For most of 2022, supply shortages, along with increasing energy demand have been pushing the prices of energy products, including crude oil and natural gas to levels not seen since 2014. Oil prices have dropped off early summer peaks quite a bit as some of those shortages have moderated, however energy commodity prices in general remain significantly above their 2022 starting point.

The Energy sector has a broad carryover effect on multiple other sectors in the economy, which is why I have learned that it’s useful to pay attention to the price of crude oil and other energy commodities, like natural gas on the global market. Despite increasing attention on things like electric vehicles, “green” technologies and solutions aimed at reducing carbon footprints, the plain and simple fact of the matter is that oil continues to be a key driver of economic stability all over the world. That even applies to the production of the material assets used in “green” technologies like electrical car batteries and solar panels, to name just a couple of simple examples. Oil and natural gas liquids (NGLs) are also used in a variety of other petrochemical applications and industries including plastics, home building, fertilizers, and pharmaceuticals to name just a few. It also means that when events threaten the stability of supply and price, the ripple effect could extend into just about every part of the global economy.

Over the last ten years, shale oil exploration and production have helped the U.S. narrow the gap between western and Brent (mostly oil from the Middle East) and WTI (the generalized benchmark for U.S. oil) crude production, with a major portion of shale oil coming from the Permian Basin of the southwestern part of the United States. The challenge associated with U.S. production – and one of the things that contributed to keep oil prices relatively low prior to the COVID-19 pandemic – is that exploration and production of shale oil exceeded the capacity of midstream companies to transport the oil to its primary distribution centers before it is sold throughout the world.

Midstream oil companies include those that are involved in the ongoing construction, operation, and maintenance of pipelines and storage facilities out of the areas of the U.S. that drive shale production, like the Permian Basin. Limitations of existing pipeline and storage capacity have been the primary reason that inventory out of that area in particular remained stuck in the Basin through 2019 and kept the entire industry waiting for new pipeline projects to be completed. Many of those projects were delayed in 2020 because of the pandemic, but have since been completed or were near enough to completion that resumption of activity should increase the flow of crude out of the Permian through the rest of 2022 and into next year.

Enterprise Products Partners (EPD) is one of the biggest midstream companies with operations in crude oil, natural gas and liquified natural gas (LNG) transport and storage, among other things. EPD isn’t an easily recognizable company by name, but it is well-established and recognized among its peers, with a very interesting fundamental profile that includes a large dividend and critical fundamental metrics like free cash flow that have seen significant improvements over the past year. EPD’s management has also noted that operating margins ticked higher in 2021, driven primarily by strong export demand for natural gas liquids logistics and consumer-led demand for petrochemicals such as cleaning products and a built a useful backlog of pending orders into 2022. These are expected to provide a good tailwind into 2023 as previously suspended or deferred projects are carefully and deliberately brought back into production to keep pace with demand. Another element that I expect will work in this company’s favor is its presence in the transportation systems used for LNG in the United States. With Russian energy exports being severely restricted in response to its war against Ukraine, demand for regionally produced LNG products should also remain high.

