(Bloomberg) — With a dovish Federal Reserve pivot seemingly off the table after last week’s employment report, risks for speculators are running high before Thursday’s release of the consumer price index. Anything above the prior reading of 8.3% would be big trouble for the stock market, according to JPMorgan Chase & Co.’s trading desk.

“This feels like another -5% day,” the team led by Andrew Tyler wrote in a note Monday, noting that the S&P 500 dropped 4.3% on Sept. 13, when August’s inflation reading came in hotter than expected. The scenario is the worst case laid out as a rough guide for clients seeking to navigate the heightened market volatility around economic data.

JPMorgan economists led by Mike Feroli expect September’s CPI to decline to 8.1%, in line with the median forecast in a Bloomberg survey. Should the data arrive in a range between 8.1% and 8.3%, the bank’s sales trading team see a potential “buyer’s strike” where the S&P 500 slides 1.5% to 2%.

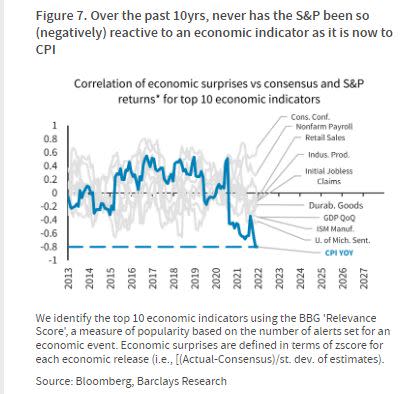

Unsurprisingly, data on inflation are exerting a huge influence on the stock market. Plotting the S&P 500 performance against top 10 economic indicators such as monthly payrolls and quarterly gross domestic product, Barclays Plc strategists including Anshul Gupta and Stefano Pascale found that, over the past decade, never have stocks been so negatively reactive to an economic indicator as they are now to CPI.

With the exception of the CPI report for the month of July, the S&P 500 has fallen every time the data was released as consumer prices came in mostly hotter than expected.

The upcoming data is likely to set the future path of Fed tightening after recent market jitters. The S&P 500 last week scored its best two-day really since April 2020 after weakening manufacturing stoked speculation for a less hawkish central bank, only to slump as a solid jobs report validated those who say thoughts of a Fed pivot are wishful.

“This week’s CPI will be the most important catalyst into the November 2 Fed meeting; 75bps feels like a foregone conclusion but the following two meetings lack a consensus,” JPMorgan’s Tyler wrote, adding stronger inflation will prompt the bond market repricing to increase the probability of another jumbo rate hike in December.

On the flip side, the team said, any softening inflation may spark an equity rally, where the S&P 500 is “most likely” to jump 2% to 3% if CPI print comes in below 7.9%. The positive reaction can be more pronounced if CPI pulls back by an amount that exceeds the 60 basis points experienced in July.

“Then calls for a Fed pause/pivot may become deafening,” the team wrote.

©2022 Bloomberg L.P.