(Bloomberg) — Copper miners are boosting output at last after several years of anemic performance. But it may not be enough to meaningfully lift stockpiles from historically low levels, keeping supplies tight in a market critical to the energy transition.

The reason is a bottleneck in capacity at the world’s smelters, whose role turning ore into metal makes them a crucial cog in the supply chain between miners and the manufacturers of products from mobile phones and air-conditioning units to electric vehicles.

“There isn’t enough smelting capacity around,” said Ye Jianhua, an analyst at Shanghai Metals Market. A surplus of mine production would “hardly alleviate the tightness associated with low refined copper inventories next year,” he said.

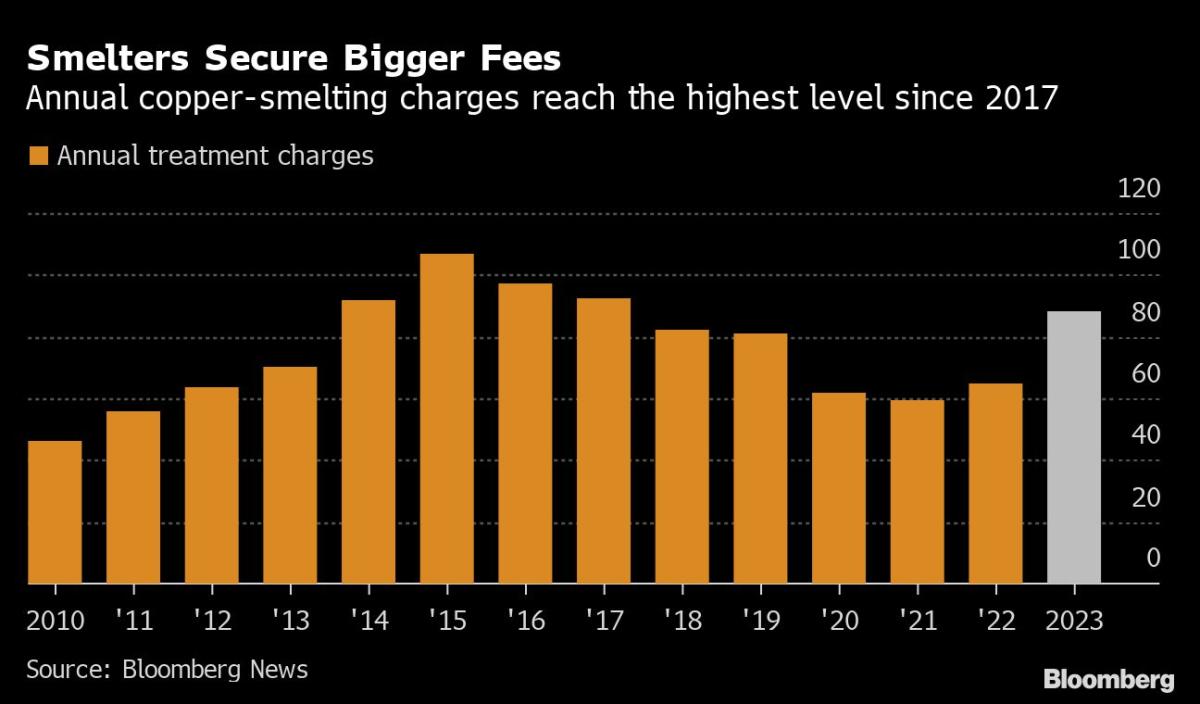

The prospect of a wave of supply being met by insufficient conversion capacity is being reflected in a surge in fees to turn semi-processed ores, or concentrates, into refined metal. The levies, known as treatment and refining charges, are deducted from the price of concentrates and are a key driver of profitability for smelters as well as for many traders.

Benchmark annual smelting fees jumped 35% to the highest in six years when they were agreed on Thursday by US miner Freeport-McMoRan Inc. and Chinese smelters at an industry gathering in Singapore. China accounts for about half of global copper consumption and its smelting industry is the world’s largest.

Numerous traders, miners and analysts said they are expecting a build-up of copper concentrates over the next year. Some are expecting an increase of global inventories of the ores of 500,000 tons of copper content or more. But the smelter bottleneck means that most expect the market for copper metal — the form that sets the price on the London Metal Exchange — will see much less of a surplus, if at all.

On one side, copper ore supply will grow at the fastest rate in seven years, according to the International Copper Study Group, with production rising in Africa and Latin America, as several new mines — including Anglo American Plc’s Quellaveco mine in Peru and Teck Resources Ltd.’s Quebrada Blanca 2 project in Chile — ramp up capacity.

On the other, global smelting capacity will expand more slowly. China has largely driven increases in recent years, and while its output is expected to rise next year, it likely won’t keep pace with the increase in mine supply.

Even existing capacity has been constrained. Chinese smelters have experienced increasing disruptions in recent years, including from power outages and government efforts to reduce energy intensity and consumption, said Xu Yulong, deputy general manager at China Copper International Trading Group.

When Chinese smelter representatives met executives at top mining companies this week in Singapore to negotiate next year’s supply agreements, officials from China Copper highlighted the ongoing disruptions, including a scheduled cut in processing due to a planned relocation of a smelter in the Yunnan province, according to two people familiar with the talks.

Energy Transition

The consensus that mine supply and smelting capacity will be mismatched for some time to come could still turn out to be wrong — and it wouldn’t be the first time that traders have been wrongfooted by what seemed a sure thing in the copper market.

Miners could face unforeseen difficulties raising production. China’s smelters may be able to process more than anticipated. A sharp global economic downturn would hit demand for copper and leave smelters idle.

And even if the short-term outlook is for plentiful supplies of copper ore, few are expecting the mismatch to last. Three major new smelters outside China are planned for the second half of 2024, by Adani Enterprises Ltd. in India, Freeport McMoRan in Indonesia and Ivanhoe Mines Ltd. at its Kamoa-Kakula mine in Democratic Republic of Congo.

Big miners, meanwhile, are warning of a significant supply shortfall starting around the middle of the decade, with not enough new projects to keep pace with demand that is projected to boom thanks to the energy transition away from fossil fuels.

In a speech at a gala dinner in Singapore this week, Maximo Pacheco, chairman of Chile’s state copper company Codelco, said he expects a surplus in the short term. But he warned: “Over the medium term the reality will be the opposite — demand will far outstrip supply.”

–With assistance from Archie Hunter and Mark Burton.

©2022 Bloomberg L.P.