(Bloomberg) — Michael J. Wilson, one of Wall Street’s biggest equity bears, says a Federal Reserve pivot to dovishness is becoming likely amid falling money supply, but such a move won’t allay concerns about earnings.

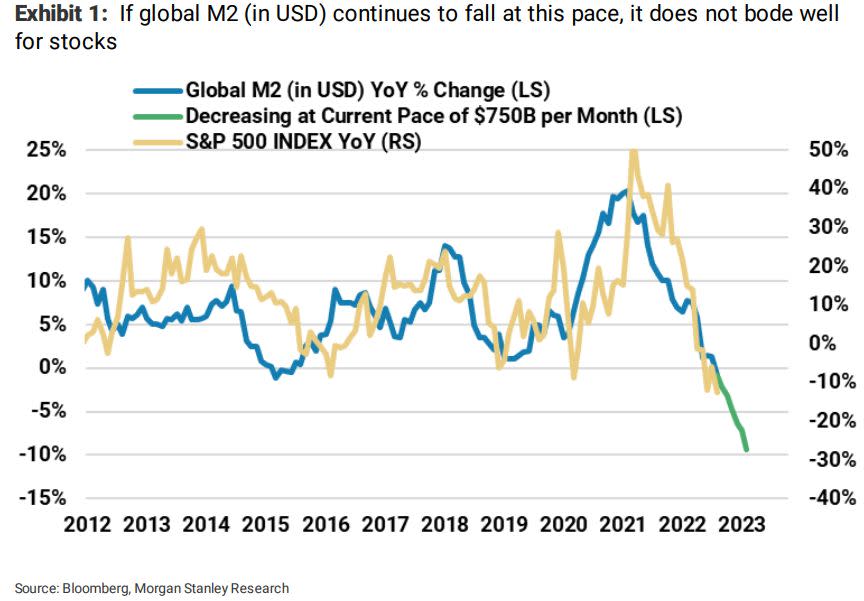

“We find M2 growth in what we call the ‘danger zone’ -– the area where financial/economic accidents tend to occur,” Wilson, Morgan Stanley’s chief US equity strategist, wrote in a note on Sunday, referring to the Fed’s broadest measure for money supply.

While “a Fed pivot is likely at some point,” the timing is uncertain and it won’t change the trajectory of earnings estimates, he added.

Wilson, who predicted this year’s equities selloff, wrote that the year-on-year rate of change in money supply in dollars for the US, China, the Eurozone and Japan has turned negative for the first time since March 2015, a period that immediately preceded a global manufacturing recession. Such tightness is unsustainable “and the problem can be fixed by the Fed, if it so chooses,” he wrote.

The strategist said last week that US equities are in the “final stages” of a bear market and could stage a rally in the near term going into the earnings season before selling off again.

Wilson has said that he sees an eventual low for the S&P 500 coming later this year, or early next, at the 3,000 to 3,400 point level. That implies a drop of as much as 16% from Friday’s close.

©2022 Bloomberg L.P.