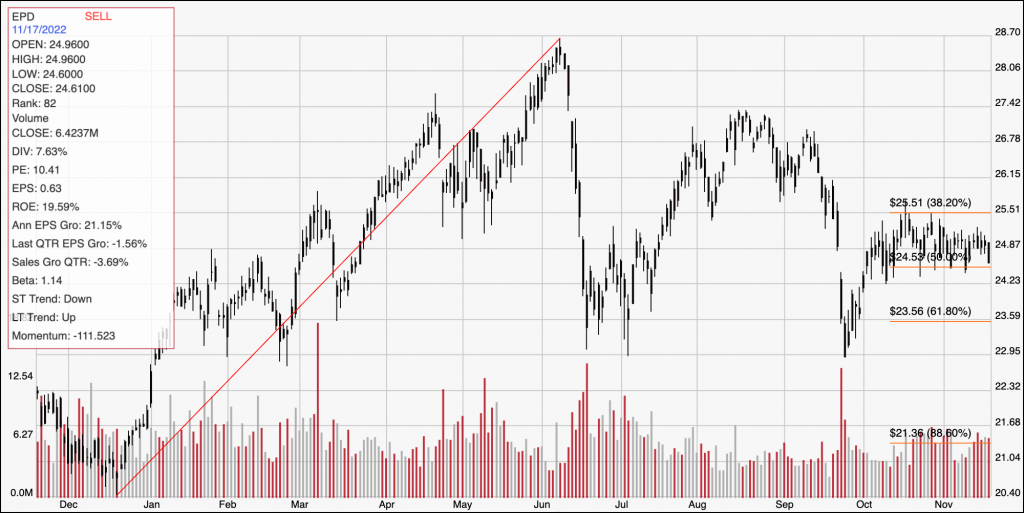

EPD peaked in June of 2021 at around $26 per share and dropped back towards the end of the year to a low point at around $20. From that low, the current geopolitical climate gave the stock a new tailwind, pushing it to a peak at almost $29 in June. The stock dropped off of that high to a new, higher lo w at around $23 in September, from which the stock has since settled into a new consolidation range between $24.50 and $25.50 over the last several weeks. I think that, on a selected basis, energy stocks continue to provide many of the best values in the marketplace, with commodity price support that should make these stocks more resilient than many other industries under current economic conditions. What about EPD? Are its fundamentals strong enough to mark it as a useful value as well? Let’s find out.

Fundamental and Value Profile

Enterprise Products Partners L.P. (Enterprise) is a provider of midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals and refined products in North America. The Company’s segments include NGL Pipelines & Services; Crude Oil Pipelines & Services; Natural Gas Pipelines & Services, and Petrochemical & Refined Products Services. The Company’s midstream energy operations include natural gas gathering, treating, processing, transportation and storage; NGL transportation, fractionation, storage, and import and export terminals, including liquefied petroleum gas (LPG); crude oil gathering, transportation, storage and terminals; petrochemical and refined products transportation, storage, export and import terminals, and related services, and a marine transportation business that operates primarily on the United States inland and Intracoastal Waterway systems. EPD has a current market cap of about $53.5 billion.

Earnings and Sales Growth: Over the last twelve months, earnings increased by a little more than 21%, while revenues were almost 43% higher. In the last quarter, earnings decreased by about -2%, while sales were about -3.7% lower. The company’s margin profile is healthy; in the last quarter, Net Income as a percentage of Revenues in the last quarter was 8.8%, declining only slightly from 9.12% over the last twelve months.

Free Cash Flow: EPD’s free cash flow is healthy, at a little more than $5.8 billion over the last twelve months. That does mark a decline from about $7.1 billion in the quarter prior and $6.3 billion a year ago. The current number also translates to a Free Cash Flow Yield of 10.9%.

Debt to Equity: EPD’s debt to equity is 0.97, which is a little higher than I prefer to see, but also isn’t unusual for stock’s in this industry; however the company’s margin profile indicates operating profits should be adequate to service their debt. Their balance sheet has been a bit of a concern, as liquidity has been limited in the last quarter, as the company reported $255 million in cash and liquid assets versus $26.5 billion in long-term debt, with no major near-term debt obligations. A year ago, cash and liquid assets were more than $2.9 billion, with a major drop below $500 million nine months ago that has continued to the latest report. Their operating margins, along with healthy and growing free cash flow suggest that debt service isn’t a problem, however the drop in liquidity is a source of concern as the company’s normally healthy financial flexibility becomes more and more restricted.

Dividend: EPD’s annual divided is $1.90 per share, which translates to a much larger-than-normal yield of about 7.72% at the stock’s current price. A number of other companies in the Energy sector have been forced to reduce or even eliminate dividend payments, so EPD’s ability to maintain their attractive dividend and even increase it (from $1.80 at the start of 2022) is a sign of management’s confidence.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target at around $28.50 per share. That means that the stock is undervalued, with about 15% upside from its current price. It is also worth noting that earlier this year, this same analysis yielded a fair value target at around $31.50 per share.

Technical Profile

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above covers the last year of price activity. The red diagonal line traces the stock’s increase from about $20.50 in December of last year to its peak in June at almost $29. It also informs the Fibonacci retracement lines shown on the right side of the chart. Since early October, the stock has moved into a narrow consolidation range between the 38.2% and 50% retracement lines, with $24.50 acting as current support and $25.50 providing immediate resistance. A push above $25.50 should find next resistance between $27 and $27.50, based on pivot activity in August and September, while a drop below $24.50 should have limited downside, with next support sitting at around $23.50, inline with the 61.8% retracement line. The strongest sign of a bearish breakdown would come from a drop below $23; in that case, the stock could fall to about $21 before finding new support.

Near-term Keys: EPD’s fundamental strength remains generally solid, with strengthening Free Cash Flow and a still-useful value proposition. Its high, increasing dividend also offers an interesting argument for the stock as a useful long-term buy-and-hold position, however I do see the current, steep decline in available cash as a concern that should be monitored. If you prefer short-term trading strategies, a push above $25.50 could be an interesting signal to buy the stock or work with call options, using $27 to $27.50 as a useful bullish profit target. The stock’s current consolidation pattern, and limited downside don’t provide a lot of great signals to use for a bearish trade; however a drop below $23 could be a reason to consider shorting the stock or buying put options, with $21 providing a useful bearish profit target.