(Bloomberg) — As the bond market limps toward 2023, it faces the prospect of a final bout of chaos, exacerbated by dwindling trading volume typical during the last weeks of the year.

The most punishing time period on record for investors in US government bonds has also been one of the most volatile, with frequent large daily changes in yield. Mostly, those were about pricing in Federal Reserve rate increases aimed at squelching inflation. Developments this week made clear that the turbulence may endure a while longer.

The benchmark 10-year note’s yield’s daily range exceeded 12 basis points three times. One case involved comments by St. Louis Fed President James Bullard on Thursday suggesting a higher eventual peak for the policy rate than the current consensus of about 5%.

It wasn’t unusual. There have been yield swings exceeding 10 basis points on 51 days so far this year, Beth Hammack, co-head of Goldman Sachs Group Inc.’s global financing group and an adviser to the Treasury Department, said on a panel at the New York Fed’s annual Treasury market structure conference this week.

That’s too many, Hammack said, even if such changes were arguably too rare during the previous 10 years, when the Fed was providing extraordinary accommodation.

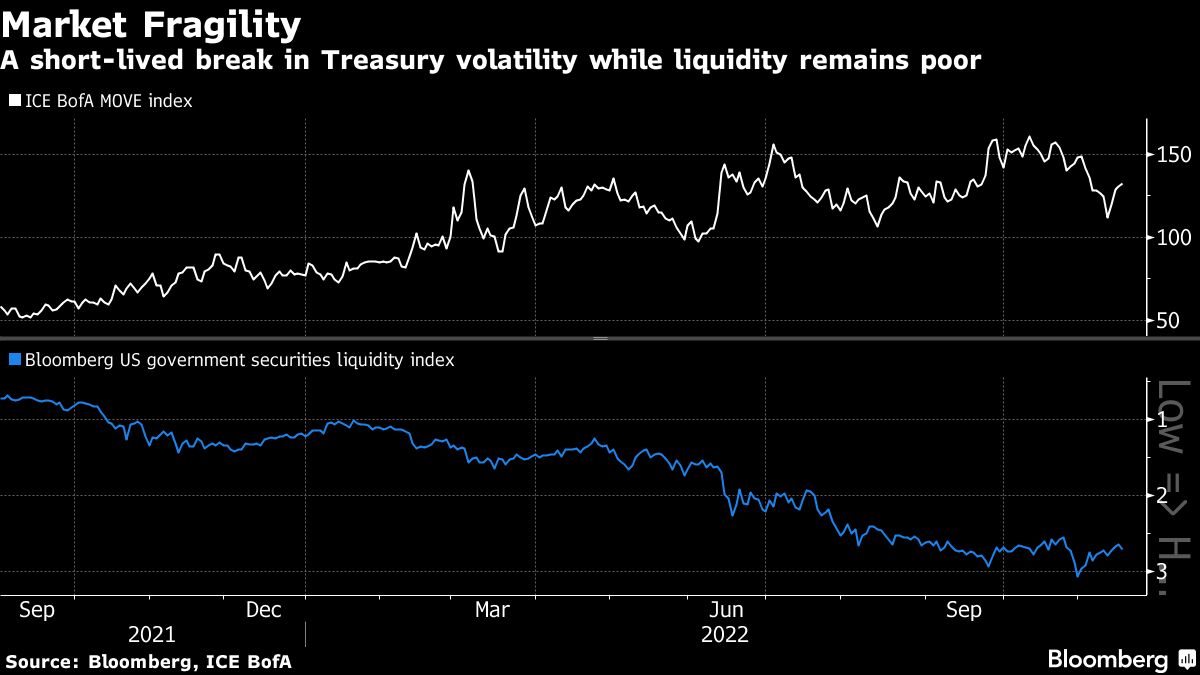

“The Treasury market is still particularly volatile right now and liquidity feels thin,” she said. A gauge of the market’s volatility based on options prices, the ICE BofA MOVE Index, resumed its advance this week after a month-long retreat from the highest levels since the onset of the pandemic in March 2020.

Trading volume has increased this year, exceeding $600 billion per day on average in recent months, Nellie Liang, the Treasury Department’s top domestic finance official, said at the same event. But it’s been boosted by investors shedding old-vintage Treasuries, though to a lesser extent than during the market breakdown in March 2020.

To investors like Matt Smith, investment director at London-based Ruffer LLP and a recent buyer of 30-year bonds, Treasuries remain a short-term trade despite the highest yields of the past decade. The rally that Bullard’s comments halted is “a counter trend move in rates and I don’t expect that will last too long,” he said.

Potential flash points between now and year-end are mostly in the next four weeks, when employment and inflation data for November set the tone for the Fed’s Dec. 14 policy decision. The minutes of its last meeting are set to be released on Wednesday.

Bullard’s Nov. 17 suggestion that 5% to 5.25% is the lowest level the Fed’s policy rate should eventually reach drove the bond market to various new extremes this week, even as yields remained below their year-to-date highs. His comments came the day after stronger-than-estimated October retail sales data cast doubt on the effectiveness of the central bank’s six rate increases since March.

The two-year note’s yield, a proxy for near-term expectations for the Fed’s rate, climbed, exceeding the 5- and 10-year yields by the most in a generation. Meanwhile the 10-year dipped below the central bank’s target range, currently 3.75%-4%, for the first time in the cycle, another sign that investors foresee economic damage that will necessitate rate cuts.

“This is a market that wants to trade the future outcome today” in spite of sub-optimal conditions, said George Goncalves, head of US macro strategy at MUFG. “Putting new money to work at this time of the year doesn’t make sense.”

What to Watch

- Economic calendar

- Nov. 21: Chicago Fed national activity index

- Nov. 22: Richmond Fed manufacturing index

- Nov. 23: MBA mortgage applications; durable goods orders; jobless claims; S&P Global manufacturing and services PMIs; University of Michigan sentiment revisions; new home sales

- Fed calendar:

- Nov. 22: Cleveland Fed President Loretta Mester; Kansas City Fed President Esther George; St. Louis Fed President James Bullard

- Nov. 23: FOMC Nov. 1-2 meeting minutes

- Auction calendar:

- Nov. 21: 13- and 26-week bills; 2- and 5-year notes

- Nov. 22: 2-year floating rate notes; 7-year notes

- Nov. 23: 4-, 8- and 17-week bills

©2022 Bloomberg L.P.