“Uncertainty” has been a good way to describe market conditions throughout 2022. To compound the difficulty, it seems unlikely that the forecast is going to get better going into 2023, which makes it harder for investors to decide to keep their money working for them.

Inflation continues to remain high, despite repeated interest rate increases from the Fed, with the central bank expected to remain hawkish in its attempts to rein in inflation and curb the pace of economic growth. Those efforts continue to be contradicted, however by supply constraints that are only exacerbated by the Russia-Ukraine conflict, which isn’t likely to see a near-term resolution, and domestic constraints that existed even before COVID-19 came to dominate the world’s attention in 2020 and 2021. With all of those problematic questions still open-ended, it is no surprise that the market remains in bear market territory, even with this month’s rally off of a bottom for most of the major indices.

While a bear market is a scary thing in an of itself, it also opens the possibility of new buying opportunities in good stocks at much better prices than than they have been in quite some time. The market is an emotional animal, and that is one of the reasons that the mantra “all trends are finite” tend to hold true. That’s also true of downward trends; while bear markets can extend into a two or possibly even three-year time period, they inevitably find their own end. Value-oriented, patient investors who can recognize stocks that offer big discounts along with solid fundamentals during these extended downturns are in a better position than the momentum hunters, that are usually trying to figure out where the bottom of the market might be.

Just as most investors fail to recognize increasing risk at the top of a long bull market and period of economic expansion, they also tend to give in to their fear the longer a bear market lasts, which is why fear tends to drive average investors away from the markets. It takes a bit of a contrarian perspective of things, but the fact is that smart investors can usually find terrific opportunities even when the market is uncertain and sitting near its yearly lows. Sometimes, you can even find pockets of the economy that are diverging from those scary downward patterns.

The wireless telecommunications industry is an interesting case in point. Shelter-in-place orders, work-at-home arrangements, and the continued need to maintain social distancing measures during 2020 and 2021 have increased just about everybody’s reliance on their mobile devices, which is generally good news for the companies that provide those products and the services that come with them. The economic pressures associated with high interest rates and rising consumer costs, however also means that demand for new devices, including upgraded smartphones, tablets, wearables, and so on, may remain muted. That is likely to keep pressure on those companies to manage their operations as efficiently as possible – which could be a challenge, as leverage in this industry was already very high before the pandemic hit, even among the largest and most established companies, like AT&T and Verizon Communications Inc. (VZ). Continued pressure on revenues is likely to persist for these company’s existing operating models and force liquidity, which was already a red flag for most of the industry, to deteriorate.

That’s the bad news – but I also think that there is quite a bit of good news to consider, as well. Over the last few years, VZ has been one of the biggest investors in acquiring 5G spectrum, and are the first major provider to start rolling out 5G connectivity in their network. The implementation has seen slow, but steady progress so far, with only a small portion of its nationwide network having access to 5G towers, and the truth is that 5G-level bandwidth has proven to be spotty so far at best. Even so, this is an area that VZ continues to invest in heavily, and as one of two dominant players in the telecomm industry and in building out the infrastructure for 5G service, it should be expected that in the long run, these issues will be resolved. That is why 5G still represents a long-term growth opportunity. Sooner or later, consumer trends will shift back in favor of the tools that enable faster wireless connectivity, and that means that companies that have been at the front of the pack on the capital investment, development and implementation side will still be the winners in this game.

VZ’s stock price has followed a downward trend, especially over the last six months that can be attributed to some of the short-term concerns I just described, but also runs counter to an overall strong fundamental profile that includes a bargain proposition that puts its target price about 60% above its current price. VZ has borrowed heavily to finance its capital investments, including its 5G buildout, but that is also countered by healthy free cash flow and operating margins that have held up better than expected in the current economic environment, along with a higher-than-average dividend. Does the combination make VZ a stock worth paying attention to? Let’s find out.

Fundamental and Value Profile

Verizon Communications Inc. is a holding company. The Company, through its subsidiaries, provides communications, information and entertainment products and services to consumers, businesses and governmental agencies. Its reportable segments are Verizon Consumer Group and Verizon Business Group. Its Consumer segment provides wireless and wireline communications services. Its wireless services are provided across wireless networks in the United States under the Verizon Wireless brand. Its wireline services are provided in nine states in the Mid-Atlantic and Northeastern United States, over its 100% fiber-optic network under the Fios brand and via traditional copper-based network. Its Business segment provides wireless and wireline communications services and products, video and data services, corporate networking solutions, security and managed network services, local and long-distance voice services and network access to deliver various Internet of Things (IoT) services and products. VZ has a current market cap of about $153.4 billion.

