(Bloomberg) — The latest reading of the US labor market on Friday is expected to show job growth on more of the downward glide path sought by Federal Reserve policy makers in their fight to beat back inflation.

Payrolls are projected to have risen about 200,000 in November, a second month of decelerating gains. Such growth, while moderating, is nonetheless consistent with solid hiring that will extend the Fed’s rate-hiking campaign into 2023. The report will be the last of its kind before the central bank’s final policy meeting of the year.

Job openings data on Wednesday are seen illustrating a still-healthy appetite for labor.

Later that day, at a Brookings Institution event, Fed Chair Jerome Powell will offer his assessment of the economy as investors seek clues about the peak in the benchmark interest rate.

The jobs report is also forecast to show moderating average hourly earnings growth. The Bloomberg survey median calls for a 4.6% annual increase, which would be the smallest since August 2021 and a step in the right direction for Fed policymakers. The unemployment rate probably held at 3.7%, just above a five-decade low.

Among other key US data, the income and spending report on Thursday is forecast to indicate a softening in core inflation for October. While simmering down, the annual pace is still more than twice the central bank’s goal.

Other reports include a survey of manufacturing purchasing managers, weekly jobless claims, consumer confidence, and the Fed’s Beige Book of regional economic conditions across the country.

What Bloomberg Economics Says:

“Even though mid- to lower-income households have depleted excess savings built up during the pandemic, household balance sheets are still historically strong in aggregate. Many lower-income households are getting a boost from state and local government stimulus checks. Older Americans are about to get an 8.7% cost-of-living adjustment to their social-security payments. Residual savings from pandemic-era federal stimulus continue to keep household spending resilient.”

–Anna Wong, Andrew Husby and Eliza Winger, economists. For full analysis, click here

Elsewhere, the euro-zone may reveal another double-digit inflation reading — the last such report before the European Central Bank’s December rate decision. Australian consumer prices are likely to increase again, and rate hikes are expected from Thailand to southern Africa.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

Asia

Factory output figures from Japan and South Korea will give an indication of how slower global growth is weighing on production there, while export figures from Korea at the end of the week will offer the latest health check on the state of global demand.

Japan’s labor market is likely to show continued tightness, though not enough to guarantee the wage gains Bank of Japan Governor Haruhiko Kuroda seeks for sustainable inflation.

Capital spending data may show Japanese firms are still betting on a post-pandemic recovery rather than a looming recession. The numbers will feed into revised GDP figures the following week.

Australia’s monthly inflation rate is expected to speed up, though quarterly figures will continue to hold more sway on policy making.

The Reserve Bank of Australia’s Jonathan Kearns is set to speak on Wednesday, with Governor Philip Lowe giving remarks on Friday.

China’s PMI reports on Wednesday will be closely watched as the resurgence in Covid cases, and lockdowns to contain the spread, hamper activity yet again.

Almost all economists reckon the Bank of Thailand will raise its key rate by a quarter point, returning the benchmark to the level it had before the pandemic.

Europe, Middle East, Africa

A pivotal week for euro-zone monetary policy will feature both key data and high-profile remarks from ECB officials.

Most important is the inflation reading for November, due on Wednesday. Multiple officials have pointed to this as a significant input for their final decision of the year, on Dec. 15, both as an indicator of price pressures and as a data point to feed into their economic projections.

While projected to slow for the first time this year, inflation probably held above 10% for a second month in November, economists say. Their median prediction is for an outcome of 10.4%, down from 10.6% in October.

Inflation data from the region’s four biggest economies will also be released, with all but Spain predicted to show at least a slight a slowdown.

ECB President Christine Lagarde testifies in the European Parliament on Monday, and will make an appearance in Thailand later in the week. Chief Economist Philip Lane delivers a speech in Florence on Thursday. A so-called non-monetary policy meeting of the Governing Council takes place Wednesday, the day of the inflation data.

Inflation figures will also be released in Switzerland. While running less than a third of that in the neighboring euro region, the consumer-price report will take on added significance because it too is the final take before the Swiss National Bank’s rate decision on Dec. 15, the same day as the ECB.

Swiss inflation probably held at 3% in November, the median of 14 forecasts shows. That would mark the sixth consecutive month where it has been at least a percentage point above the central bank’s 2% ceiling.

Looking south, Ghana’s rate decision on Monday may be a close call. Inflation at 40% has yet to peak, producer prices are surging, and the cedi has depreciated by almost 28% against the dollar since last month’s 250 basis-point hike. At the same time, business sentiment has slumped.

