(Bloomberg) — The Federal Reserve looks set to deliver a fourth straight super-sized rate increase with Chair Jerome Powell repeating his resolute message on inflation and opening the door to a downshift — without necessarily pivoting yet.

The Federal Open Market Committee is expected to raise rates by 75 basis points on Wednesday to a range of 3.75 to 4%, the highest level since 2008 as the central bank extends its most aggressive tightening campaign since the 1980s. The decision will be announced at 2 p.m. in Washington and Powell will hold a press conference 30 minutes later. No fresh Fed forecasts are released at this meeting.

The central bank chief may emphasize policymakers remain steadfast in their inflation fight, while leaving options open for their gathering in mid-December, when markets are split between another big move or a shift to 50 basis points.

In July, his comments were wrongly interpreted by investors as a near-term policy pivot, with markets rallying in response, which eased financial conditions — making it harder for the Fed to curb prices. The chair may want to avoid a misstep, even if he suggests a shift to smaller increases at upcoming meetings.

“They may want to go slower just in the interest of financial stability,” said Julia Coronado, the founder of MacroPolicy Perspectives LLC. “It’s a challenge for messaging because they don’t want to ease financial conditions significantly. They need tight financial conditions to keep cooling the economy off. So he doesn’t want to sound dovish, but he may want to go slower.”

Powell is trying to curb the hottest inflation in 40 years amid criticism he was slow to respond to rising prices last year. The hikes have roiled financial markets as investors worry the Fed could trigger a recession.

What Bloomberg Economics Says…

“The Fed is widely expected to hike rates by 75 basis points for a fourth consecutive meeting. Less certain is how Fed Chair Powell will communicate a potential future downshift in the rate-hike pace — the degree of conviction, the risks around hike sizing, and implications for the terminal rate. We expect that he will present a 50-basis-point move as the base case and clarify that a downshift in the pace of rate hikes does not necessarily mean a lower terminal rate.”

— Anna Wong, Andrew Husby and Eliza Winger (economists)

Wednesday’s expected move comes less than a week before midterm elections in the US, where Republicans have made high inflation a top issue and tried to pin blame on President Joe Biden and his party in Congress. Last week, two Democratic senators urged Powell to not cause unnecessary pain by raising rates too high.

Rates

Economists overwhelmingly predict the FOMC will raise 75 basis points, though one is looking for a step down to 50 basis points instead. Investors are close to fully pricing in 75 basis points at this Fed meeting, according to interest-rate futures markets.

The Bank of Canada unexpectedly slowed its pace of interest-rate hikes to a half point last week, though economists noted Canada’s higher share of adjustable-rate mortgages magnify the macroeconomic impact of the central bank’s rate increases.

