(Bloomberg) — The sentiment on stocks and global growth among fund managers surveyed by Bank of America Corp. shows full capitulation, opening the way to an equities rally in 2023.

The bank’s monthly global fund manager survey “screams macro capitulation, investor capitulation, start of policy capitulation,” strategists led by Michael Hartnett wrote in a note on Tuesday. They expect stocks to bottom in the first half of 2023 after the Federal Reserve finally pivots away from raising interest rates.

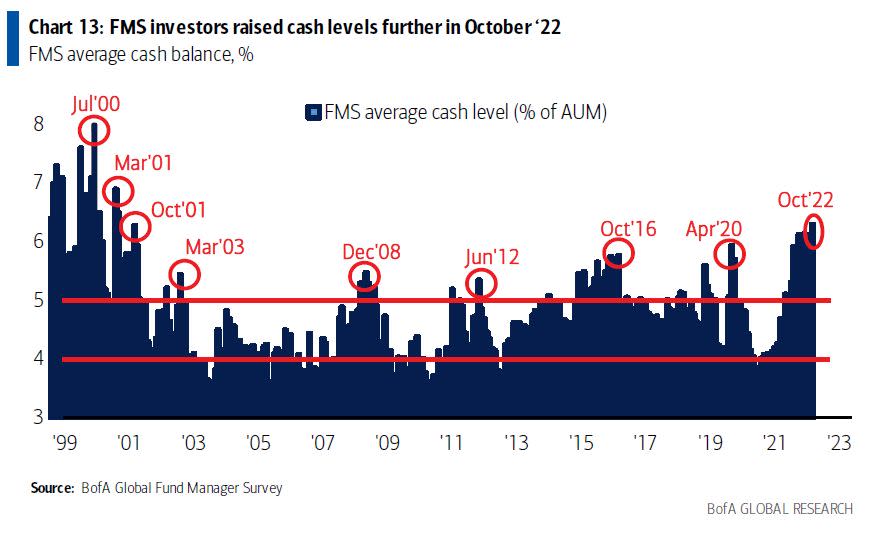

“Market liquidity has deteriorated significantly,” the strategists said, noting that investors have 6.3% of their portfolios in cash, the highest since April 2001, and that a net 49% of participants are underweight equities.

Nearly a record number of those surveyed said they expect a weaker economy in the next 12 months, while 79% forecast inflation will drop in the same period, according to the survey of 326 fund managers with $971 billion under management, which was conducted from Oct. 7 to Oct. 13.

“While the stock market was immune to the bleak sentiment till last month, it has started to better reflect investors’ pessimism,” Hartnett wrote.

As the earnings season gains traction, 83% of investors expect global profits to worsen over the next 12 months. A net 91% said global corporate profits are unlikely to rise 10% or more in the next year — the most since the global financial crisis — a sign that suggests further downside to S&P 500 earnings estimates, according to the strategists.

Global equities have rallied in recent days amid support from technical levels, changes in UK government policies and a focus on earnings. Hartnett and his team described the rally after a US inflation print last week as a “bear hug.”

Other survey highlights include:

- In absolute terms, investors are most bullish on cash, health care, energy and staples, and most bearish on equities, UK and Eurozone stocks, as well as bonds

- The most crowded trades are long US dollar, short Europe equities, long ESG assets, long oil, short emerging markets/China debt and equities as well as short UK debt and equity

- A record high share of 68% see the dollar as overvalued

- Investors see European sovereign-debt markets as the most likely source for a systemic credit event

- Investors see rising odds of a policy pivot in the next 12 months, with 28% of participants seeing lower short-term rates within that timeframe

©2022 Bloomberg L.P.