Rate setters in Lesotho and Namibia are expected to follow South Africa’s Reserve Bank and raise rates on Tuesday and Wednesday, respectively, to protect their currency pegs. Also on Wednesday, Mozambique’s central bank is set to keep borrowing costs unchanged.

Policymakers in Botswana will probably do likewise on Thursday for a second straight meeting after a large cut in gasoline prices that may ease pressure on inflation.

Latin America

October trade results kick off a busy week in Mexico, followed by unemployment, remittances, the year-to-date budget balance, manufacturing, and Banco de Mexico’s quarterly inflation report.

The resilience of Latin America’s second-biggest economy in the second half of 2022 may see Banxico mark up its full-year output forecast, while the specter of recession in the US pushes the bank to cut its 2023 GDP forecast of 1.6%.

After posting 11.7% growth in 2021 it’s all gone downhill for Chile: the economy shrank in July-September, will likely do so again in the fourth quarter, and the central bank is forecasting a negative print for 2023. Of the seven October economic indicators posted this week, expect some double-digit tumbles.

Consumer prices in Peru’s capital of Lima appear to have peaked, but still-surging core inflation may cinch the case for a 17th straight rate hike at the central bank’s Dec. 7 meeting.

Brazil’s broadest measure of inflation — the IGP-M index — is expected to have fallen for a fourth month in November.

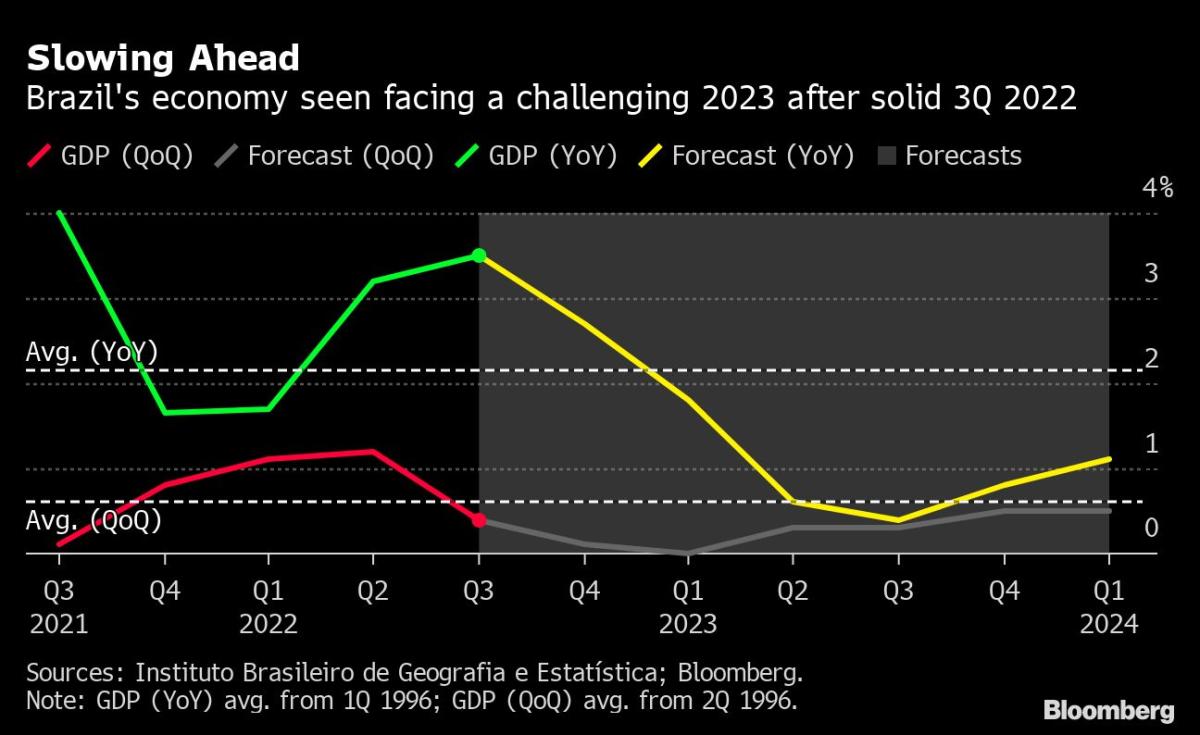

Third-quarter output figures from Brazil released on Thursday may represent a near-term high-water mark for Latin America’s biggest economy, with analysts forecasting a protracted bout of below-trend growth into 2024.

–With assistance from Malcolm Scott, Robert Jameson, Sylvia Westall and Monique Vanek.

©2022 Bloomberg L.P.