(Bloomberg) — Federal Reserve officials raised interest rates by 75 basis points for the third consecutive time and forecast they would reach 4.6% in 2023, stepping up their fight to curb US inflation that’s persisted near the highest levels since the 1980s.

Wednesday’s decision by the Federal Open Market Committee, which was unanimous, lifts the target range for the benchmark federal funds rate to a range of 3% to 3.25% — the highest since before the 2008 financial crisis, and up from near zero at the start of this year.

In a statement following a two-day meeting in Washington, officials led by Chair Jerome Powell repeated that they are “highly attentive to inflation risks.” The central bank also reiterated it “anticipates that ongoing increases in the target range will be appropriate,” and “is strongly committed to returning inflation to its 2% objective.”

Powell will hold a press conference at 2:30 p.m.

Fresh projections indicate a fourth-straight 75 basis-point hike could be on the table for the next gathering in November, about a week before the midterm elections.

For Bloomberg’s TOPLive blog on the Fed decision and press conference, click here

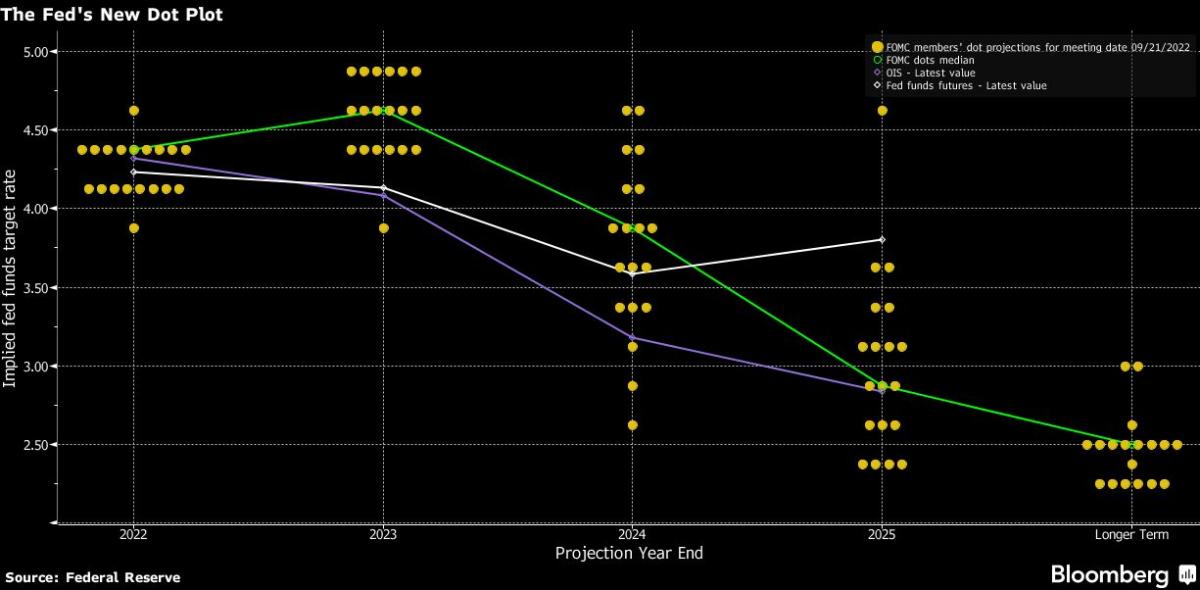

Policy makers now expect the key rate to rise to 4.4% by year end and 4.6% during 2023, according to the median estimate in updated quarterly projections published alongside the statement.

Further ahead, rates were seen stepping down to 3.9% in 2024 and 2.9% in 2025.

The policy-sensitive two-year Treasury yield surged, jumping above the 4% level. Meanwhile the S&P 500 index plunged — reversing early day gains — and the dollar index hit a new record high.

Swaps traders boosted where they now see the funds rate ending the year to about 4.31%, from around 4.22% before the FOMC meeting wrapped.

The projections, which showed a steeper rate path than officials laid out in June, underscore the Fed’s resolve to cool inflation despite the risk that surging borrowing costs could tip the US into recession.

Powell and his colleagues, slammed for a slow initial response to escalating price pressures, have pivoted aggressively to catch up and are now delivering the most aggressive policy tightening since the Fed under Paul Volcker four decades ago.

The updated forecasts also showed unemployment rising to 4.4% by the end of next year and the same at the end of 2024 — up from 3.9% and 4.1%, respectively, in the June projections.

Estimates for economic growth in 2023 were marked down to 1.2% and 1.7% in 2024, reflecting a bigger impact from tighter monetary policy.

Inflation peaked at 9.1% in June, as measured by the 12-month change in the US consumer price index. But it’s failed to come down as quickly in recent months as Fed officials had hoped: In August, it was still 8.3%.

Job growth, meanwhile, has remained robust and the unemployment rate, at 3.7%, is still below levels most Fed officials consider to be sustainable in the longer run.

The failure of the labor market to soften has added to the impetus for a more-aggressive tightening path at the US central bank.

Fed action is also taking place against the backdrop of tightening by other central banks to confront price pressures which have spiked around the globe. Collectively, about 90 have raised interest rates this year, and half of them have hiked by at least 75 basis points in one shot.

©2022 Bloomberg L.P.