Every year, market watchers and talking heads look for a central narrative that can weave the market and economy’s movements into a single cohesive thread. That storyline often focuses on one of any number of factors – economic, political, or social – that history has proved can impact the market in a material way.

Through the latter part of 2021 and into this year, the pandemic has consistently defied attempts to look past its effects and global impact. Variants of the virus sparked multiple infection waves through 2021 that kept hospitalizations high and strained the health care system in general. As 2022 started, some of those effects seemed to have tapered enough that the narrative began to shift its focus to questions about the pace of inflation and the increases in interest rates that have come as a result.

For most of this year, the COVID discussion has taken a back seat to questions about inflation, interest rates, and the global issues, including war that are constraining supply and keeping prices high. While news and global attention is focused elsewhere, COVID isn’t going away. Even while local and national governments have transitioned to endemic-phase monitoring and management, the fact remains that the risk of new variants can’t be entirely dismissed as we’ve seen at least two new virulent strains this year alone, with the coldest months of the year coming. I believe that means that research into the long-term efficacy of current vaccines will be an ongoing concern, with continued emphasis on encouraging vaccinations, booster shots, along with antiviral treatments. The good news is that for the nRNA vaccines available in the U.S., updates to vaccines, if needed, are easier and less time-consuming than for other vaccine types.

For pharmaceutical companies like Pfizer Inc. (PFE) that have led the global effort to development, deliver and administer vaccines around the globe, I think vaccines will remain

Even more appropriate is the fact that vaccines are just one part of a diversified pharmaceutical company’s development pipeline and product portfolio. PFE’s dominant position for COVID vaccines (Pfizer vaccines are estimated to account for about 70% of all vaccinated individuals, of any age, in the U.S.) gives it additional resources to invest in its robust pipeline of drugs in other important segments, including oncology. Oncology, in fact is expected to remain solid as growth in new, emerging drugs should offset declines in known names like Lyrica and Enbrel.

As one of the leading pharmaceutical companies in the industry, PFE boasts a broad portfolio with eight separate drug brands that each account for more than $1 billion in annual sales, but none that contribute more than 14% of total revenue (not counting its COVID vaccine). They also have a large development pipeline, especially as already mentioned in oncology drugs where most analysts see strong long-term growth that should offset the effect of increased competition in existing brands as patent protections expire and biosimilar and generic drugs start to take up market share.

PFE’s stock price hasn’t dropped as much as a lot of other stocks this year, but it is about -18% below its starting point for the year, with indications that many of the broad economic concerns, including rising inputs are having an impact on its bottom line. Even so, the company’s leading position in its industry and continued, positive results from sales of its COVID vaccine have it on solid fundamental footing. The stock has also been rallying since early October from a yearly low at around $41 to its current price at about $49. Does that suggest that the stock could translate to a useful opportunity for long-term oriented investors? Let’s find out.

Fundamental and Value Profile

Pfizer Inc. (Pfizer) is a research-based global biopharmaceutical company. The Company is engaged in the discovery, development and manufacture of healthcare products. Its global portfolio includes medicines and vaccines, as well as consumer healthcare products. The Company manages its commercial operations through two business segments: Pfizer Innovative Health (IH) and Pfizer Essential Health (EH). IH focuses on developing and commercializing medicines and vaccines, as well as products for consumer healthcare. IH therapeutic areas include internal medicine, vaccines, oncology, inflammation and immunology, rare diseases and consumer healthcare. EH includes legacy brands, branded generics, generic sterile injectable products, biosimilars and infusion systems. EH also includes a research and development (R&D) organization, as well as its contract manufacturing business. Its brands include Prevnar 13, Xeljanz, Eliquis, Lipitor, Celebrex, Pristiq and Viagra. PFE has a current market cap of $271.9 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by about 33%, while revenues declined by -6%. In the last quarter, earnings decreased by -12.75% while sales were -184% lower. The company’s margin profile is healthy, and strengthening, which is an interesting counter to the earnings pattern; over the last twelve months, Net Income as a percentage of Revenues was 29.81%, and increased to 38.02% in the last quarter.

