(Bloomberg) — For investors looking for a dip-buying opportunity in the global chip industry, Berkshire Hathaway Inc. may have a recommendation: Taiwan Semiconductor Manufacturing Co.

Warren Buffett’s conglomerate picked up a $5 billion stake in the firm in the recent quarter amid a rout that wiped out over $250 billion from the stock. It hasn’t commented publicly on the deal but market watchers attribute the purchase to TSMC’s cheap valuations, technology leadership and solid fundamentals.

Berkshire’s buy, along with a similar move by Tiger Global Management LLC, may suggest that value is emerging in the chip industry after a turbulent period marked by slowing demand and US-China tensions. A growing number of Wall Street banks have reaffirmed bullish calls on TSMC, with analysts at Morgan Stanley saying the stock has reached “a good entry point.”

“With its superior technology leadership, TSMC is a great value play in the long-term if you look past the current semiconductor downcycle,” said Andy Wong, fund manager at LW Asset Management. “Buffett could be investing in the next-decade growth with burgeoning demand from IoT, renewable and automobiles.”

TSMC’s shares have jumped about 10% in Taiwan since Berkshire’s acquisition was disclosed last week. Morgan Stanley says they are trading below their downcycle valuation with a 30% to 40% discount due to geopolitical risks, according to a Nov. 8 note.

The stock has a valuation multiple of around 12.6 times based on its estimated earnings for the next year, according to data compiled by Bloomberg. Goldman Sachs Group Inc. estimates that to be the lower end of the 10-year average. The company is cheaper than most of the members of the Philadelphia Stock Exchange Semiconductor Index, which tracks the biggest US-listed chip companies.

“We expect TSMC to continue to show its resilience versus other peers during the industry downcycle given its superior execution,” Goldman analysts wrote in a Nov. 16 note. Valuations are attractive and the firm is best placed to capture the industry’s long-term structural growth in 5G, artificial intelligence, high-performance computing and electric vehicles, they added.

Cash Flow

TSMC also has another advantage: it has managed to deliver double-digit sales growth and a gross margin well above 50% this year despite a slowdown in the sector. This has capped the stock’s year-to-date loss at 21%, helping it outperform peers such as Micron Technology Inc. and SK Hynix Inc.

The Taiwanese company’s history of healthy cash flow and stable dividends may have also helped draw Buffett, according to analysts.

“TSMC (and other foundries) all have to incur heavy capital expenditure in the race for tech/capacity leadership, but history shows TSMC has managed to generate respectable cash flows despite capex,” said Phelix Lee, equity analyst at Morningstar Asia Ltd. The company has a track record of paying dividends since the 2000s, he added.

The stock’s latest dividend yield is 2.6%, higher than Micron’s 0.8% and almost on par with SK Hynix’s, according to data compiled by Bloomberg.

Still, while Buffett’s bet has boosted retail sentiment toward the stock, the shares may continue to experience swings in the short term due to geopolitical risks and inventory adjustments in the chip industry.

The semiconductor sector is at the center of a growing rift between the US and China as the two nations vie for leadership in the global technology industry. Washington has imposed elevated sanctions on high-end chips produced for Chinese customers specifically to forestall them making their way into the hands of the Chinese military.

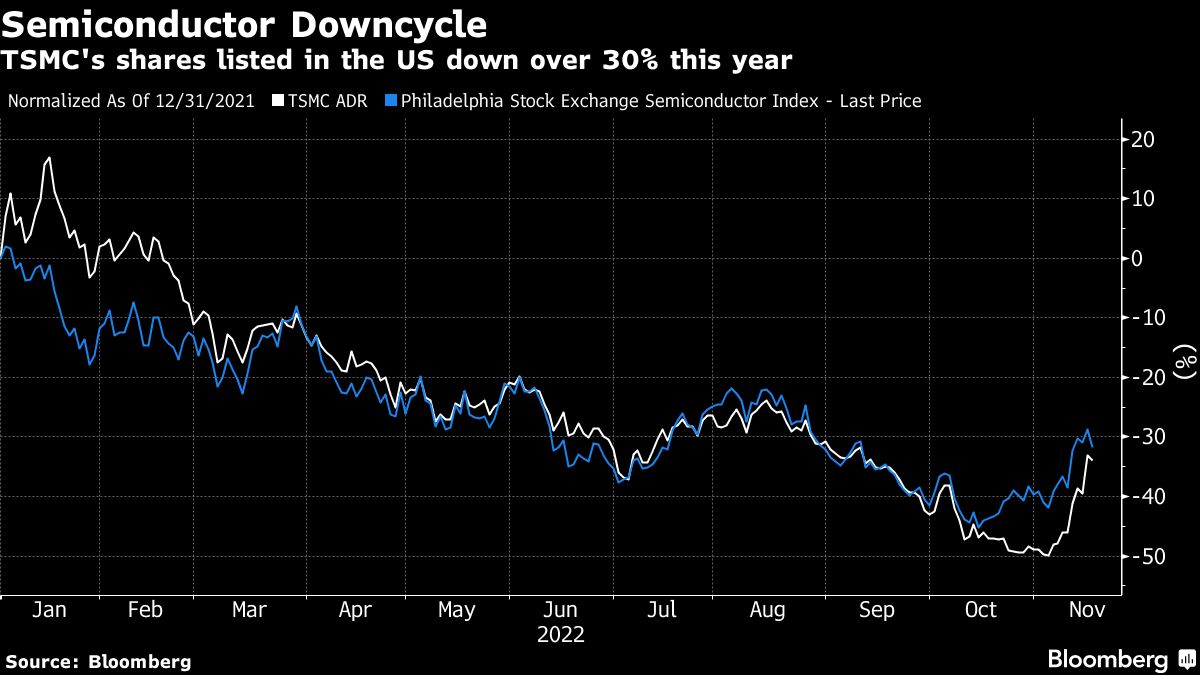

To reflect the risks, analysts have cut the average target price for TSMC’s stock by about 30% since February. Its shares listed in the US are down over 30% this year, in line with the drop posted by the global semiconductor benchmark.

“Investors are worried about higher-than-usual inventory, which shows no signs of easing yet,” said Jason Su, fund manager at Cathay Taiwan 5G Plus Communications ETF. “Companies including TSMC said earlier they expect inventory correction to continue through first half next year,” he said, adding that chip stocks are likely to rebound after inventory adjustments are completed.

©2022 Bloomberg L.P.