2022 has meant a lot of uncertainty in the marketplace. Inflation, rising interest rates and war are just the biggest headlines that have kept the markets on edge, pushing the market into a confirmed bear market by June, and testing those lows as a new set of bearish momentum is picking up.

While everybody wants to keep the good times rolling and see long-term market rallies extend into infinity, the reality is that economies ebb and flow through cycles of prosperity to scarcity and back again. Cyclicality also sees its way into the stock market, as stock prices follow their own ebb and flow. Industries whose peaks and valleys tend to coincide with broad economic conditions are known as cyclical stocks.

Cyclical stocks are those that are expected to do well when economic conditions are generally healthy, and that will naturally struggle when the economy struggles. One of the core sectors of the economy that fits this very generalized description is the Transportation sector, which takes in a broad set of industries, including airlines, railroads, trucking and freight, overseas shipping, and so on. One of the major contributors to rising costs throughout the economy have been constraints on the supply chain, along with rising fuel prices. These are dynamics that generally work against stocks in the Transportation industry.

Uncertainty and volatility amid signs that the economy is struggling mean that you can often find stocks in these industries trading at pretty significant discounts to their not-so-distant highs. That makes them tempting fodder for a contrarian, value-oriented investor. I like to pay attention to these stocks, because their fundamentals can give me some useful clues about their ability to weather an economic downturn. These are also stocks that, like any other, can see big swings from high to low based on nothing more than the market’s expectation for what the economy might do in the near future.

CSX Corporation (CSX) is a good example of the kind of stock I’m referring to. As one of the four largest transportation companies in the oligopoly that is the U.S. Road & Rail industry, this is a stock that is very sensitive to a variety of economic dynamics, from commodity and fuel prices to interest rate fluctuations. The collapse of oil prices during the pandemic might have been taken as a good thing for this sector, since fuel costs should generally be lower; but as economy activity ground to a halt during the second quarter of 2020, so did the demand for transportation services.

From a bear market bottom in March of 2020, the stock rebounded like most of the rest of the market as investors acted on the hope that the net economic effect would be temporary; in fact, the stock used the market’s broad, forward-looking and bullish hope of a recovery as a reason to push the stock from around $22 in July 2020 to a peak in early May of 2021 at around $35. From that point, the stock dropped back to a short-term low at around $30 in late September of last year. The stock then picked up a lot of bullish momentum, peaking in March at around $39, followed by a new wave of bearish momentum that saw the stock hit a new, 52-week low at around $27.50 in mid-June. The stock staged a new, failed rally to a peak at around $32.50 in August, with the stock sliding back since then to its current price at around $27.50.

The sensitivity of stocks like CSX to the kind of pressures and dynamics I’ve just outlined is why it is important to take a critical look at the company’s balance sheet and overall fundamental strength. This is a company with a strong fundamental profile, and a balance sheet that weathered the pandemic storm remarkably well and still appears well positioned now. That is a positive sign that bodes well for the company in the long-term; for bargain hunters, the stock’s current trading price prompts the question of whether CSX represents a compelling enough value under current market conditions to justify taking its long-term opportunity seriously. Let’s dive in.

Fundamental and Value Profile

CSX Corporation is a transportation company. The Company provides rail-based freight transportation services, including traditional rail service and transport of intermodal containers and trailers, as well as other transportation services, such as rail-to-truck transfers and bulk commodity operations. The Company categorizes its products into three primary lines of business: merchandise, intermodal and coal. The Company’s intermodal business links customers to railroads through trucks and terminals. The Company’s merchandise business consists of shipments in markets, such as agricultural and food products, fertilizers, chemicals, automotive, metals and equipment, minerals and forest products. The Company’s coal business transports domestic coal, coke and iron ore to electricity-generating power plants, steel manufacturers and industrial plants, as well as export coal to deep-water port facilities. CSX has a current market cap of $59 billion.

Earnings and Sales Growth: Over the last twelve months, earnings were 25% higher, while sales increased 27.6%. In the last quarter, earnings grew 28.2% while sales almost 12% higher. CSX operates with a healthy, robust margin profile that has been remarkably resilient, but also matches its current declining earnings pattern; in the last twelve months, Net Income was a little over 28% of Revenues, and strengthened to almost 31% in the last quarter.