Free Cash Flow: PFE’s free cash flow is very strong, at more than $28.4 billion over the last twelve months. That does mark a decline from about $29.8 billion a year ago, and $31.8 billion in the last quarter. The current number translates to a Free Cash Flow Yield of 10.12%.

Debt to Equity: PFE’s debt to equity is .35, which is a conservative number. The company’s balance sheet indicates that operating profits are more than adequate to service their debt, with healthy liquidity to provide additional flexibility. Cash and liquid assets were about $23.4 billion in the last quarter, while long-term debt was $32.6 billion – down from $49.7 billion at the beginning of 2021 and $36.1 billion a year ago. It is worth noting that the real profit opportunity in the COVID vaccine wasn’t seen in the initial implementation and distribution. Profitability comes, as anticipated by management and many industry analysts, from the ongoing need for boosters, in similar fashion to the yearly flu or pneumonia booster that doctors generally recommend for just about everybody.

Dividend: PFE’s annual divided is $1.60 per share, and which translates to a yield of about 3.29% at the stock’s current price. It is also noteworthy that the dividend increased at the beginning of 2020 from $1.52 per share, and from $1.56 in mid-2021, and which I think provides a useful indication of management’s confidence in their approach.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $56 per share. That means that PFE is modestly undervalued right now, by about 15%.

Technical Profile

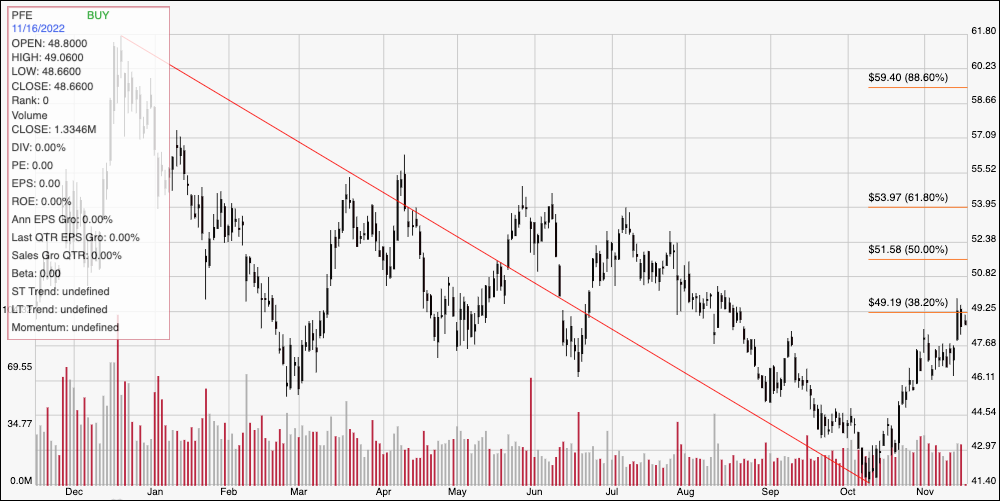

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s downward trend from a 52-week high at around $61 per share in December of last year to its low in early October at around $41.50. It also provides the baseline for the Fibonacci retracement lines shown on the right side of the chart. The stock has been picking up a lot of momentum in the last month and a half, and is approaching immediate resistance at the 38.2% retracement line, which sits at around $49 per share. Current support is around $46 based on pivot activity seen this month as well as in late September. A push above $49 could see upside to about $51.50 before finding next resistance at around the 50% retracement line, while a drop below $46 should find next support at around $44.50.

Near-term Keys: PFE’s balance sheet has “fortress”-level strength, with robust free cash flow to provide additional stability and growth potential along with improving profitability. The current decline in free cash flow is a concern, as it does reflect what I attribute as rising input costs that are rippling into every sector of the economy; however PFE has a lot of flexibility to work with and better ability than most companies to ride through what could simply be a cyclical concern. PFE’s value proposition is interesting enough to make the stock something to consider using right now for a long-term investing opportunity. If you prefer to focus on short-term trading strategies, you could use a push above $49 as a signal to consider buying the stock or working with call options, using a bullish near-term target price at around $51.50 to take profits. You could also use a drop below $46 as an opportunity to think about shorting the stock or buying put options, using $44.50 as a practical bearish target.