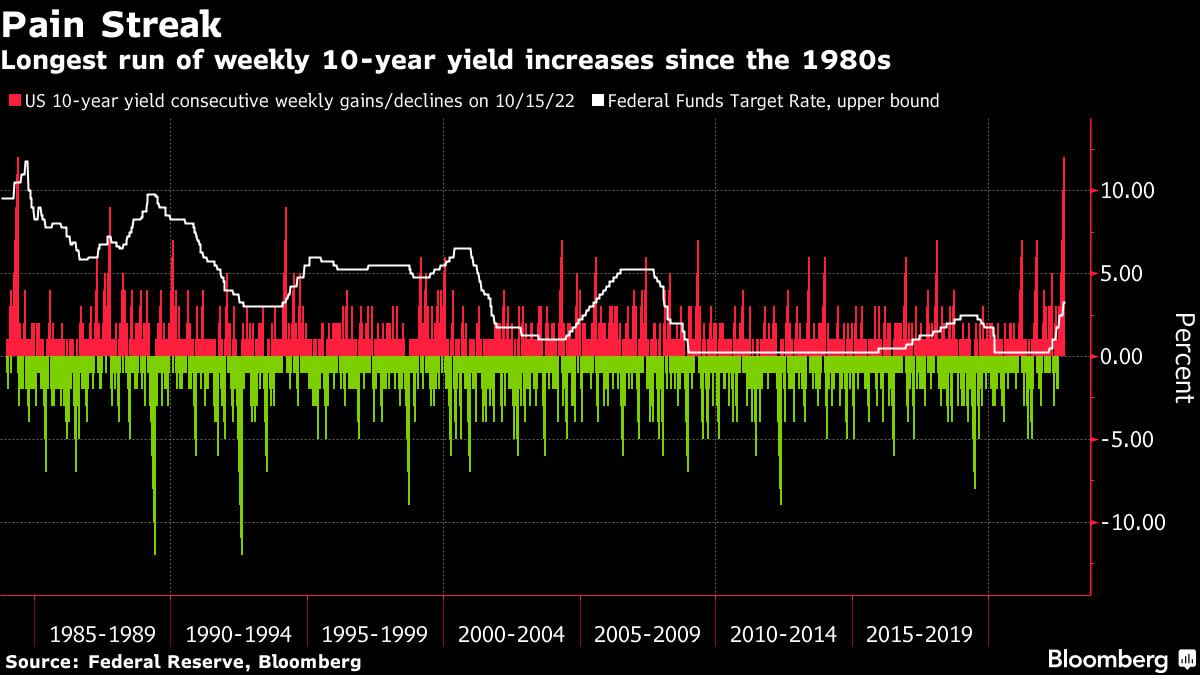

(Bloomberg) — US Treasuries have entered the longest sustained slump in 38 years, as policy makers signal their determination to keep raising rates until they are sure inflation is under control.

The yield on benchmark 10-year notes jumped 23 basis points this week to 4.25% on Friday, heading for a 12-week streak of increases that would match the duration of the 1984 episode when then-Federal Reserve Chairman Paul Volcker was carrying out a series of rapid interest rate hikes.

Bonds and equities have fallen sharply this year as central banks rushed to hike interest rates to tame surging inflation. That sent yields and volatility soaring, prompting investors to pile into the dollar as the key safe haven. Twenty-two of 31 major currencies tracked by Bloomberg are down more than 10% this year.

The latest spur for the worldwide selloff came as swaps traders priced in the highest peak yet for the Fed’s policy rate, projecting it topping-out at 5% in the first half of 2023. March and May 2023 overnight index swap contracts each exceeded 5% on Thursday in the New York session. Both were below 4.70% as recently as Oct. 13 before US consumer inflation exceeded estimates.

“This is a kind of milestone,” former US Treasury Secretary Lawrence Summers said on Twitter. The market-implied terminal rate is “more likely than not to rise more.”

Tighter policy expectations drove the yield on 10-year inflation-protected Treasuries up as much as 3 basis points to 1.76%, the highest since 2009, feeding through to lower equity valuations due to a drag on corporate earnings.

The rapid collective central-banking pivot from stimulus to stinginess is placing strains on governments and economies around the world. The Bloomberg aggregate bond index has now tumbled 25% from the peak reached in Jan. 2021 as the first global bear market in at least a generation shows no signs of waning.

On Friday the yield on three-year Australian debt surged 15 basis points to 3.78%, a 10-year high, and the Bank of Japan was forced to intervene for a second day to try and hold the 10-year yield at its 0.25% ceiling.

Investors also received fresh warnings about aggressive tightening from Fed Bank of Philadelphia President Patrick Harker. Officials are likely to raise interest rates to “well above” 4% this year and hold them at restrictive levels to combat inflation, Harker said in prepared remarks on Thursday.

The Fed has hiked its policy rate five times since March and the market is expecting a fourth consecutive three-quarter-point increase at the next meeting in November.

–With assistance from Elizabeth Stanton.

©2022 Bloomberg L.P.