It’s always interesting to watch the way market momentum and investor attention shifts over time. Societal and geopolitical concerns are just two elements that have shifted the tide of economic fortune over the last couple of years.

COVID and the continuing pandemic dominated the news cycle as soon as it arrived in the United States in early 2020. Corporate America’s ability to pivot quickly and adapt rapidly to keep business going was a primary reason that the market rebounded strongly from its initial drop to bear market levels in March of 2020 to soar well past pre-pandemic highs through most of 2021. 2022 started a bit rockier as rising inflation prompted the Fed to take an increasingly hawkish approach to monetary policy that continues today. The ongoing reality of war between Russia and Ukraine, and the geopolitical and economic pressures that come with it have added to rising cost pressures on energy-related commodities that have rippled downstream to practically every other segment of the market. Altogether, these different elements have kept all three major indices into bear market territory through the summer and into the start of fall.

Interest rate fears stoked by inflation, plus the threat of war are just a couple of things that history has shown to make up a pretty toxic mix for the stock market. it’s an ignorant investor that doesn’t recognize that broad market risk is high right now, with additional signs that there could be more pain ahead. That kind of momentum is something that makes most stocks seem radioactive, but even under such difficult conditions, there are assets that have proven to be resilient.

One of the ways that a lot of people like to get defensive – to find useful “safe haven” assets – is to work with precious metals like gold and silver as way to diversity their portfolio. Working with the commodities themselves can be a good way to directly hedge against broad market risk. If you don’t want to work directly with the commodity itself, another alternative is to invest in the companies that mine, process, and produce it.

Barrick Gold Corp (GOLD) is one of the largest gold miners in the world, with operations in Canada, the United States, Central and South America, and Australia. The past year of market activity saw the stock peak in April at around $26, and then fall to into a downward trend that didn’t find bottom until late in September at around $14. That movement might defy the notion of using the stock as a way to get defensive when uncertainty is high, but another part of the value of a defensive-oriented strategy is to think about the company itself and the long-term opportunity it might offer.

Looking beyond the commodity and its value as a defensively-positioned asset, this is also a company with a very strong balance sheet, good Free Cash Flow, and an attractive value proposition. With geopolitical questions about Russia and its place in the global community in the aftermath of its aggression towards Ukraine not likely to see a quick resolution, I think that means that GOLD is a company that should continue to act as a good, defensively positioned proxy for the precious metal – and is something that you might want to consider as a smart way to diversify your portfolio.

Fundamental and Value Profile

Barrick Gold Corp is a gold mining company. The Company is principally engaged in the production and sale of gold and copper, as well as related activities, such as exploration and mine development. The Company’s segments, include Barrick Nevada, Golden Sunlight, Hemlo, Jabal Sayid, Kalgoorlie, Lagunas Norte, Lumwana, Porgera, Pueblo Viejo, Turquoise Ridge, Veladero and Zaldvar. Pueblo Viejo, Lagunas Norte, Veladero and Turquoise Ridge are its individual gold mines. The Company, through its subsidiary Acacia, owns gold mines and exploration properties in Africa. Its Porgera and Kalgoorlie are gold mines. Zaldivar and Lumwana are copper mines. The Pascua-Lama project is located on the border between Chile and Argentina. The Company owns a number of producing gold mines, which are located in Canada, the United States, Peru, Argentina, Australia and the Dominican Republic. GOLD has a current market cap of about $29 billion.

Earnings and Sales Growth: Over the last twelve months, earnings decreased by about -17.25%, while revenues also dropped by -1.18%. In the last quarter, earnings were -7.69% lower, while revenue growth was flat, but positive, at 0.21%. The company’s margin profile is a sign of strength, showing a moderate increase, and divergence from the earnings pattern; over the last twelve months, Net Income was 16.87% of Revenues, and improved to 17.07% in the last quarter.

