(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Federal Reserve officials look on track for another jumbo increase in interest rates this month, as they hasten to crimp demand and assure Americans they will bring inflation back down to 2%.

Fed Governor Chris Waller signaled his backing Friday for a 75 basis point hike by saying he supported “another significant increase.” Earlier, St. Louis Fed President James Bullard said that he is leaning “more strongly toward” a jumbo move when officials gather Sept. 20-21. Both have been good bellwethers so far this year on where Fed policy is headed.

Their remarks followed hawkish comments from other policy makers this week, led by Chair Jerome Powell, that implicitly or explicitly endorsed a third consecutive 75 basis-point increase. Powell had previously said the decision was between that and a half-point increase, depending on the data. Officials now enter a blackout period on public comment ahead of the meeting.

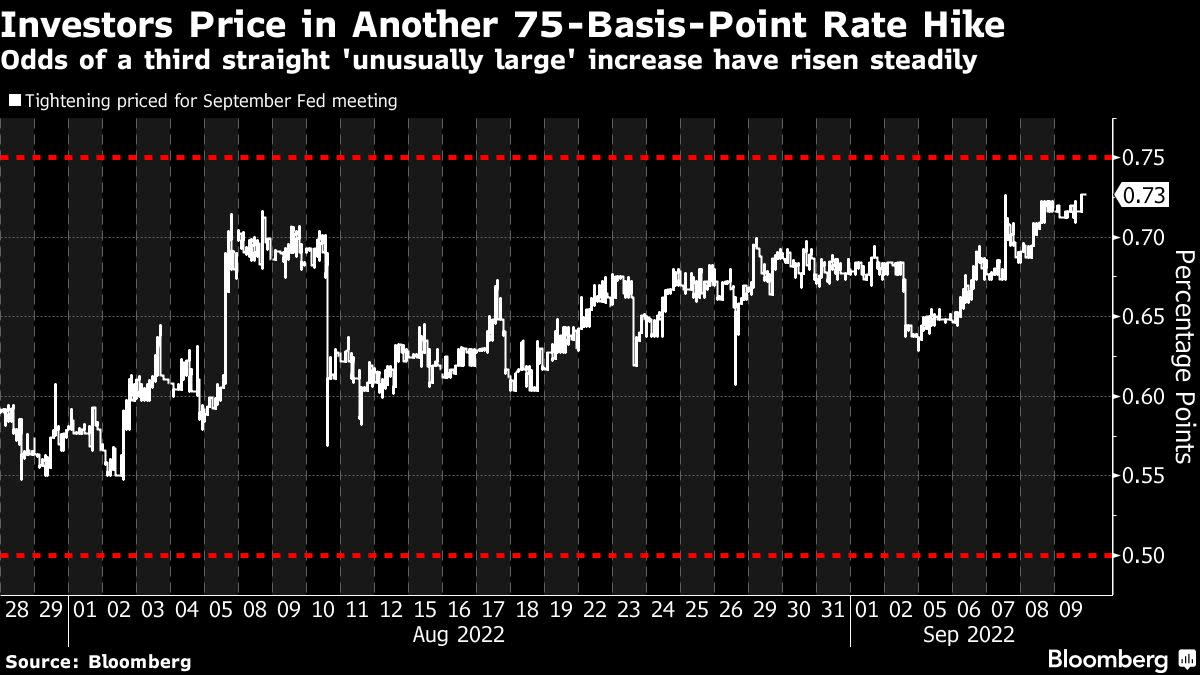

Wall Street has taken notice, with a growing number of big banks changing their calls to a 75 basis-point move this month from 50 basis points, including economists at Goldman Sachs Group Inc, Deutsche Bank AG, Barclays Plc and Bank of America Corp.

If the Fed does go big again — and investors have fully priced such a move in financial markets — it will represent the most aggressive series of rate increases since former Chair Paul Volcker was battling inflation back in the 1980s.

The rush to get rates to restrictive territory, in which policy is restraining economic activity and not stoking demand, is rooted in the committee’s sense of asymmetric risks from inflation being too high for too long.

Officials worry that a long period of high inflation will erode public confidence that the central bank can deliver 2% inflation, making it more costly for the Fed to get back to the target.

“The clock is ticking,” Powell said Sept. 8.

“The longer that inflation remains well above target the greater the concern that the public will start to just naturally incorporate higher inflation into its” decisions, he said. “Our job is to make sure that doesn’t happen.”

Officials have been careful to avoid pledges of pausing or slowing the rate-hike campaign, and have set a high bar for the economic data to persuade them to do so.

“Until I see a meaningful and persistent moderation of the rise in core prices, I will support taking significant further steps to tighten monetary policy,” Waller said Friday.

Policy is already impacting financial conditions, and some parts of the economy have cooled.

Thirty-year mortgage rates have nearly doubled from the start of the year to 5.9%, according to Freddie Mac. Housing activity has slowed. Prices for global commodities and used cars in the U.S. are coming off their peaks, while the dollar is about 11% higher against a basket of ten major currencies this year, according to a Bloomberg index.

Taken together, it adds up to the start of disinflationary trends for the U.S. that officials may begin to see in the August consumer price index report Tuesday.

But Fed officials have been clear that it will take a long, consistent run of data to assure them that inflation is on a downward path and that policy can move off its tightening bias.

While cautious not to say that they are pausing on their run to near 4% on the benchmark lending rate, some officials are saying they will be more nuanced in how they assess the data going forward.

“We will have to determine the course of our policy through observation rather than reference to theoretical models or pre-pandemic trends,” Kansas City Fed President Esther George said in remarks Friday. “Given the likely lags in the passthrough of tighter monetary policy to real economic conditions, this argues for steadiness and purposefulness over speed.”

©2022 Bloomberg L.P.