(Bloomberg) — Global finance chiefs gather in Washington in the coming days with the warning of a possible $4 trillion loss in the world’s economic output ringing in their ears.

That’s the Germany-sized hole in the growth outlook through 2026 that International Monetary Fund chief Kristalina Georgieva identified last week as a looming risk.

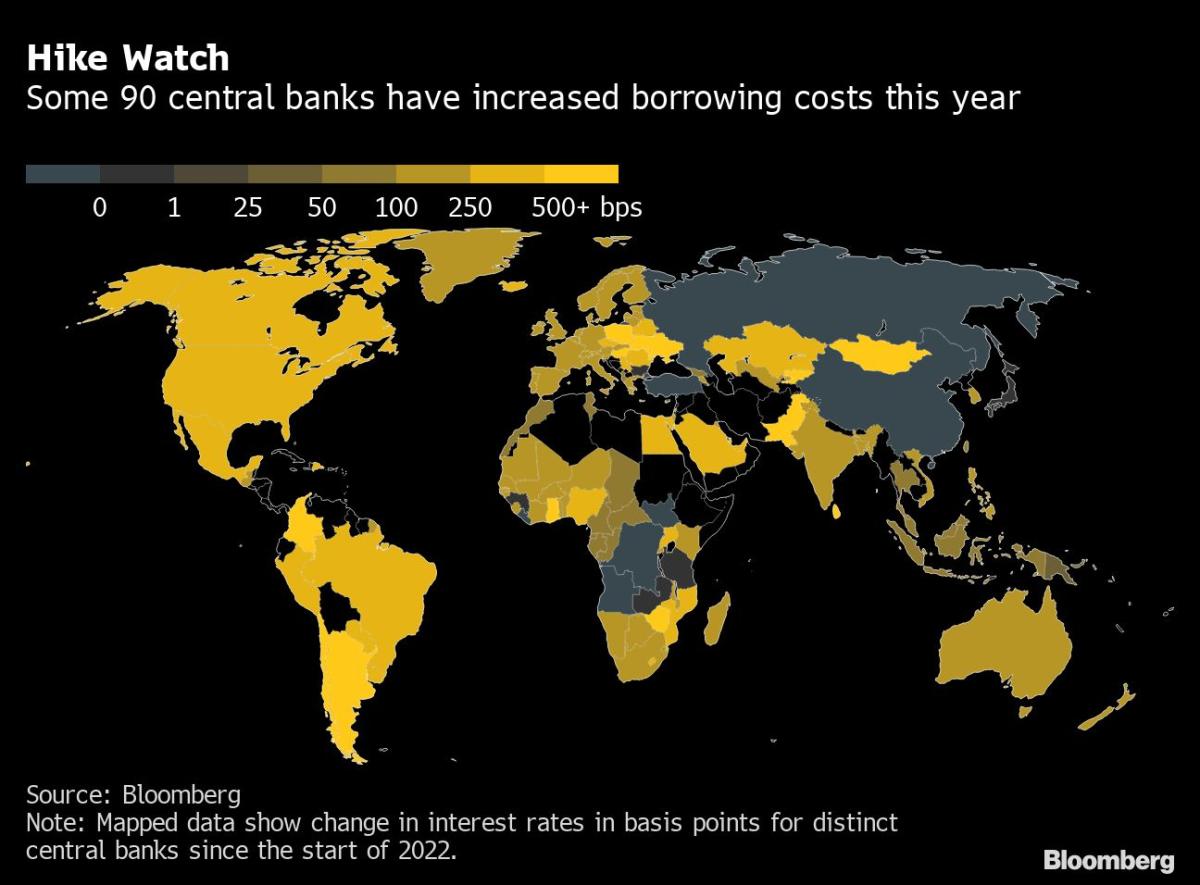

She’ll play host as central bankers, finance ministers and others confront the fallout on the global economy of rampant inflation, aggressive monetary-policy tightening, rising debt and the biggest ground war in Europe since World War II.

That the IMF and World Bank annual meetings will be fully in-person for the first time since the outbreak of Covid-19 in early 2020, showing progress in bringing the pandemic to heel, will be of limited comfort given other headaches.

The current confluence of economic, climate and security crises makes it unlike anything global policy makers have seen since 1945. Yet certain elements, such as the emerging-market havoc wreaked by Federal Reserve interest-rate hikes in the early 1980s, chime with the present predicament.

“The big question for the meetings is, ‘What are we going to do in terms of the institutional response to this, beyond business as usual,’” Masood Ahmed, president of the Washington-based Center for Global Development, said last week.

Here’s a quick look at some issues officials will grapple with:

- World Economic Outlook: the IMF releases this on Tuesday. Georgieva said last week that the 2023 global growth forecast of 2.9% will be lowered.

- Ukraine: the country Vladimir Putin’s forces invaded in February will stay in focus, from the impact of a depleted grain harvest to Russia’s gas squeeze on Europe. The IMF board on Friday approved a $1.3 billion loan for Ukraine, its first lending to the nation since early March.

- Food Prices: the IMF board last month approved a new emergency finance “food shock window” to help nations hurt by rising agricultural costs.

- The UK: the country remains vulnerable after market turmoil forced a partial U-turn on a tax-cut package from new Prime Minister Liz Truss’s government that was panned by the IMF.

- The Fed: US tightening is hurting other economies. IMF calculations show 60% of low-income countries and a quarter of emerging markets at or near debt distress.

- Climate: the crisis is only getting worse, as shown recently by disasters from flooding in Pakistan to a hurricane that slammed Puerto Rico and Florida.