Free Cash Flow: GOLD’s free cash flow is healthy at about $1.8 billion over the last year, which is an impressive improvement from about $401 million at the beginning of 2019, and $1.17 billion at the end of 2019, but below the $2.35 billion high water mark seen a little over a year ago. The current number translates to a modest Free Cash Flow Yield of 6.45%.

Debt/Equity: The company’s Debt/Equity ratio is .16, reflecting a conservative approach to leverage. Their balance sheet, in fact is a point of strength, since cash and liquid assets have improved from $3.3 billion in December 2019 and $5 billion a year ago to almost $5.8 billion in the last quarter. Long-term debt currently stands at $5.13 billion, versus more than $12.5 billion in January of 2015 and $5.4 billion in the last quarter of 2020.

Dividend: GOLD’s annual divided is $.40 per share and translates to a yield of about 2.51% at the stock’s current price. The dividend has increased steadily since 2019; at the beginning of that year, the dividend was $.16 per share, $.28 per share at the beginning of 2020, and $.36 per share a year ago. The steady increase is a good sign that the company is focused not only on managing their business but also about finding constructive ways to return value to its shareholders.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $24 per share. That means the stock is significantly undervalued right now, with 47% upside from its current price.

Technical Profile

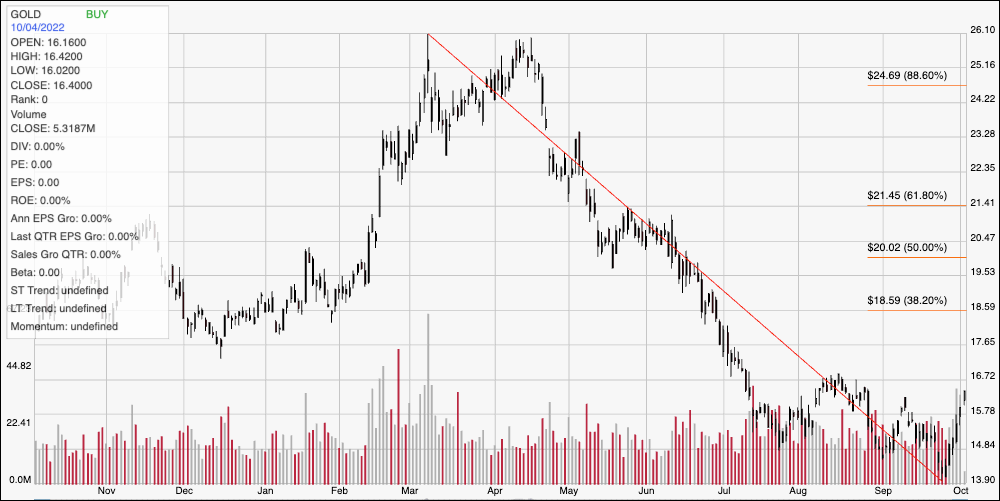

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above shows the last twelve months of price activity for GOLD. The red diagonal line traces the stock’s downward trend from its February high at around $26 to its low in September at around $14; it also provides the baseline for the Fibonacci retracement lines on the right side of the chart. The stock has picked up bullish momentum since finding its trend low, breaking through previous resistance to mark new, current support at around $16 to start this week, with immediate resistance expected to be seen around $17 per share. A push above $17 should give the stock room to rally to between $18 and $19, depending on the state of buying momentum, while a drop below $16 should have limited downside, with next support expected at around $15.

Near-term Keys: GOLD’s fundamental strength and value proposition are elements that I think make GOLD a hard stock to ignore – especially under current market conditions. With inflation and geopolitical concerns from Ukraine expected to remain high, precious metals should make sense as a smart place to think about diversifying your portfolio. If you prefer to work with short-term trades, a drop below $16 could offer an opportunity to short the stock or to work with put options, with an eye on $15 to $14 as a practical, very short-term profit target. A push above immediate resistance at $17 could act as a signal to think about buying the stock outright or to use call options, with an eye on $18 to $19 as a practical profit target range on a bullish trade.