(Bloomberg) — The bond market is bracing for more turbulence as a crucial reading on the still-tight US labor market is set to give traders a chance to reassess the Federal Reserve’s commitment to its aggressive path of interest-rate hikes.

Fed officials underscored their focus on the domestic economy in the past few days, even after chaos in UK markets forced the Bank of England to intervene to preserve financial stability. Against that backdrop, Friday’s release of US September job figures looms as a test of the Fed’s plan to rein in inflation by tightening policy further and unwinding its mammoth balance sheet.

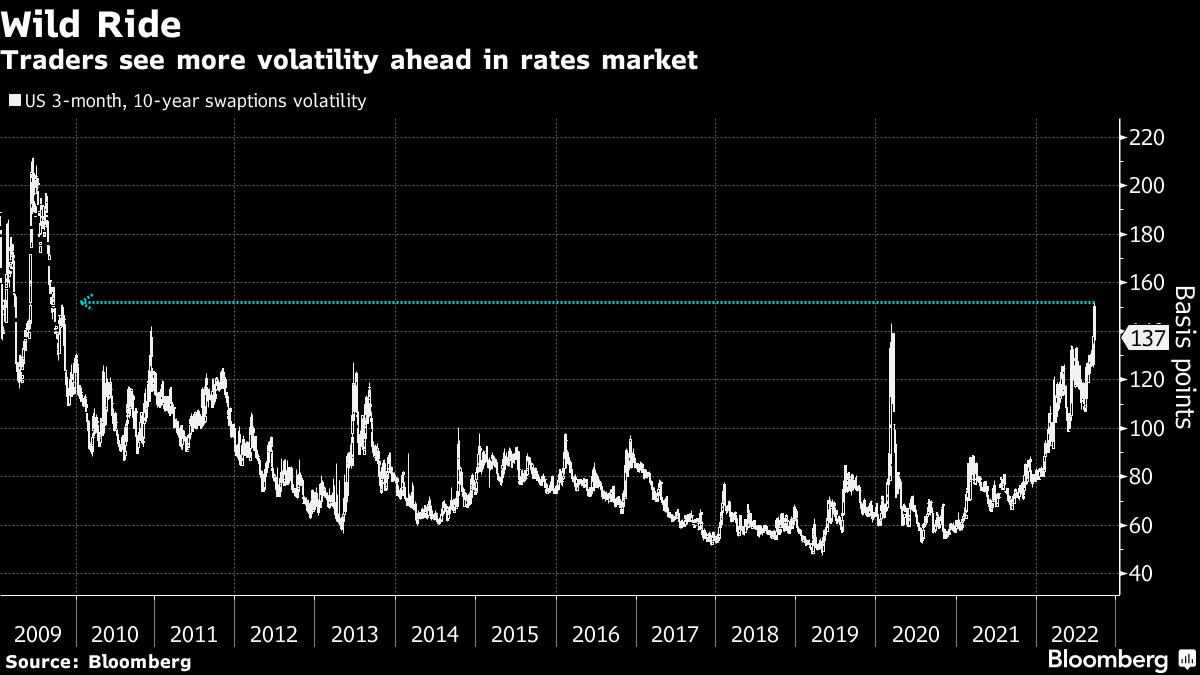

Signs of a softening labor market may have some traders wagering that asset prices have baked in peak Fed hawkishness, while a strong report would risk driving yields even higher, deepening the worst losses in decades for bond investors. Either way, it’s a fair bet that more gyrations are ahead. That’s a daunting prospect at a time when one measure of rates volatility is already the highest since the global financial crisis, sapping liquidity in the world’s most important debt market.

“This kind of rate-market volatility is going to continue,” said Nancy Davis, founder of Quadratic Capital Management. “We are seeing stagflation in terms of asset prices now with both stocks and bonds selling off together. It’s a hell of a time for people.”

Yields on Treasuries, which help determine the value of more than $50 trillion in global assets, are near or beyond the highest in over a decade as more aggressive Fed rate increases are seen as a lock by investors. Stronger-than-forecast inflation data on Friday offered the latest evidence that the central bank will need to keep tightening, until a financial shock or a steep rise in unemployment challenges its primary policy focus.

The Treasury 10-year yield surged above 4% this week for the first time since 2010, before tumbling back to around 3.8% after the BoE resumed buying long-dated bonds. Treasury yields still rose for the 9th straight week — the longest streak since 1994.

Fed officials over the past week affirmed the need to tighten policy well beyond the current band of 3% to 3.25%, while acknowledging they’d monitor the impact on global-market stability. Swaps traders see a peak rate of about 4.5% around March. Fed officials’ latest median projections show the funds rate at 4.4% at year-end.

Read more: Fed’s Mester Says Rates Need to Keep Rising to Reduce Inflation

Job creation likely slowed in September, most economists polled by Bloomberg predict. That’s the sort of result Fed officials want, and it’s a scenario that could comfort markets by curbing the degree of rate hikes traders expect. Stock markets have been reeling as well, with the S&P 500 Index slumping to the lowest since 2020.

“It’s a time when bad economic data is good for markets,” Quadratic’s Davis said.

Upside Risk

Of course, an upside jobs surprise could catapult yields ever higher, and there’s reason to gird for that outcome given the steady drop in the four-week moving average of jobless claims from its August peak. The median forecast is for 250,000 new jobs in September, down from 315,000 in August. Wage growth is seen moderating to a still healthy annual pace of 5.1%, from 5.2%.

Evidence the job market remains robust is also likely to re-energize one of bond investors’ favorite trades this year: wagering on yield-curve flattening. That spread is inverted between many maturities already, a relationship that has a track record of preceding US recessions.

Two-year Treasury yields are roughly 45 basis points above 10-year rates. In August, that gap inverted as far as 58 basis points, the most in decades.

“The bond market has migrated to a two-factor labor/inflation model,” said Steve Boothe, head of the investment-grade fixed income team at T. Rowe Price. “The curve inversion can deepen and persist. Flattening will likely be led by the 2/10’s part of the curve and persist until we price in a recession.”

What to Watch

- Economic calendar

- Oct. 3: S&P manufacturing; construction spending; ISM manufacturing/prices paid/new orders/employment; Ward vehicle sales

- Oct. 4: Factory orders; durable and capital goods orders; JOLTS job openings

- Oct. 5: MBA mortgage applications; ADP employment; trade balance; S&P services/composite PMI; ISM services

- Oct. 6: Challenger job cuts; jobless claims

- Oct. 7: Nonfarm payrolls; wholesale inventories/trade; consumer credit

- Fed Calendar:

- Oct. 3: Atlanta Fed President Raphael Bostic; New York Fed President John Williams

- Oct. 4: Dallas Fed President Lorie Logan; Williams; Cleveland Fed President Loretta Mester; Fed Governor Philip Jefferson; San Francisco Fed President Mary Daly

- Oct. 5: Bostic

- Oct. 6: Chicago Fed President Charles Evans; Fed Governor Lisa Cook; Fed Governor Christopher Waller; Mester

- Oct. 7: Williams, Bostic

- Auction calendar:

©2022 Bloomberg L.P.