Stocks in the Technology sector get a lot of attention and buzz from investors, analysts and talking heads alike no matter the time of year or current status of the economy. A big reason comes from the reality that progress, innovation and evolution in just about every other sector of the economy is driven by the influence of technology on improving processes, products, and services from one end of the supply chain to the other.

The importance of technology in every aspect of global economy is also a reason I believe that not only the Tech sector, but the Semiconductor industry in particular should always be included as part of an overall view of economic and market health. After all, semiconductors are the backbone of just about any technological tool we use – whether you’re talking about your smartphone, personal computer, and so much more. A lot of the basic functions of any modern car, for example is heavily reliant on software and the microchips and processors that they run on. As the world becomes ever-more connected through wireless Internet communications (think 5G and the Internet of Things, for example), that reliance is a constant force that keeps the Tech sector and Semiconductor companies at the forefront of the current and long-term economic picture.

The caveat, of course is that just because the rest of the market is paying attention to a sector or industry, it doesn’t mean that every stock in that grouping is a good investment. One of the big challenges the Semiconductor industry specifically has had to deal with over the last few years are disruptions to semiconductor supply that go all the way back to the trade war between the U.S. and China in 2018 and 2019. A lot of U.S. semiconductor companies have historically been heavily dependent on Chinese tech companies to help provide production and fabrication services, particularly in the Tech sector. Trade tensions were heavily focused on Tech demand for Chinese goods and services, increasing costs and restricting chip supply.

Fueled in part by the trade war, as well as a general industry shift to be more locally self-reliant, a lot of those companies have been working to bring more of those operations to U.S. shores. For many of the companies investing in domestic fabrication and production, this is a long-term, multiyear process. The ongoing war in Ukraine, along with its impact on energy prices (another element that touches every sector, including Tech in one way or another) only makes the overall picture look cloudier right now, which is why a lot of stocks in the Tech sector have seen significant drawdowns in price through most of this year. Some of that momentum has been reversed in the last month or so, as it seems that a lot of investors are beginning to recognize the deep discounts that many of the best Semiconductor companies are trading at today.

Microchip Technology (MCHP) is a good example of a Semiconductor company that fits this description. This is a company that has a long history in, and therefore still has exposure to China, but that also boasts a global customer base that spreads across multiple sectors of the economy. This is a stock that fell to extreme lows in early 2020 due to the pandemic and the pressures that came with it, but nearly quadrupled by the end of 2021. Since then, concerns about inflationary pressure on the entire Tech industry pushed the stock almost 50% off of its yearly high and into its own, clear bear market territory. The stock hit a temporary low at around $57 in October before starting a new rally to its current price at around $73 per share, but is still significantly below its 52-week high. Does that mean the stock could represent a good value, or is it just a big risk to take right now, since Tech stocks seem likely to stay volatile? Let’s find out.

Fundamental and Value Profile

Microchip Technology Incorporated is engaged in developing, manufacturing and selling specialized semiconductor products used by its customers for a range of embedded control applications. The Company operates through two segments: semiconductor products and technology licensing. In the semiconductor products segment, the Company designs, develops, manufactures and markets microcontrollers, development tools and analog, interface, mixed signal and timing products. Its functional activities include sales, marketing, manufacturing, information technology, human resources, legal and finance. Its product portfolio comprises general purpose and specialized 8-bit, 16-bit, and 32-bit microcontrollers, a spectrum of linear, mixed-signal, power management, thermal management, radio frequency (RF), timing, safety, security, wired connectivity and wireless connectivity devices, as well as serial electrically erasable programmable read-only memories (EEPROMs) and serial flash memories. MCHP has a current market cap of about $40.1 billion.

Earnings and Sales Growth: Over the last twelve months, earnings have grown by 43.3%, while revenues increased by 25.66%. In the last quarter, earnings were almost 7% higher, while revenues rose by almost 6%. The company’s margin profile over the last twelve months showed Net Income was 24.14% of Revenues over the last twelve months, and strengthened to 26.35% in the last quarter.