Elsewhere this week, a faster core inflation reading in the US, UK financial stability news, a South Korean rate hike and the Nobel Prize for economics will be among highlights.

What Bloomberg Economics Says:

“When foreign finance ministers and central bankers gather in Washington for the World Bank-IMF meetings in the coming week, many may claim the rest of the world can’t afford any further Fed hikes.”

–Anna Wong, Andrew Husby and Eliza Winger. For full analysis, click here

Click here for what happened last week and below is our wrap of what’s coming up elsewhere in the global economy.

US Economy

In the US, the consumer price index is the highlight in the coming week. The Labor Department’s report on Thursday will offer Fed officials a snapshot of how inflationary pressures are evolving after a series of huge interest-rate increases.

Economists estimate the CPI rose 8.1% in September from a year ago, marking a deceleration from the prior month’s 8.3% annual increase as energy prices settled back. However, excluding fuel and food, the so-called core CPI is still accelerating — it’s expected to show a 6.5% annual gain, versus 6.3% in August.

An increase of that magnitude in the core measure would match the largest advance since 1982, illustrating stubborn inflation and keeping the pump primed for a fourth-straight 75 basis-point rate increase at the Fed’s November meeting.

Investors will hear from a number of US central bankers in the coming week, including Vice Chair Lael Brainard and regional Fed presidents Loretta Mester, Charles Evans and James Bullard. Minutes of the Fed’s September meeting will be released on Wednesday.

Other data include figures on prices paid to US producers. So-called wholesale inflation has shown signs of moderating as commodity prices weaken amid concerns about a global economic slowdown.

The week will be capped by retail sales data. Economists forecast a modest monthly advance in September, helped by a pickup in purchases of motor vehicles. Excluding cars, the value of retail sales is seen declining for a second month. Because the figures aren’t adjusted for inflation, the data suggest demand for merchandise slowed in the third quarter.

Asia

Bank of Korea Governor Rhee Chang-yong may resort to a mini U-turn on the scale of rate hikes. While he returned to the usual quarter-point increment in August, many economists see him opting for a move twice that size on Wednesday as the Fed’s rapid tightening piles pressure on the won.

The Monetary Authority of Singapore is seen set to tighten for a fifth straight meeting, while the State Bank of Pakistan is expected to keep the benchmark rate steady for a third.

Assistant Governor Luci Ellis may shed light on the Reserve Bank of Australia’s latest thinking on policy following its pivot to smaller hikes.

Bank of Japan Governor Haruhiko Kuroda and Finance Minister Shunichi Suzuki will be in Washington for the IMF meetings, with the yen’s movements still under close scrutiny.

Europe, Middle East, Africa

The week kicks off with announcement of the Nobel Prize for economics on Monday. The award was established by Sweden’s Riksbank in 1968, adding a sixth category to existing prizes for physics, chemistry, medicine, peace and literature. Three U.S.-based academics won in 2021 for work using experiments that draw on real-life situations to revolutionize empirical research.

The Bank of England’s Financial Policy Committee will take center stage on Wednesday, a sure-fire sign the UK is facing significant issues.

The panel, responsible for emergency intervention to prevent a bond-market spiral last month, will release a record of its latest meeting. That may offer insights into whether officials see a risk of renewed turmoil that already plagued pension funds following Britain’s mini-budget. It may also address the implications of a sharp increase in mortgage rates.

BOE Governor Andrew Bailey is among several officials due to speak in the coming week, many of whom will appear at or around the IMF meetings.

Similarly, several other officials from around Europe will speak in Washington or nearby. European Central Bank President Christine Lagarde, and Thomas Jordan, her Swiss National Bank counterpart, are both scheduled to deliver remarks.

In terms of European data, the UK will offer the most significant news. Jobs and growth reports may paint a richer picture of how the British economy is faring amid soaring rates and high inflation.

Euro-zone industrial production on Wednesday is likely to have partially rebounded in August after a much bigger decline the previous month.

Inflation data will take prominence throughout the rest of the region. In Hungary on Tuesday, the pace of price growth may reach close to 20%, while on Thursday, Sweden’s key measure is expected to exceed 9%. Israel and Egypt will release inflation reports as well.

Further south, Ghana’s measure of price growth is expected to be more than triple the ceiling of the central bank’s 10% target for a third straight month.

Latin America

The week gets under way with the Brazilian central bank’s closely watched weekly Focus survey of market expectations. Analysts have cut their 2022 inflation forecasts for 14 straight weeks to 5.74%, while the 2022 GDP forecast has been marked up during that time to 2.7%.

That increasingly optimistic take on Brazil’s consumer prices will likely be borne out by data posted Tuesday: analysts expect price gains moderated for a third straight month in September, leaving the year-on-year pace just above 7% — fully five percentage points below April’s 12.13% peak.

With inflation in Chile near a three-decade high, the central bank is all but certain to extend a record tightening cycle, likely pushing the key rate up 50 basis points to an all-time high of 11.25%. The bank next meets in December.

On Thursday, Mexico’s Banxico posts the minutes of its Sept. 29 meeting, where policy makers hiked the key rate to a record 9.25%. Many analysts see another 125 to 175 basis points of tightening before officials determine that their job is done.

Finishing off the week, Argentina on Friday is expected to report September year-on-year inflation not far off the 83.45% posted by Turkey, the highest in the Group of 20. Analysts surveyed by Argentina’s central bank see a year-end rate of 100.3%.

©2022 Bloomberg L.P.