(Bloomberg) — On a day when a hotter-than-expected inflation print rattled Wall Street and beyond, the pain was particularly acute for a group of speculators who had just piled into risky stock bets across multiple corners of the options market.

Traders had poured money into a slew of bullish contracts in the runup to Tuesday’s data, before prices plunged across the board. Contracts sold off as the consumer price index accelerated gains in July — dashing hopes of a nascent slowdown.

Calls on the S&P 500 with a strike price of 4,300 expiring in December — that someone spent $90 on in a widely talked about trade on Monday that was worth $80 million — tumbled 40% to $59.60 as of 12:55 pa.m. in New York.

Contracts betting the iShares Russell 2000 exchange-traded fund (ticker IWM) would rise to $199 by month-end lost more than half their value to 35 cents — after one investor on Friday paid 53 cents each for 30,000 contracts. Meanwhile, bullish bets linked to the SPDR S&P Biotech ETF (ticker XBI) with a strike price at $100 expiring in November, dropped 42% to $1.42. Yet on Friday, one trader had snapped up roughly 15,000 such calls for about $2.65.

The renewed market selloff highlights the futility of any attempt to get in front of the inflation data, something whose path virtually no one has accurately predicted since the Federal Reserve rushed to rescue the economy from the pandemic shutdown. This year, the S&P 500 has moved an average 1.5% on the day when the data was released, double the rate of change during similar events in the previous five years.

“Bear trap turned into a bull trap for now,” said Alon Rosin, Oppenheimer & Co.’s head of institutional equity derivatives. The inflation reading “shows basically that the Fed’s inflation expectations regarding 2% target are a dream. It’s likely going to be a battle of economic reality versus investor positioning ahead.”

Down more than 3% in New York, the S&P 500 is snapping a four-day advance and looks poised for the worst post-CPI reaction since the start of the pandemic crisis in early 2020.

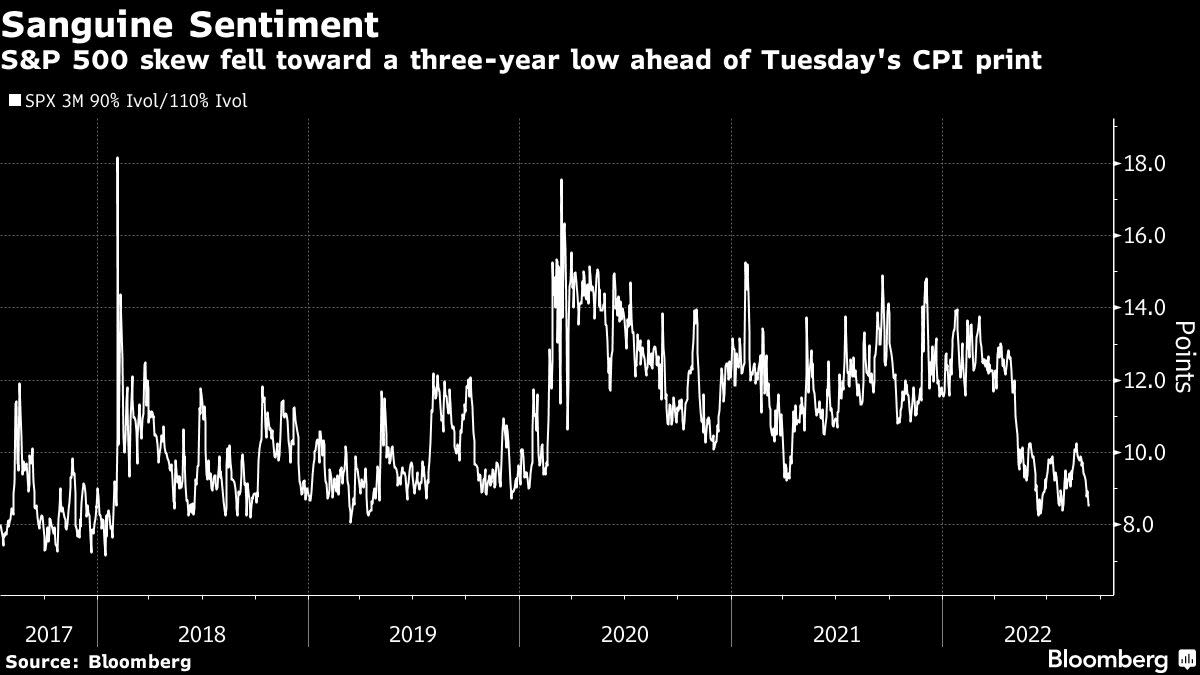

Bets in the derivatives market were leaning bullish enough in the runup to the report. That’s demonstrated in the skew of the S&P 500, a measure of the cost of bearish versus bullish contracts. The gauge of options on Monday fell for a fourth session in five, hovering near a three-year low.

To be sure, a non-trivial proportion of bullish wagers were likely snapped up by skittish investors as a hedge against their overall defensive positioning. In Bank of America Corp.’s latest monthly survey released Tuesday, money managers’ allocation to stocks sat at record lows amid fear of a Fed-induced economic recession.

“If investors were buying calls as an alternative to getting long stock on the recent rebound that was just derailed by CPI, they might not necessarily be worse off,” said Chris Murphy, co-head of derivatives strategy at Susquehanna International Group. “In that case, you might have actually been better off long a relatively inexpensive upside call as opposed to buying the underlying stock or ETF.”

All the same Tuesday’s equity selloff resumed a trend this year where the CPI day hasn’t been kind to stock investors. With the exception of the report for the month of July, the S&P 500 has fallen every time the data was released as consumer prices came in mostly hotter than expected.

“This report confirms my suspicion that investors were too hopeful the Fed would slow its more assertive pace of policy tightening,” said Lauren Goodwin, economist and portfolio strategist at New York Life Investments. “The most likely change engendered from the August inflation report is an increase in the pace of hiking from here.”

©2022 Bloomberg L.P.