(Bloomberg) — Euphoria is sweeping every corner of Wall Street in the wake of the latest data that suggests inflation is peaking from a four-decade high. Yet big money managers are in no mood to celebrate – betting that the world will have to contend with elevated prices for years to come, in a game-changer for investing strategies of all stripes.

JPMorgan Asset Management is clinging onto a record allocation in cash in at least one of its strategies while a hedge fund solutions team at UBS Group AG is staying defensive. Man Group quants expect the great inflation trade to endure, with all signs suggesting price pressures will stay strong for a long while yet.

Their cautionary stance comes amid lower-than-expected price data for October that’s spurred a big cross-asset rally with the likes of Citigroup Inc. betting that the US central bank will moderate its hawkish threats.

“The path to a soft landing where the Federal Reserve is able to bring inflation all the way back down to target without causing material economic damage is still narrow,” said Kelsey Berro, a fixed-income portfolio manager at JPMorgan Asset Management. “While the direction of travel for inflation should be lower, the pace of deceleration and the ultimate leveling off point remain highly uncertain.”

JPMorgan Asset remains invested in highly rated short-term debt as it sees enduring price pressures. The firm’s chief investment officer has long warned against sticky inflation that other had predicted would subside after the pandemic.

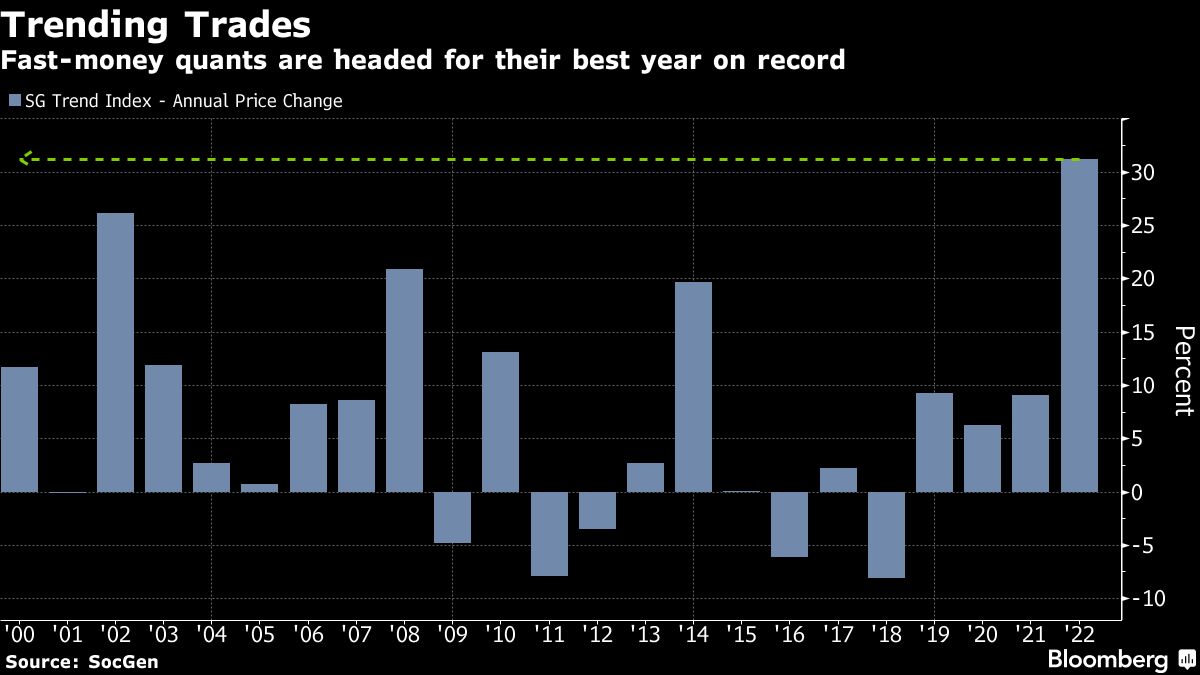

At Man AHL, the firm’s quantitative investment program, money managers expect trend-following strategies, which have been a big winner after riding relentless inflation-driven price trends, to continue to outperform. A variety of carry trades that take advantage of price differences remain attractive as inflation persists, according to the world’s largest publicly traded hedge fund firm.

“It certainly was the case that people were too optimistic about the outlook for markets earlier this year, and it is still very possible that they’re too optimistic right now,” said Russell Korgaonkar, chief investment officer of Man AHL.

A measure of the market’s inflation expectations is more in line with the belief that the price growth ahead will trend closer to the Fed target of 2%. Traders see borrowing costs peaking next year while pricing in a half-point Fed hike in December.

But any money manager with hopes of rapidly easing price pressures may be getting ahead of themselves, according to Bank of America Corp.

“‘Inflation stick’ of briskly rising services and wage inflation is here to stay,” Bank of America strategists led by Michael Hartnett wrote. “Inflation will come down but remain above” ranges of the past 20 years.

Investors have also been venturing outside the safety of cash — which they had turned to as an alternative to equities — in what might amount to a wager that inflation is coming down. In recent weeks, cash-like exchange-traded funds have seen record outflows, with nearly $5 billion exiting the $20 billion iShares Short Treasury Bond ETF (ticker SHV) in the fund’s biggest two-week outflow on record, according to data compiled by Bloomberg.

But money managers such as UBS’s hedge fund solutions business are not ready to move away from their defensive positioning just yet.

“We have been preparing our portfolios for this new regime of higher inflation and lower growth and we expect risk assets to remain volatile,” said Edoardo Rulli, deputy chief investment officer of UBS’s hedge fund solutions business. “We remain defensively positioned with beta to equity and credit markets at historically low levels.”

Ed Clissold, the chief US strategist at Ned Davis Research Inc., also says it might be too soon to jump back into stocks or bonds. The firm is still underweight equities and overweight cash.

“Cash yields could remain attractive,” Clissold said. “Aggressive Fed easing would not likely come until something breaks. That would mean lower risk asset prices, like stocks.”

©2022 Bloomberg L.P.