(Bloomberg) — For the third time in as many quarters, disappointing results from Snap Inc. are roiling social media stocks and adding to signs that the economic slowdown is deepening.

The maker of the Snapchat app reported its slowest quarterly sales growth ever on Thursday, saying a decline in advertising spending continues to drag on results.

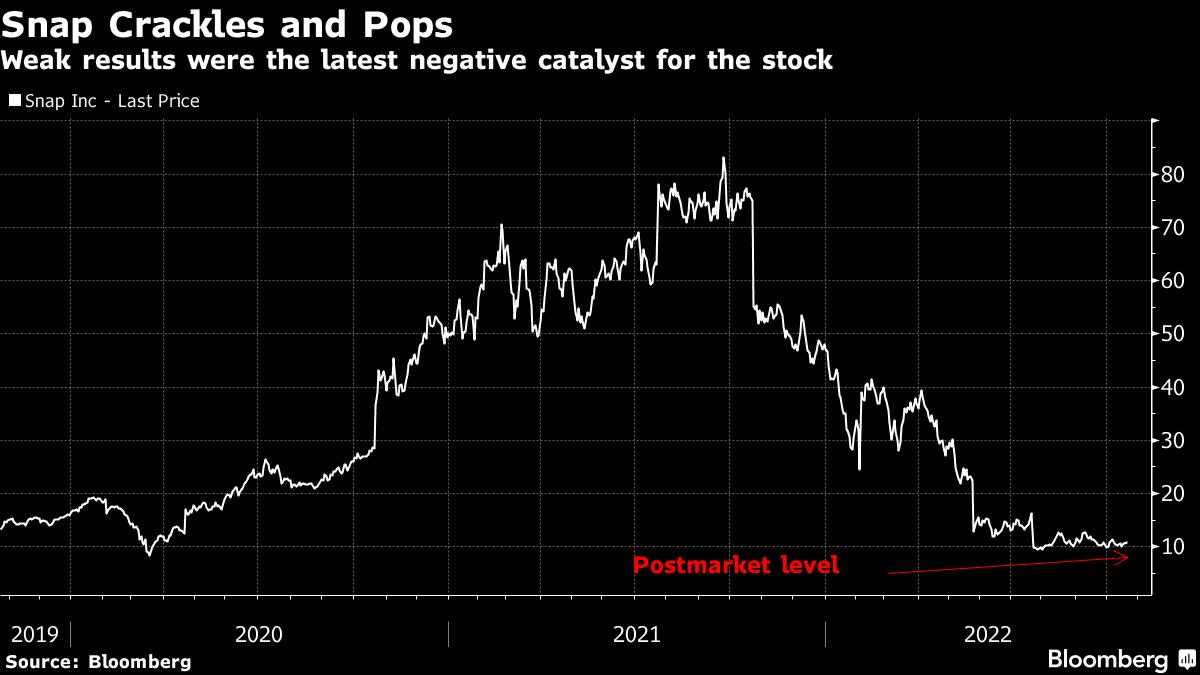

Shares of Snap plunged 27% in late trading, with the selloff spreading to peers including Meta Platforms Inc., Alphabet Inc. and Pinterest Inc. The companies were set to lose a combined market value of about $29 billion. Futures on the Nasdaq 100 Index fell 0.9%, signaling further pain for a tech-heavy benchmark that has plunged 32% this year.

Snap spent the quarter shrinking and refocusing its business, announcing in August that it was cutting 20% of its workforce and slashing projects that don’t contribute to user or revenue growth, or to the company’s augmented reality efforts. The changes were in response to plunging sales, which Snap attributed to a slowdown in marketer spending.

Snap and platforms like Meta’s Facebook and Alphabet’s Google are competing for a shrinking pool of advertising dollars this year. Spiraling inflation is putting pressure on companies and consumer spending. Meanwhile, new rules from Apple Inc. that require all apps to get smartphone users’ permission to be tracked online have made it more difficult for advertisers to measure and manage their ad campaigns.

Revenue growth “continues to be impacted by a number of factors we have noted throughout the past year, including platform policy changes, macroeconomic headwinds, and increased competition,” Snap said in its prepared remarks for investors. “We are finding that our advertising partners across many industries are decreasing their marketing budgets, especially in the face of operating environment headwinds, inflation-driven cost pressures, and rising costs of capital.”

Snap’s quarterly results were the first from big internet companies that depend on advertising, setting the stage for what investors can expect when larger players like Alphabet and Meta Platforms report next week.

–With assistance from Alex Barinka, Subrat Patnaik and Phil Serafino.

©2022 Bloomberg L.P.