(Bloomberg) — Federal Reserve Chair Jerome Powell said officials will not flinch in the battle to curb inflation, hardening expectations that they will deliver a third straight jumbo rate hike later this month.

“We need to act now, forthrightly, strongly as we have been doing,” Powell said Thursday in remarks at the Cato Institute’s monetary policy conference in Washington. “My colleagues and I are strongly committed to this project and will keep at it.” He spoke with a moderator in a virtual question-and-answer session.

U.S. central bankers are raising interest rates rapidly to curb the hottest inflation in four decades. They next meet on Sept. 20-21 and Powell has kept the option open for another 75 basis-point move, following increases of that size in June and July, or a half-point increase. He’s said the decision depends on the “totality” of the incoming data.

Officials will get an important update on Tuesday with the release of consumer prices for August. Economists surveyed by Bloomberg forecast an 8.1% rise for the 12-month period versus 8.5% in July.

“The Fed has and accepts responsibility for price stability,” he said, noting that history cautions against prematurely loosening policy. That reiterates a warning he issued Aug. 26 at the Fed’s annual retreat in Jackson Hole, Wyoming.

Investors have hardened their bets that the Fed would go big again after hawkish comments from other Fed officials. That trend continued after the European Central Bank raised rates earlier on Thursday by 75 basis points and futures markets show a Fed hike of that size almost fully priced in for later this month.

Short-term Treasury yields extended gains as investors listened tom Powell, while S&P 500 index futures remained lower and the dollar appreciated.

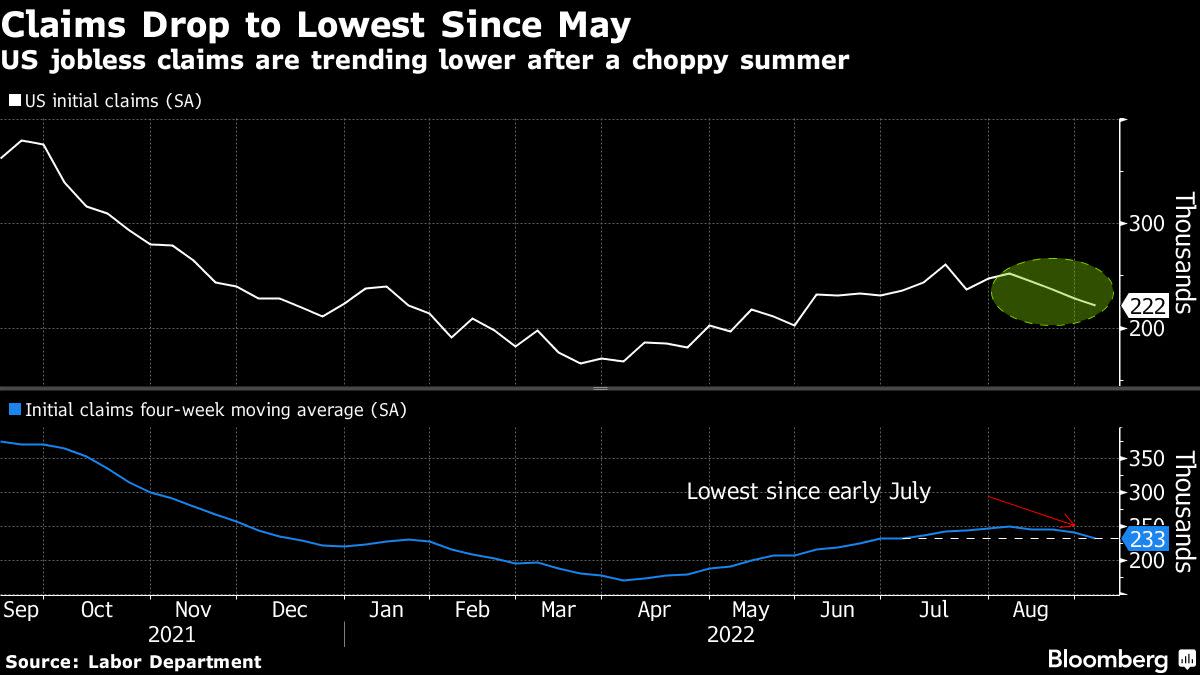

The U.S. economy has fared well on the back of steady consumer spending even as higher rates bite down on housing and investment. The labor market remains strong with unemployment at 3.7%.

“Demand is very, very strong still in the labor market. We’re still printing new payroll job numbers at a high level, wages are running at elevated levels,” Powell said. “By our policy interventions, what we hope to achieve is a period of growth below trend, which will cause the labor market to get back into better balance, and that will bring wages back down to levels that are more consistent with 2% inflation.”

Fed officials hope to engineer a rare soft landing where growth moderates and inflation falls with a low cost to employment. But they are also concerned that public expectations on future prices start to drift higher after remaining above their 2% target for more than a year.

They have signaled clearly that the way they intend to fight that drift is raise borrowing costs even higher and hold them there for a long time. If that is the strategy that rules the debate this month, then it argues for another jumbo move.

“It is very important that inflation expectations remain anchored,” Powell said, adding that the “clock is ticking” on ensuring that they stay that way.

“The longer that inflation remains well above target the greater the concern that the public will start to just naturally incorporate higher inflation into its economic decision making,” he said. “Our job is to make sure that doesn’t happen.”

©2022 Bloomberg L.P.