Free Cash Flow: CSX’ Free Cash Flow is healthy, at a little over $3.7 billion. That marks an improvement from $3.6 billion a year ago, but a drop from about $3.9 billion. Their current Free Cash Flow number translates to a Free Cash Flow Yield of 6.32%.

Debt to Equity: CSX has a debt/equity ratio of 1.22. This indicates the company is highly leveraged; but this is also very typical of stocks in the Transportation industry. Their balance sheet shows $812 million in cash and liquid assets against roughly $16 billion in long-term debt as of the most recent quarter. The company’s operating profile suggests there should be no problem servicing the debt they carry.

Dividend: CSX pays an annual dividend of $.40 per share, which at its current price translates to a dividend yield of about 1.46%. Their dividend payout ratio is also conservative, at less than 25% of their earnings over the last year.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $34 per share. That means the stock is somewhat undervalued at its current price, with 24% upside from its current price.

Technical Profile

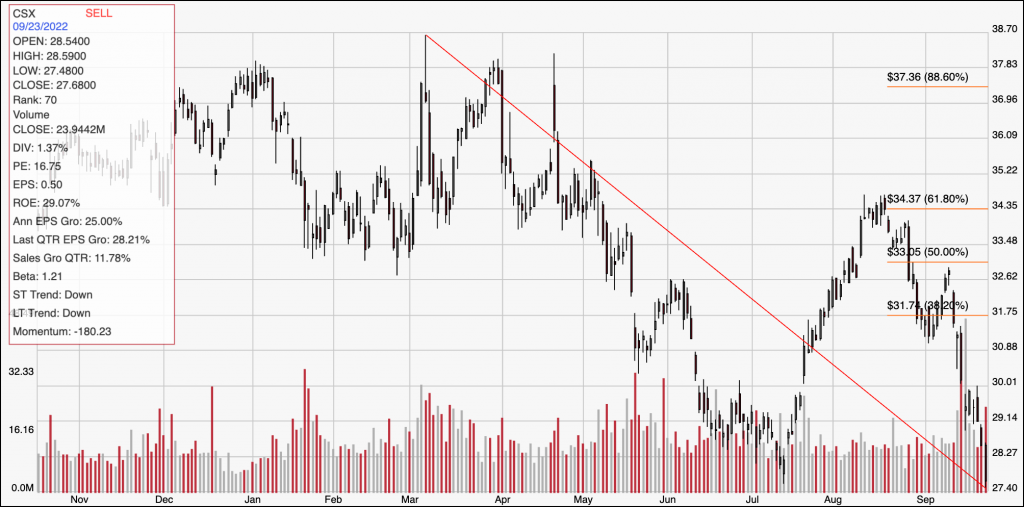

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the past year of price activity for CSX. The red diagonal line traces the stock’s downward trend from its March high at around $39 to its new low reached this week a little above $27. It also provides the baseline for the Fibonacci retracement levels outlined on the right side of the chart. The stock has dipped below its previous yearly low, set in July at around $27.50, but could be stabilizing around that level now, so I’ll mark current support at around $27.50, with immediate resistance at around $29. If $27.50 doesn’t hold as current support, next support is likely to be at around $26 based on the current distance between support and resistance. The stock’s strongly bearish momentum makes a new, strong bullish rally a low-probability event in the very near term; however a push above $29 could see the stock rally to about $31 before finding additional resistance a little below the 38.2% retracement line.

Near-term Keys: CSX is a stock with generally healthy fundamentals, and a value proposition that is attractive; however keep in mind that taking a value-based position in this stock means that you are tacitly accepting the likelihood of continued price volatility for as long as current market conditions last. If you prefer to work with short-term, momentum-oriented trades – and you are willing to be very aggressive – you could use a push above $29 as a signal to consider buying the stock or working with call options, with a practical target price at around $31. The stock’s current drop below $27.50, if it continues could be a signal to consider shorting the stock or buying put options, with a practical, quick exit target at around $26 on a bearish trade.