The Tech sector often leads the broad stock market’s movements. As a value investor, the rush into Tech during a bull market leaves me a little cold; but when the market has turned bearish, and people are running away from Tech stocks en masse, I think the opportunity to find great value starts to get more and more interesting.

While the Tech sector led the market through 2020 and 2021 to the upside, it’s become something of a red-headed stepchild in 2022. Supply constraints that started prior to the pandemic, but continue to have an effect have been compounded by increasing interest rates along with geopolitical tensions this year, all of which has pushed most of the biggest names in the Tech sector into their own respective bear markets. That big push to the downside included just about every industry, including Semiconductors.

In the semiconductor space, I like to pay attention not just to the producers – Intel, Advanced Micro Devices, Samsung Electronics, and so on – but also the companies that provide solutions and services to aid their production. That means equipment manufacturers, like Applied Materials Inc. (AMAT) are always of interest. This is a company whose balance sheet has held up extremely well throughout the past two years, even with concerns about chip supply. I also think an interesting, long-term tailwind for this company comes in the shift that a lot of the Tech sector in the U.S. has made to begin investing in more localized manufacturing and fabrication solutions. Intel Corp (INTC), for example is putting a major focus on building its own foundry services within the continental United States – something that I think also provides an opportunity for companies like AMAT to provide much of the equipment that goes along with it.

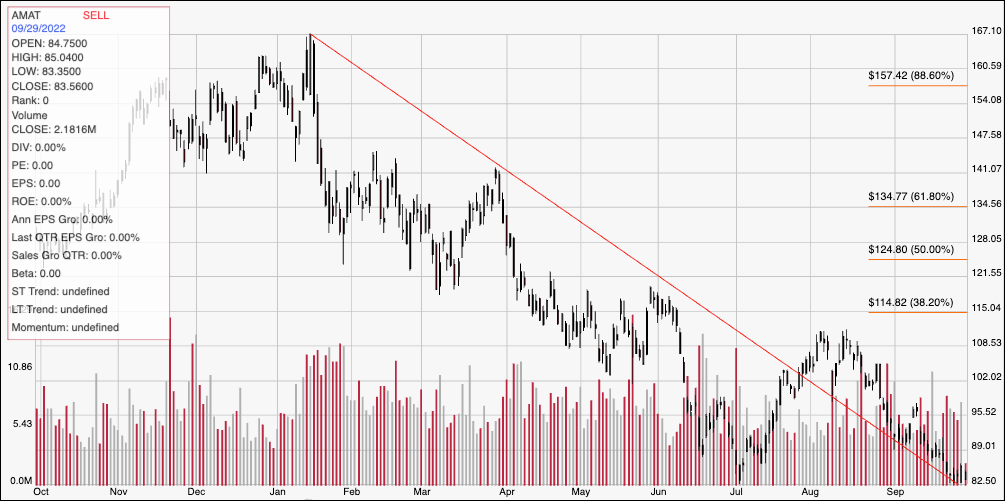

After rallying from a pandemic-driven low at around $54 in 2020, the stock peaked at the start of this year at around $167 – more than tripling in value and making one of the clear standouts in a sector that clearly stood above the rest during that period. However, the broad market’s bearish momentum has pushed the stock about -50% lower since then and into its own long-term downward trend. The stock did stage a temporary rally – along with the rest of the market – in July at around $83 to an August peak at around $109. From that point, the stock has dropped back again, and is revisiting its 52-week low point as of this writing. That’s scary for growth investors, and would undoubtedly make any of the talking heads on TV talk about how bad things may get. There certainly is the potential for continued bearishness; it may even accurate to say that the stock is likely to extend its downward trend even more in the near term. For value seekers, however, these are also levels that are worth paying attention to. Are the company’s fundamentals strong enough to suggest the stock could offer a useful value proposition at its current price? Let’s dive in to find out.

Fundamental and Value Profile

Applied Materials, Inc. provides manufacturing equipment, services and software to the global semiconductor, display and related industries. The Company’s segments are Semiconductor Systems, which includes semiconductor capital equipment for etch, rapid thermal processing, deposition, chemical mechanical planarization, metrology and inspection, wafer packaging, and ion implantation; Applied Global Services, which provides integrated solutions to optimize equipment and fab performance and productivity; Display and Adjacent Markets, which includes products for manufacturing liquid crystal displays, organic light-emitting diodes, upgrades and roll-to-roll Web coating systems and other display technologies for televisions, personal computers, smart phones and other consumer-oriented devices, and Corporate and Other segment, which includes revenues from products, as well as costs of products sold for fabricating solar photovoltaic cells and modules, and certain operating expenses. AMAT has a current market cap of $72.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by 2.11%, while sales improved by about 5.23%. In the last quarter, earnings were about 4.9% higher, while sales improved by 4.4%. The company’s margin profile is impressive; Net Income versus Revenue was 26.42% over the last twelve months, but tapered to 24.63% in the last quarter. The narrowing in the last quarter is less than ideal, but given the level of Net Income to Revenue, it’s also not a major concern.

Free Cash Flow: AMAT’s Free Cash Flow is strong, at $4.9 billion. This number is up over the last year, from $4.7 billion, but dropped over the last two prior quarters, from $5.9 billion. The current number translates to a modest Free Cash Flow Yield of 6.65%.

Debt to Equity: AMAT has a debt/equity ratio of .45, which is conservative, and implies debt management shouldn’t be a problem. The company has nearly $3.5 billion in cash and liquid assets, against $5.45 billion in total long-term debt.

Dividend: AMAT pays an annual dividend of $1.04 per share – an improvement from $.80 in 2019, $.88 in early 2021, and $.96 before the last earnings announcement – and which, at its current price translates to a dividend yield of about 1.21%. While the yield isn’t impressive, the fact is that an increasing dividend payout is a strong sign of management’s confidence in the road ahead and their intent to return value to their shareholders.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $96 per share. That means that AMAT is undervalued, with about 15% downside from its current price, and with a practical bargain price for the stock at around $77.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red line traces the stock’s downward trend from a January peak around $167 to its low this week at around $82.50. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. Current support should be at $82.50, with the stock hovering through most of this week around that level along with the springboard it provided in for the stock’s short-term July rally. Immediate resistance is at around $89. A drop below $82.50 could have additional downside to about $75.50 based on the current distance between support and resistance, while a push above $89 should find next resistance at around $96.

Near-term Keys: If you prefer working with short-term, momentum-based trades, I think the stock’s price activity could offer some interesting set ups. A bounce off of support at around $82.50 could be an aggressive signal to consider buying the stock or working with call options, with $89 providing an attractive short-term target. A drop below $82.50, on the other hand could be a good signal to consider shorting the stock or buying put options, with a target profit price at around $75.50. What about the value proposition? AMAT’s fundamentals are solid, with the stock offering a value proposition that is interesting, but not quite compelling at its current price level. Given the pace and strength of the stock’s bearish momentum, I would watch the stock carefully, any signs of stabilization in the mid-$70 range could offer an interesting opportunity to buy a good company at a nice price.