(Bloomberg) — For investors burned by inflation, a very bad year is starting to look even worse.

As stock prices tumbled and bonds were hit with the deepest losses in decades, the surge in consumer prices turned a few corners of the financial markets into profitable refuges earlier this year. Oil prices rallied. Other commodities did, too. Even rising home prices and rents propped up the real estate sector.

But the hiding places are rapidly disappearing.

That’s because the persistent increase in core inflation — which strips out volatile food and energy prices — is poised to drive the Federal Reserve to continue its most aggressive series of interest rate hikes in decades. And that’s bad new for assets of all stripes.

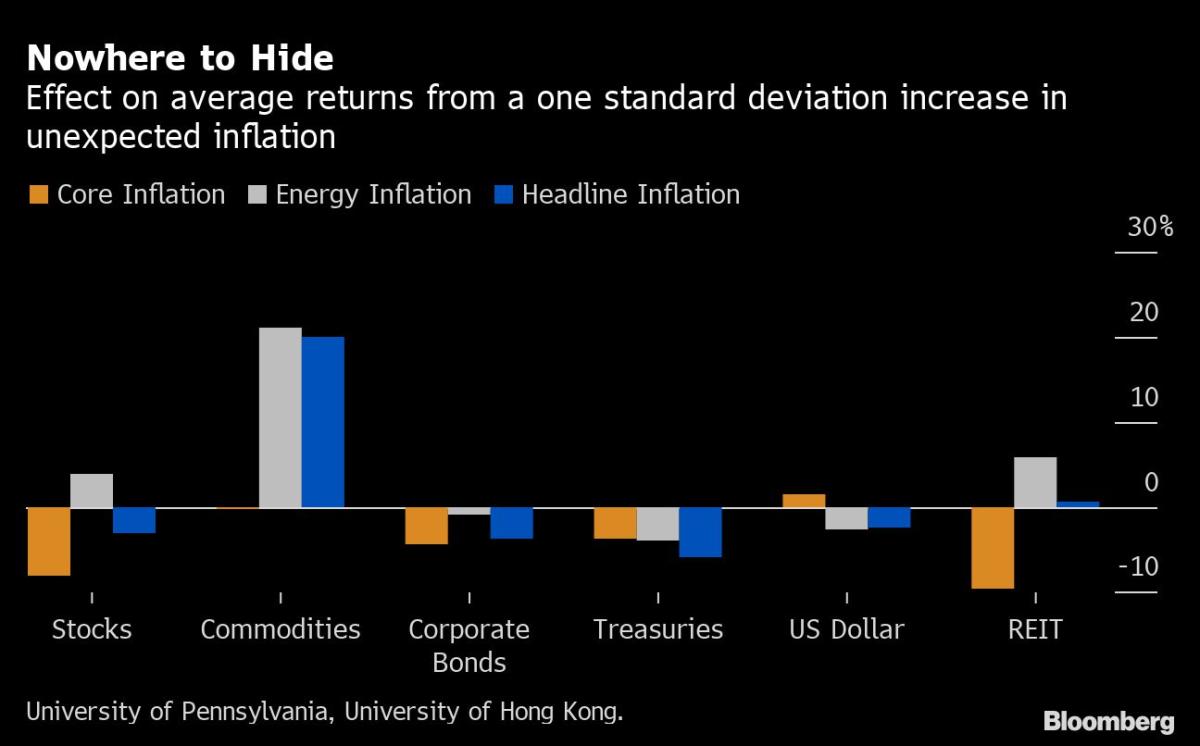

A new study by researchers from the University of Pennsylvania and the University of Hong Kong found that stocks, bonds, commodities and real estate investment trusts are all exposed to losses when core inflation unexpectedly rises, according to data from 1963 to 2019.

“The first half of the year when energy and food inflation were rising faster than core, commodities did great and looked like a great hedge against inflation,” said Nikolai Roussanov, a finance professor at the Wharton School of the University of Pennsylvania who co-authored the study. “But when energy prices started falling, we’ve seen that correlation reverse and commodities broadly are not doing so well.”

The shift adds to the darkening outlook in global financial markets, which have been hit hard this year as central banks worldwide tightened monetary policy, marking a sharp break from the easy-money era that helped stocks and bonds rally through the pandemic.

On Tuesday, the US Labor Department reported that the core consumer price index rose 6.3% in August from a year earlier, the first acceleration since March. The figures dashed investors’ hopes for a slowdown and cemented expectations the Fed on Sept. 21 will raise its key rate by three-quarters of a percentage point for the third straight time.

Such aggressive tightening raises the risk of a sharp slowdown in the economy that would batter corporate profits and demand for commodities like oil.

The S&P 500 Index tumbled more than 4% on Tuesday alone, following the inflation report, and ended the week down nearly 5%. A Bloomberg commodity index has plunged 3% since Tuesday. And Treasury yields climbed, pushing US government debt to a loss of more than 11% this year, by far the worst since the Bloomberg index starts in 1973. The US dollar has been among the few bright spots, with the currency pulled up by rising interest rates.

The shift in the commodities markets is consistent with what has been seen since the early 1960s, according to Roussanov and his fellow researchers. While commodities return 21% when energy inflation rises by one standard deviation, they actually fall 0.1% when core inflation sees the same jump.

A similar study by researchers from hedge-fund firm Man Group Plc and Duke University also found that both stocks and bonds tend to perform poorly during inflationary times while commodities are the one major asset class that reliably outperforms when inflation is high. But the caveat is once headline inflation begins falling from its peak the return for the asset class has tended to be zero, according to one of the authors.

“The whole market and the whole world is navigating from this period of high and rising inflation, that we’ve been in, to a period of still high, but lower inflation,” said Man Group portfolio manager Teun Draaisma. “We’re on the cusp of that change.”

The shift is fueling a movement out of commodities funds as investors brace for slower economic growth or a recession. Broad-based commodity exchange-traded funds are set to see cash pulled out for a fifth straight month in September, with almost $17 billion withdrawn since the start of May.

“With core inflation very strong this implies that aggressive monetary tightening will be delivered,” said Peter Chatwell, head of global macro strategies trading at Mizuho International Plc. “This should reduce demand in the near term, and take most asset prices lower.”

©2022 Bloomberg L.P.