Trying to find a positive story thread for the stock market in 2022 might seem a bit like looking for a needle in a haystack. That’s only true, however if your strategy for the markets relies exclusively on looking for growth.

In bear market conditions, with inflation increasing and interest rates rising, it’s easy to pass off the stock market as a bad place to put your money right now. The most skeptical alarmists would suggest moving everything to cash and waiting for a year or more before looking for any new investing opportunities in the stock market. That mindset ignores the fact that even in bear market conditions, there are always pockets of the economy and the market that continue to provide useful opportunities. That’s the needle in the haystack, and it’s the reason value-focused investors like me tend to think about bear markets as a growing pool of opportunity.

The Energy sector has not been immune from the effect of inflation this year. However, the net effect of supply chain constraints that existed before the start of the year, and that have been further exacerbated by Russia’s war in Ukraine and its resultant, increasing global, geopolitical and economic isolation is that crude and natural gas prices rose during the summer to levels not seen in at least eight years. While prices have dropped from those highs, they still remain elevated well above pre-pandemic levels, with little indication there is much more downside to come. While that implies that gas at the pump is also going to remain high for consumers, it should also provide a headwind to stocks in the sector. That’s why many of the best values that are available in the stock market right now can be found among Energy stocks.

In the Oil and Natural Gas industries, companies are broken into additional categories depending on where in the supply chain they tend to operate. Downstream companies are those that are closer to the consumer – for example, refineries, local and regional utility providers, and filling stations – while upstream companies are those that operate closer to the extraction and production of raw energy materials. Between the two extremes are a lot of different processes and operations, and companies at every possible point along the way but that are usually called midstream. These are the companies that are usually involved in transportation and storage of raw materials.

Halliburton Company (HAL) is a pretty well-known name to even a casual observer of energy prices and their dynamics. Most of the company’s operations lie in working with companies at the upstream stage of the energy supply chain; the companies that primarily reside at this end of the supply chain are also usually the most immediate benefactors of rising raw material prices. In the second quarter of this year, the company recorded a charge of $344 billion on its books associated with the company’s exist from Russia – a clear economic impact of the conflict in Ukraine that can’t be ignored. The caveat is that industry experts expect HAL to make up the difference as other countries, including the U.S. release emergency reserves and pressure remains high for those countries to increase their production to meet demand in the long-term. After falling from a June peak at around $44 to an October low at around $24, the stock has picked up a lot of bullish momentum, rising to its current price around $36. Does that 30% increase in one month mean that HAL could be offering a good buying opportunity right now, and what does that suggest about the company’s value proposition? Let’s find out.

Fundamental and Value Profile

Halliburton Company provides services and products to the upstream oil and natural gas industry throughout the lifecycle of the reservoir, from locating hydrocarbons and managing geological data, to drilling and formation evaluation, well construction and completion, and optimizing production throughout the life of the field. It operates through two segments: the Completion and Production segment, and the Drilling and Evaluation segment. The Completion and Production segment delivers cementing, stimulation, intervention, pressure control, specialty chemicals, artificial lift and completion services. The Drilling and Evaluation segment provides field and reservoir modeling, drilling, evaluation and wellbore placement solutions that enable customers to model, measure, drill and optimize their well construction activities. It serves national and independent oil and natural gas companies. As of December 31, 2016, it had conducted business in approximately 70 countries around the world. HAL has a current market cap of about $32.7 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 114.3%, while revenues grew by almost 39%. In the last quarter, earnings rose 22.45% while sales increased by about 5.6%. HAL’s margin profile is historically pretty narrow, but has improved in the last quarter. In the last twelve months, Net Income as a percentage of Revenues was 9.16%, but strengthened to 10.15% in the last quarter. Follow the negative impact of the Russia withdrawal-driven charge earlier this year, this positive pattern is an encouraging sign.