Free Cash Flow: MCHP’s free cash flow is modest, but has been improving over the last year. Over the last twelve months free cash flow was about $2.8 billion, and increased from roughly $2.25 billion a year ago. The current number translates to a Free Cash Flow Yield of 6.86%.

Dividend: MCHP’s annual divided is $1.31 per share and translates to a yield of about 1.77% at the stock’s current price. It should also be noted that management increased the dividend from $.93 at the beginning of this year, and again each quarter this year to come to its current level. A consistently increasing dividend is a strong indication of management conviction and confidence.

Price/Book Ratio: there are a lot of ways to measure how much a stock should be worth; but I like to work with a combination of Price/Book and Price/Cash Flow analysis. Together, these measurements provide a long-term, fair value target around $69 per share. That means that at the stock’s current price, MCHP is slightly overvalued, with -5% downside from its current price, and with a practical discount price at around $54.50 per share. It is also worth mentioning that at the beginning of this year, this same analysis yielded a long-term, fair value target at around $62 per share.

Technical Profile

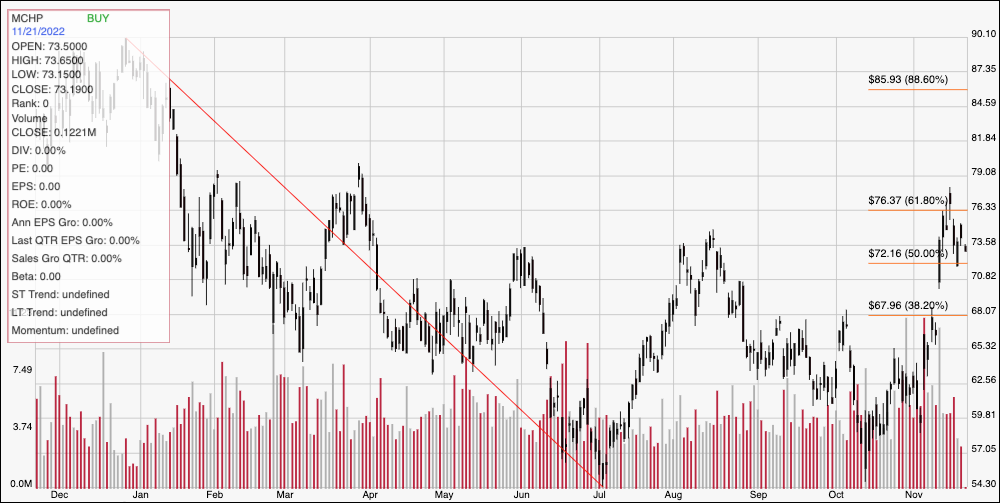

Here’s a look at the stock’s latest technical chart.

Current Price Action/Trends and Pivots: The chart above displays the stock’s price activity over the last year. The dotted yellow line traces the stock’s downward trend from a December 2021 peak at around $90 to its July low at around $54. It also provides the baseline for the Fibonacci retracement lines on the right side of the chart. After a temporary rally in August, the stock dropped back to an October low at around $57, where it picked up a new set up of bullish momentum that drove the stock to its last pivot high right around the 61.8% retracement line at $76 to mark immediate resistance at that level. Current support is around $72, a little below the August peak and right around 50% retracement line. A push above $76 should have room to rally to about $81 before finding next support, based on pivot lows seen in December 2021 and January of this year. A drop below $72 should find next support at around $68, where the 38.2% retracement line sits.

Near-term Keys: The stock’s current bullish momentum makes thinking about MCHP in bullish terms a tempting prospect for short-term trading strategies. A push above $76 could be a good signal to think about buying the stock or working with call options, with a good bullish target at around $81. A drop below $72 would be a good opportunity to consider shorting the stock or buying put options, using $68 as a practical bearish profit target. Despite some useful fundamental strengths, MCHP’s new surge of bullish momentum has pushed it past the point of useful value.