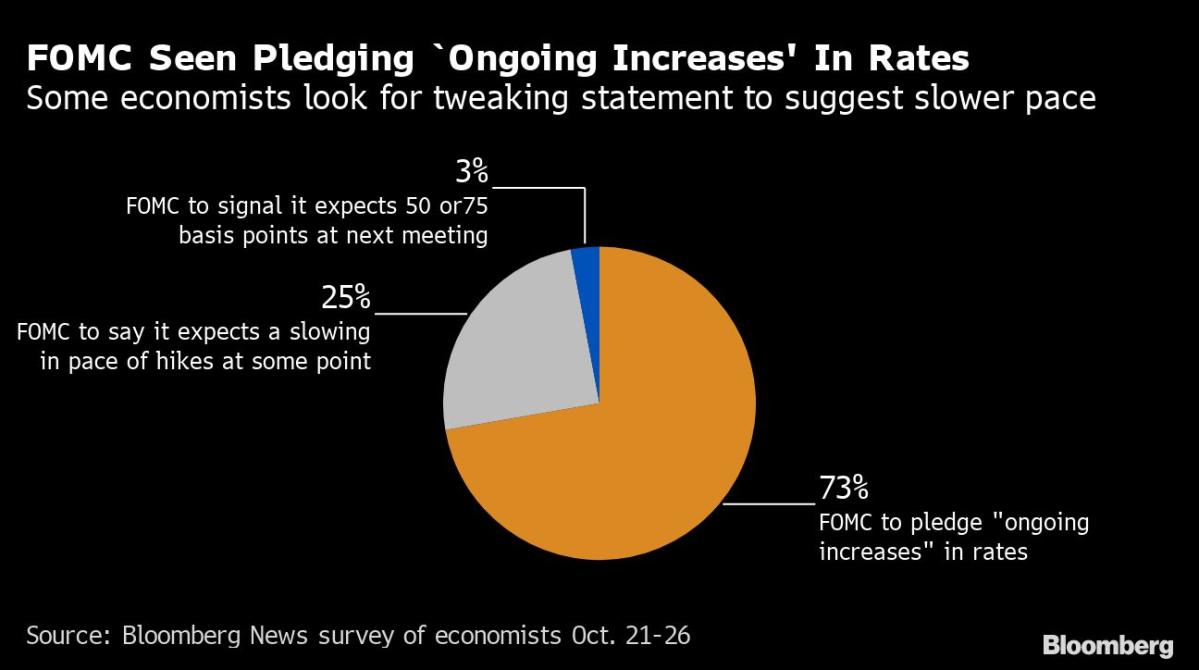

FOMC Statement

The statement is likely to retain its pledge of “ongoing increases” in interest rates, but that could be “modestly tweaked in some way to indicate that you’re closer to the end” of hikes, said Michael Feroli, chief US economist at JPMorgan Chase & Co. One option would be to say “some further increases,” he said.

Press Conference

Powell since July has said it will be necessary to slow the pace of hikes at some point, and he’s likely to reiterate that, while leaving options open in December depending on incoming data. There will be two employment reports and two consumer-price reports before the Dec. 13-14 meeting.

“Markets want some indication that the Fed’s going to downshift,” said Drew Matus, chief market strategist with MetLife Investment Management. “This whole point of downshifting and moving to a slower pace of hikes is because you don’t know how much you have to do. So if it’s raining outside and I am driving, I am slowing down.”

Dissents

About a third of economists expect a dissent at the meeting. The most likely candidates would be Kansas City Fed President Esther George, who dissented in June in favor of a smaller hike, and St. Louis Fed President James Bullard, who dissented in March as a hawk.

Balance Sheet

The Fed is likely to reiterate its plans to shrink its massive balance sheet at a pace of $1.1 trillion a year. Economists project that will bring the balance sheet to $8.5 trillion by year end, dropping to $6.7 trillion in December 2024.

No announcement is expected on sales of mortgage-backed securities.

Financial Stability

A report on financial stability is likely to be presented during the meeting, according to Nomura’s economists, and Powell may be asked whether the pace of hikes and potentially a US recession could cause international spillovers or disruptions in US credit markets. Three-month Treasury yields topped the 10-year yield last week, a so-called inversion that is often seen as a signal of a recession.

“We are not conditioned in the US to be dealing with a 4.5% federal funds rate,” said Troy Ludtka, senior US economist at Natixis North America LLC, and there are concerns credit markets could be disrupted. “Internationally is even scarier. Europe looks terrible. China is not in recession, but I think it’s their slowest growth in a long, long time.”

Ethics Questions

Powell also could be asked about the latest incidents to raise questions about ethics standards at the central bank.

Atlanta Fed President Raphael Bostic recently revealed he violated central bank policy on financial transactions, leading Powell to ask the Fed’s inspector general to review his financial disclosures.

In a separate incident, Bullard last month attended a Citigroup-hosted meeting in Washington to which media were not invited and at which he discussed monetary policy. The St. Louis Fed has since said it would think differently about accepting such invitations in the future.

©2022 Bloomberg L.P.