Earnings and Sales Growth: Over the last twelve months, earnings shrank by -6.4%, while revenues increased by about 4%. In the last quarter, earnings growth was flat, but positive, at 0.76%, while revenues where 1.34% higher. VZ operates with a healthy, stable operating profile. Over the last twelve months, Net Income was 14.22% of Revenues, and rose slightly to 14.31% in the last quarter.

Free Cash Flow: VZ’s free cash flow is healthy, at more than $14.3 billion, and translates to a useful Free Cash Flow Yield of 9.37%. Compared to the last year, Free Cash Flow is lower, from $19.2 billion, as well as from the quarter prior, at $14.7 billion.

Dividend: VZ’s annual divided is $2.61 per share (increased from $2.46 in the middle of 2020, $2.51 in 2021, and $2.56 in the last quarter), and which translates to an impressive yield of 7.16% at the stock’s current price. An interesting note I picked up from an economic report earlier this year recognized the general fundamental strength of the Telecom Services sector, T and VZ in particular, with dividend payout levels well above bond yields, and limited currency or global macroeconomic risks. That supports the notion that, to a point, this sector could be viewed as an “equity bond” for investors looking for productive, passive income.

Debt/Equity: VZ carries a Debt/Equity ratio of 1.5, which is generally considered a high number that isn’t unusual for stocks in this industry. Their balance sheet shows about $2.1 billion in cash and liquid assets versus about $148 billion in long-term debt. It should be noted that in the quarter prior, cash and liquid assets were more than $1.8 billion, marking a useful increase. Their operating profile indicates that servicing their debt, even though it is high, shouldn’t be a problem.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $59 per share, which suggests that the stock is significantly undervalued right now, with about 60% upside from its current price.

Technical Profile

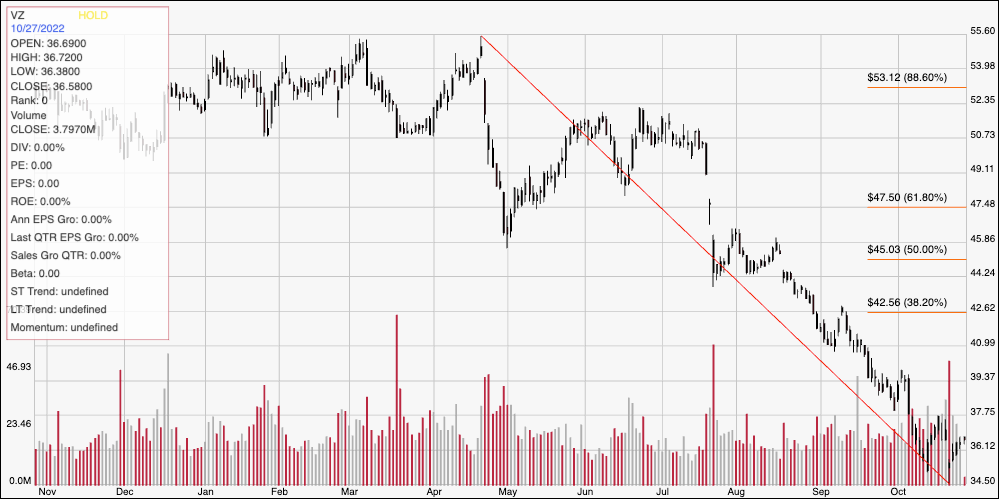

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The red diagonal line measures the length of the stock’s downward trend from high at around $55.50 in April to its low at around $34.50, reached earlier this month; it also informs the Fibonacci retracement lines shown on the right side of the chart. The stock has rallied a bit off of that low and could be establishing a stabilizing, consolidation range, with current support at around $34.50 and immediate resistance at about $37.75. A drop below $34.50 could see the stock drop further, to about $31 before finding next support, using the current distance between support and resistance as a reference. A push above $37.75 should find next resistance a little above $39, where the stock saw a temporary pivot high to start October, with additional upside to about $41 if buying momentum picks up.

Near-term Keys: VZ offers a compelling value proposition, with a higher-than-average dividend that makes tempting bait for both value and fundamental-oriented investors. The stock’s fundamental support that idea, which is why I think VZ is a stock that is worth taking very seriously at its current price as a long-term opportunity. If you prefer to focus on short-term trades, you could use a push above $37.75 as a signal to buy the stock or work with call options, with an eye on $39 as a practical, short-term, bullish profit target and $41 if bullish momentum increases. A drop below $34.50 should be taken as a signal to consider shorting the stock or buying put options, with $31 providing a useful profit target on a bearish trade.