Free Cash Flow: HAL’s free cash flow is modest, as Free Cash Flow was $1.05 billion in the last quarter versus about $1.37 billion a year ago. While the number increased over the past year, it also declined from the last quarter, when Free Cash Flow was $979 million. It is also worth noting this number was about $415 million in the last quarter of 2019. The current number translates to a very modest Free Cash Flow Yield of 3.18%.

Debt to Equity: HAL’s debt to equity is 1.04 – higher than I prefer to see, but also pretty characteristic for stocks in this industry. The company’s balance sheet shows a little over $1.9 billion in cash and liquid assets against about $7.9 billion in long-term debt. The company should have no problem servicing their debt, and it should be noted that the company has retired approximately $1.2 billion of long-term debt over the past year.

Dividend: HAL’s annual divided was $.72 per share prior to the onset of the COVID-19 pandemic, which prompted management to reduce the dividend to about $.18 per share, per year. Management increased the dividend to its current level at $.48 per share at the start of 2022. The current number translates to an annualized yield of about 1.32% at the stock’s current price.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to worth with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term target at about $18 per share. That suggests that the stock is overvalued by more than -50% right now, with a practical discount price sitting a little above $14. It should also be noted that earlier this year, this same analysis yielded a fair value target price at around $23 per share.

Technical Profile

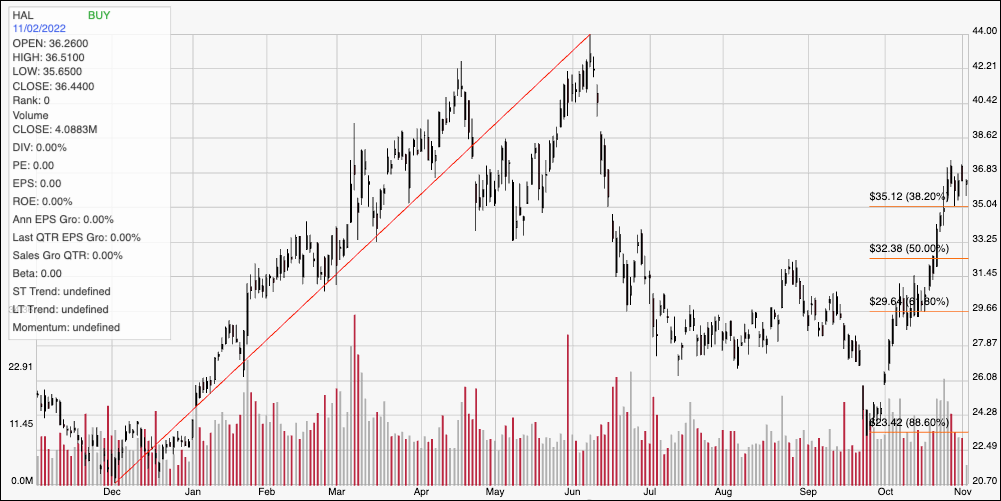

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s upward trend from December of last year, at a low point around $21 to its high in June at $44. It also informs the Fibonacci retracement lines shown on the right side of the chart. Following a downward trend that bottomed last month at around $23.50, the stock has rallied strongly, pushing above the 38.2% retracement line in the last week or so and now hovering between current support at $35 and immediate resistance at around $37. A push above $37 could see short-term upside to between $38.50 and $40, depending on the strength of buying activity. A drop below $35 should find next support at around $32, right around where the 50% retracement line currently sits.

Near-term Keys: HAL is a company with a fundamental profile that appears to be improving after some weakness earlier this year. For a value hunter like me, that is an encouraging sign; however the plain reality is that the stock’s latest price momentum has pushed the stock well past the point of useful value. That means that for now, the best probabilities with this stock lie in short-term trading strategies. Use a push above $37 as a signal to consider buying the stock or working with call options, with $38.50 offering a useful short-term profit target on a bullish trade, and $40 if buying activity increases. A drop below $35 could be a good signal to think about shorting the stock or buying put options, using $32 as a practical bearish profit target.