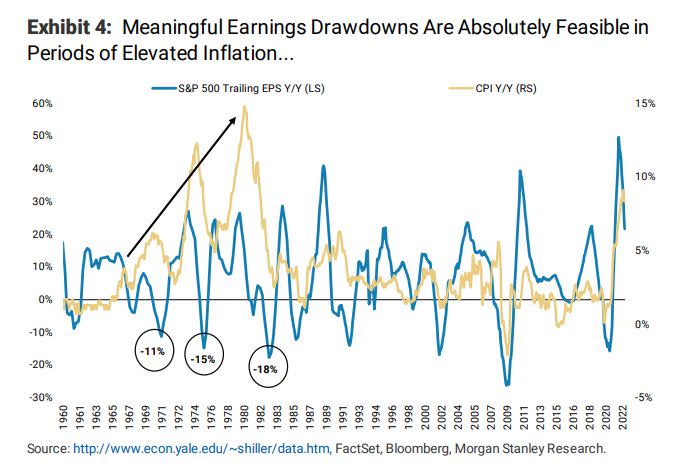

(Bloomberg) — The conventional wisdom with stock bulls is that prices will take off when the Federal Reserve wins its fight against inflation. But the end of surging consumer costs could unleash another round of bad news.

A small chorus of researchers has for months warned of a potential hazard to earnings should the campaign to tamp down inflation succeed. Specifically, the squeeze on margins that could occur should an indicator known as corporate operating leverage suffer in an environment where sales flatten out.

The indicator is a measure of the difference between a company’s fixed and variable costs. It can turn negative in the wake of peak inflation when some of a company’s costs remain high but isn’t able to offset them by raising prices because demand has faltered.

While earnings held up surprisingly well throughout the pandemic and powered a number of bear market rallies, a fall in operating leverage could prove to be the final hazard that brings stocks to their eventual lows, according to a team of Morgan Stanley strategists led by Mike Wilson.

“Thinking about the areas of inflation that are likely to remain more resilient into next year (shelter, wages, certain services) and the areas that are likely to decelerate (goods) does not paint a constructive picture for S&P 500 margins, in our view,” Wilson, one of Wall Street’s biggest equity bears, wrote in a recent note to clients.

Operating leverage, which his team measured by subtracting sales growth from earnings per share growth, is unlikely to stay positive in the coming quarters, according to his team. And while he’s one of the many sell-side analysts voicing concerns of a margin contraction, consensus estimates are still positive for next year.

Equity analysts expect earnings to increase 5.56% for the first quarter of 2023 versus a 5.48% jump in sales as margins expand. The pattern currently holds for the full year 2023 as well: earnings are anticipated to rise more than sales as operating leverage remains positive.

Credit Suisse AG’s Jonathan Golub stands with Wilson’s view. While explaining his recent S&P 500 price target downgrade, he wrote that “declining CPI combined with sticky wages should lead to a margin contraction.”

Wilson’s team has been arguing for months that the ultimate low for stocks will not be determined by the Fed, but by the growth trajectory of earnings. He sees the S&P 500 bottom in a 3,000- to 3,400-point range occurring later in 2022 or early next year.

While stocks have shed more than 22% year to date, a number of sell-side analysts say bad earnings news has already been priced in, and earnings could actually surprise and rise. Global 12-month forward earnings have been revised down every month in the last quarter. To Jim Paulsen of The Leuthold Group — an ardent stock bull — the fact that profit margins broke historical patterns and held up while inflation has soared means they may not be due to come down after all.

But to Liz Ann Sonders, chief investment strategist at Charles Schwab, profit margins may take a hit as companies lose their power to raise prices sufficiently enough to offset high fixed costs.

“Inflation especially early in the cycle tends to mean pricing power for companies,” Sonders said. “Demand is strong and spending is strong. That’s great news for earnings. If then you lose the demand side and you lose the inflation which helps boost prices, that’s when you can run into trouble.”

©2022 Bloomberg L.P.