line traces the stock’s downward trend since its peak in November of last year at around $44 to its low, reached in June at around $25.50; it also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock appears to be settling around a new, current support level at around $29, with immediate resistance right around the 38.2% retracement line at about $33. A drop below $29 should have relatively limited downside, with next support at around $27, while a push above $33 should find next resistance in the $35 price area.

Near-term Keys: If you’re looking for a short-term, bullish trade, the stock’s current support level could provide a signal point. A bounce off of that support, with momentum could act as a good signal to buy the stock or to work with call options, with an eye on $33 as a useful exit target. If the stock drops below support at $29, consider shorting the stock or working with put options, with $27 providing a good, initial profit target on a bearish trade. GIL is an interesting stock to pay attention to on a long-term basis, however the company’s current declines in Net Income, Free Cash Flow and Cash are concerns that I think bear watching for improvement. These items would need to show significant improvement before the stock’s value proposition is likely to become attractive.