(Bloomberg) —After a week to forget on Wall Street, the road gets even tougher for battle-weary investors with another hawkish policy gathering by the world’s most important central bank happening in the midst of what’s historically the worst month for US stock returns.

Hedged-to-the-teeth stock managers are raising all manner of red flags for would-be dip buyers — from the typically bearish trading patterns of September, to midterm election risk, to fears over Corporate America’s profit trajectory. And another likely supersized rate hike from the Federal Reserve on Wednesday, after a higher-than-expected August inflation reading last week, has Wall Street seeing few reasons for a sustainable rebound any time soon.

Now, even the calendar is against anyone looking to buy equities. This is the weakest month for the S&P 500 Index in data going back to the 1950s, and it’s already down more than 2%.

“Clients and the markets are very nervous,” said Victoria Greene, founding partner at G Squared Private Wealth, who says the US benchmark may push as low as 3,400, a 12% fall from current levels. “It’s too early for us to be dip buyers.”

Many investors who thought inflation had peaked got a rude awakening from Tuesday’s scorching consumer prices report. It battered stocks and sent the S&P 500 to its worst week since its June bottom.

Traders are now preparing for another 75-basis-point hike, with some predicting a 100-basis-point increase. The benchmark gauge, which through mid-August had surged as much as 17% from its June low, is up just 5.6% in the last three months.

Weakest Weeks

“The CPI report is a game-changer,” said Mark Newton, a technical strategist at Fundstrat Global Advisors and long-term bull turned short-term bear. Newton sees the S&P 500 bottoming out in mid October.

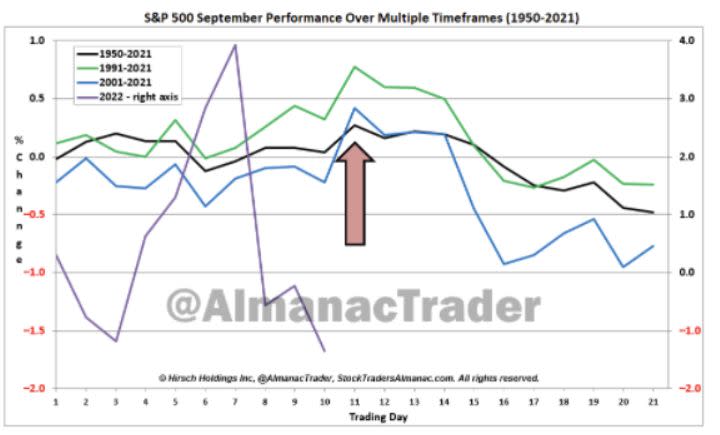

Historically, the back half of September is one of the most difficult periods for the stock market. The S&P 500 averages a 0.75% decline in the second part of the month since 1950, according to the Stock Trader’s Almanac.

There are a couple of theories for this. Investors returning from summer vacations tend to reassess portfolio positioning defensively. Companies prepare their budgets for the coming year and debate belt tightening. And mutual funds often engage in window dressing by selling positions at a loss to reduce the size of their capital-gains distributions.

Of course, anyone who seeks to divine seasonal patterns for trading convictions does so knowing that past isn’t prologue and September has eked out positive returns in recent years. Still, this is another bad omen for a market with few good ones to lure dip buyers.

And there’s little respite ahead, as October is the stock market’s most volatile month. Since World War II, the average volatility in October is 36% above the average for the other 11 months of the year, according to investment research firm CFRA. One reason is markets tend to struggle in the lead up to midterm elections, and this is a midterm year. But equities typically post a strong rally into year-end after midterms.

Bear Killer

Beyond the Fed meeting, stocks will be driven by third-quarter earnings this October. Profits have been better than feared so far, but strategists at Morgan Stanley and Bank of America Corp. warn that estimates need to be cut much further before equities can find a true low.

“The Fed needs to see inflation come down and is headed near its 2% target, but we’re a long way from that,” said Stephanie Lang, chief investment officer at Homrich Berg, who recommends being defensively positioned in favor of consumer staples and health-care companies.

Yet while October is seen as a spooky month for equities, it’s also known as a “bear killer” — turning the tide in roughly a dozen post-World War II market slumps, according to the Stock Trader’s Almanac.

If history is any guide, traders can therefore be forgiven for hoping that month may yet bring the market bottom.

“When investors are very fearful, bear markets tend to die,” said Newton of Fundstrat.

©2022 Bloomberg L.P.