(Bloomberg) — The wild-west days of crypto markets are back again as the large trading houses that once thrived on arbitraging price gaps pull back in the wake of FTX’s collapse. That’s opening up profitable opportunities for anyone that still dares to trade.

Prices for essentially identical assets on various platforms are diverging in a clear sign the dominoes are still falling across the crypto trading world. The gap between the funding rates of identical Bitcoin futures on Binance and OKEx, for instance, has been as wide as an annualized 101 percentage points and remained at least 10, compared to mostly single-digit gaps last month.

It’s a throwback to the early days of crypto, when speculators — including former FTX Chief Executive Officer Sam Bankman-Fried himself — found easy money simply buying one asset on an exchange and selling it for more on another. It’s a lucrative form of quantitative trading, which uses algorithms to profit from these price gaps. But as more sophisticated Wall Street converts entered the crypto markets, those differences shrank, making it harder to make money on the strategy.

Now with FTX’s demise sending chills through cryptocurrency markets, these players — including both big and obscure quant funds — are shrinking positions or even closing shop, causing these mispricings to stick around for longer.

“If you know what you’re doing and you have the confidence to have your money on exchanges, there are very profitable places to trade,” said Chris Taylor, who runs crypto strategies at GSA Capital, a 17-year-old quant fund that waded into the nascent asset class last year.

Started by young alumni of Chicago firm Jane Street Capital, FTX touted itself as an exchange “built by traders, for traders,” with margin lending and a wide array of derivatives. Until its implosion last week it was consistently among the five largest exchanges in terms of volumes — and a favorite among quants.

Unlike traditional markets, where hedge funds borrow through prime brokerages, crypto traders have to put up collateral directly on exchanges. So when FTX began to restrict withdrawals last week, hordes of retail and professional speculators essentially lost access to much of their assets available for trading, with any recovery now dependent on a slow and winding bankruptcy process.

The losses are now surfacing. Kevin Zhou, co-founder of hedge fund Galois Capital, said roughly half of its capital was stuck on FTX, according to the Financial Times. Travis Kling, who managed money for Point72 Asset Management before starting a crypto fund, said a large majority of his firm Ikigai’s assets are on the bankrupt platform. Wintermute, one of the largest market makers, said it has $55 million on FTX.

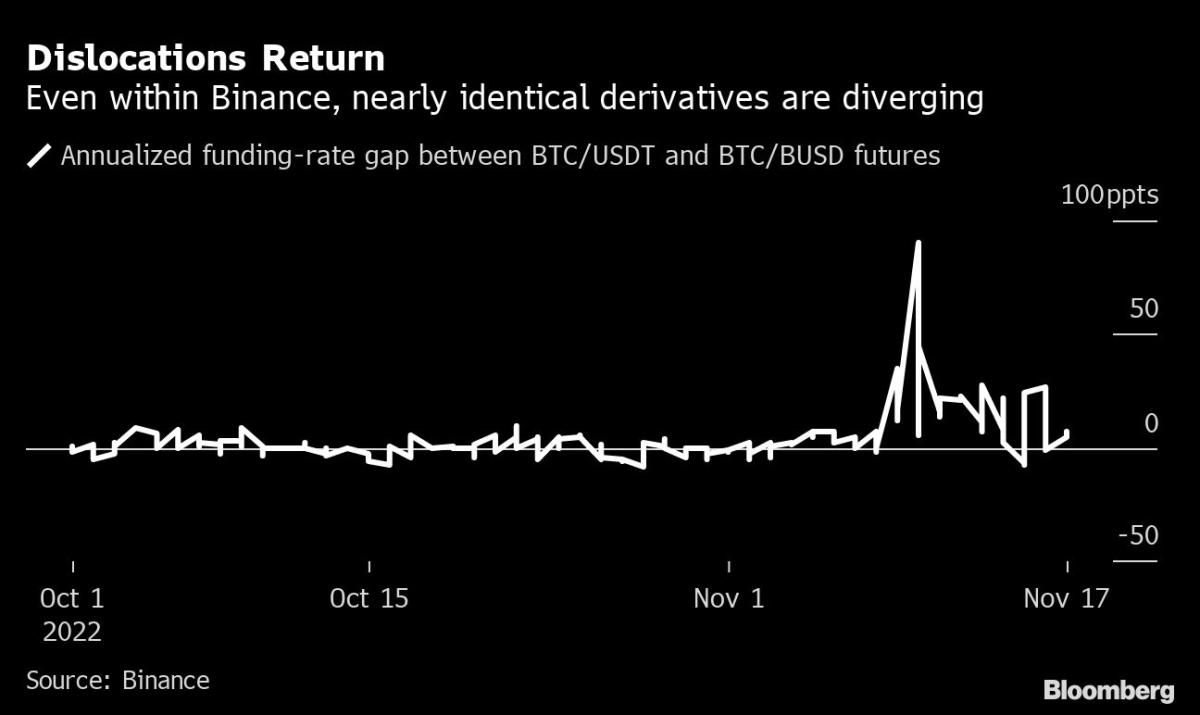

As quants cut risk, dislocations are re-emerging. On the largest exchange Binance, the funding-rate gap between Bitcoin futures against Binance USD and those against Tether — meaning both track the price in dollar terms — has widened to an average 17 percentage points on an annualized basis over the past week, compared with nearly nothing in October. (The funding rate is an interest payment that’s used to keep perpetual futures in line with the spot price.)

“Everybody is heading for the hills,” said Mitchell Dong, chief executive officer at Pythagoras Investments, which oversees about $100 million. The return of some price spreads shows “things that were previously arbed out are not so arbed out.”

His firm is writing off its 1% and 7% exposures to FTX in its market-neutral and trend-following funds respectively, he added.

Fasanara Digital, which runs about $100 million, has dialed down its risk exposure to nearly zero, says partner Nikita Fadeev.

Traders now have to decide whether to write off their exposure to FTX or create a so-called sidepocket that separates those assets from the main fund, says Barnali Biswal, chief investment officer at Atitlan Asset Management, which runs a fund that allocates to different quant managers and has 75% in cash right now.

“The age-old arbitrage strategies are more and more lucrative,” said the former Goldman Sachs managing director. “However, contagion risk is elevated. So we are being conservative in our approach.”

For most of crypto history until last year, the market teemed with obvious inefficiencies, drawing Chicago giants like Jump Trading and Jane Street. With the advent of pro traders that were used to picking pennies in far more competitive mainstream markets like American stocks, those price gaps narrowed and the easy money vanished.

The return of these anomalies now is a sign FTX’s fall has buffeted quant traders even more than this year’s other crypto crashes, like the deaths of TerraUSD and Three Arrows Capital. Bitcoin has dropped another 18% this month, taking its 2022 loss to 64%.

The downfall of what was once a trusted exchange will make professional traders seek ways to avoid putting up collateral on any centralized platforms, for instance by using prime brokerages instead, says GSA’s Taylor. In short, they will want crypto to look more like Wall Street — if the exchanges allow it.

“There was a lot more trust in FTX than there was in Terra/Luna,” he said. “You are now seeing some of the big players pull back not completely but try to have less collateral on centralized exchanges and think more about counterparty risk.”

©2022 Bloomberg L.P.